Question: dont need it in excel just the answer Question 20 Not yet answered Marked out of 5.00 p Flag question Option valuation, Black & Scholes:

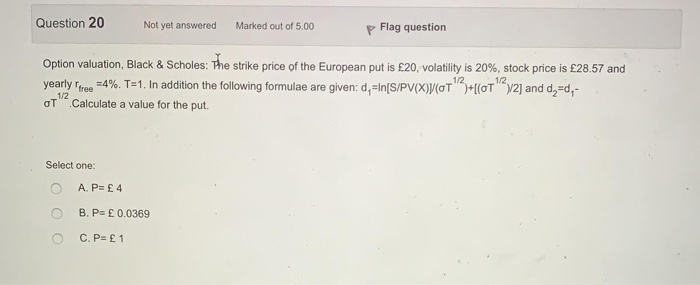

Question 20 Not yet answered Marked out of 5.00 p Flag question Option valuation, Black & Scholes: The strike price of the European put is 20, volatility is 20%, stock price is 28.57 and yearly Tree =-4%. T=1. In addition the following formulae are given: d=In[S/PV(X))(OT 3+ (OT"2] and dy=d,- OT Calculate a value for the put. Select one: O AP= 4 O B. P= 0.0369 C.P= 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts