Question: Don't get what I am doing wrong Exercise 17-16 Determine and record pension expense and gains and losses; funding and retiree benefits [L017-617 Actuary and

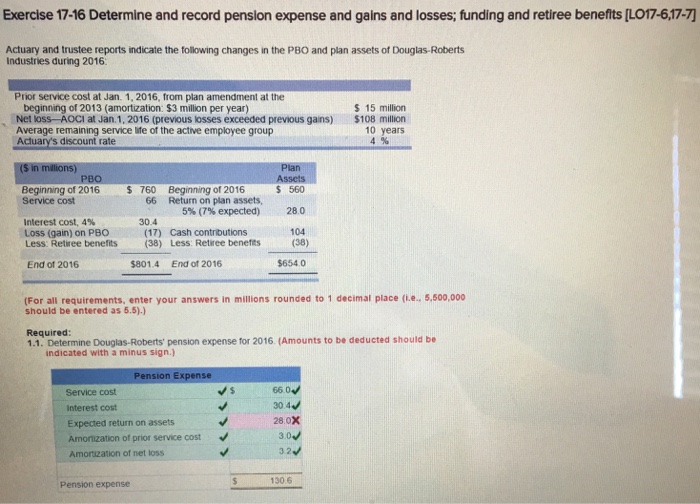

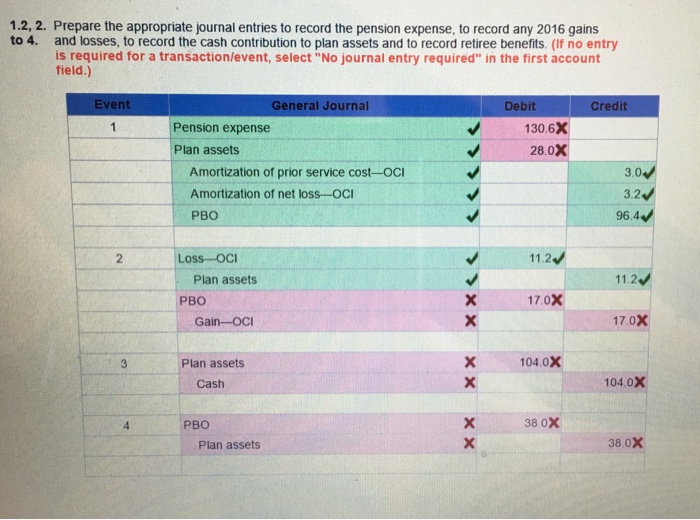

Exercise 17-16 Determine and record pension expense and gains and losses; funding and retiree benefits [L017-617 Actuary and trustee reports indicate the following changes in the PBO and plan assets of Douglas-Roberts Industries during 2016 Prior service cost at Jan. 1, 2016, from plan amendment at the S 15 million beginning of 2013 (amortization: $3 million per year) Net loss-AOCi at Jan.1, 2016 (previous losses exceeded previous gains)$108 milion Average remaining service life of the active employee group Actuary's discount rate 10 years 4% in 760 Beginning of 2016 560 280 104 (38) $654.0 Beginning of 2016 Service cost Return on plan assets, 5% (7% expected) 66 30.4 Interest cost, 4% Loss (gain) on PBO Less: Retiree benefits (17) Cash contributions (38) Less: Retiree benefts End of 2016 $801.4 End of 2016 (For all requirements, enter your answers in millions rounded to 1 decimal place (.e. 5,500,000 should be entered as 5.5).) Required: 1.1. Determine Douglas-Roberts' pension expense for 2016. (Amounts to be deducted should be indicated with a minus sign.) Pension Expense Service cost Interest cost Expected return on assets Amortization of prior service cost Amortization of net loss 66.0V 30 4 28.0X 3 2 130.6 Pension expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts