Question: don't solve it by excel please ! In the use of unmanned aerial vehicles (UAVs) that will shape the future of UAV applications, an online

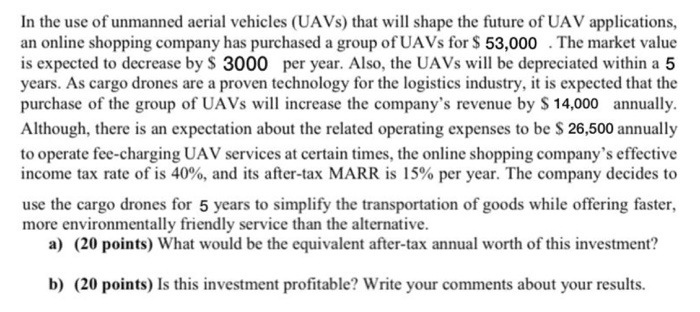

In the use of unmanned aerial vehicles (UAVs) that will shape the future of UAV applications, an online shopping company has purchased a group of UAVs for $ 53,000. The market value is expected to decrease by $ 3000 per year. Also, the UAVs will be depreciated within a 5 years. As cargo drones are a proven technology for the logistics industry, it is expected that the purchase of the group of UAVs will increase the company's revenue by $ 14,000 annually. Although, there is an expectation about the related operating expenses to be $ 26,500 annually to operate fee-charging UAV services at certain times, the online shopping company's effective income tax rate of is 40%, and its after-tax MARR is 15% per year. The company decides to use the cargo drones for 5 years to simplify the transportation of goods while offering faster, more environmentally friendly service than the alternative. a) (20 points) What would be the equivalent after-tax annual worth of this investment? b) (20 points) Is this investment profitable? Write your comments about your results

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts