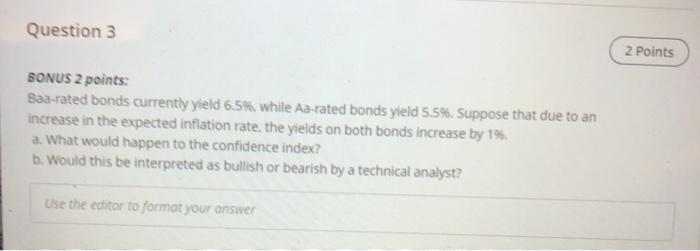

Question: dont use excel please Question 3 2 Points BONUS 2 points: Baa-rated bonds currently yield 6,5%, while Aa-rated bonds yield 5.5%. Suppose that due to

Question 3 2 Points BONUS 2 points: Baa-rated bonds currently yield 6,5%, while Aa-rated bonds yield 5.5%. Suppose that due to an increase in the expected inflation rate, the yields on both bonds increase by 19. a. What would happen to the confidence index? d. Would this be interpreted as bullish or bearish by a technical analyst? use the editor to format your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts