Question: dont use excel please Question 1 5 Points If the market index has a standard deviation of 15%, and the risk-free rate is 6% for

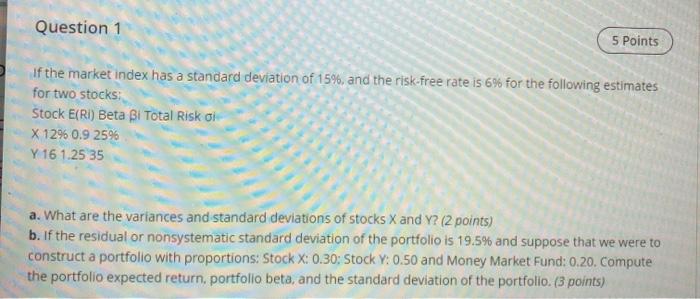

Question 1 5 Points If the market index has a standard deviation of 15%, and the risk-free rate is 6% for the following estimates for two stocks: Stock E(RI) Beta Bi Total Risk of X 1296 0.9 2596 Y 16 1.25 35 a. What are the variances and standard deviations of stocks X and Y? (2 points) b. If the residual or nonsystematic standard deviation of the portfolio is 19.5% and suppose that we were to construct a portfolio with proportions: Stock X: 0.30: Stock Y: 0.50 and Money Market Fund: 0.20. Compute the portfolio expected return portfolio beta, and the standard deviation of the portfolio (3 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts