Question: dont need 15.5 just showing reference Example 15.6 Restricted stock unit plan Simidor to hamework E15.14 Assume the same facts as example 15.5, except Lawson

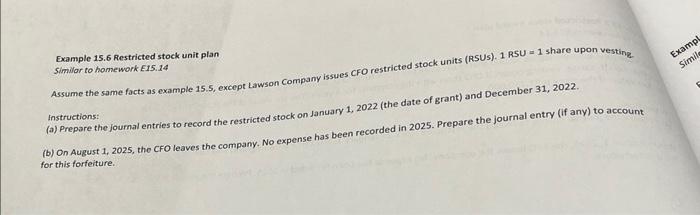

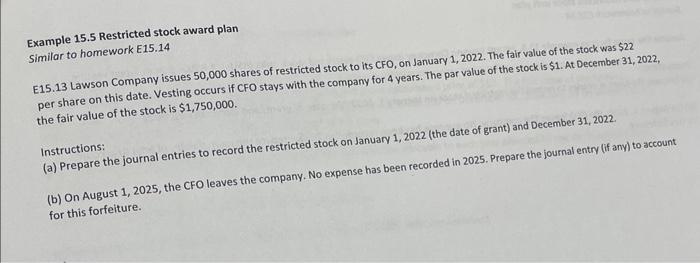

Example 15.6 Restricted stock unit plan Simidor to hamework E15.14 Assume the same facts as example 15.5, except Lawson Company issues CFO restricted stock units (RSUs). 1 RSU = 1 share upon vesting. Instructions: (a) Prepare the journal entries to record the restricted stock on January 1,2022 (the date of grant) and December 31,2022. (b) On August 1, 2025, the CFO leaves the company. No expense has been recorded in 2025. Prepare the journal entry (if any) to account for this forfeiture. Example 15.5 Restricted stock award plan Similar to homework E15.14 E15. 13 Lawson Company issues 50,000 shares of restricted stock to its CFO, on January 1, 2022. The fair value of the stock was $22 per share on this date. Vesting occurs if CFO stays with the company for 4 years. The par value of the stock is $1. At December 31,2022 , the fair value of the stock is $1,750,000. Instructions: (a) Prepare the journal entries to record the restricted stock on January 1, 2022 (the date of grant) and December 31,2022. (b) On August 1, 2025, the CFO leaves the company. No expense has been recorded in 2025. Prepare the journal entry (if any) to account for this forfeiture

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts