Question: Dont use excel Question 1: A company is evaluating a project that will require an investment of $21,500,000 and will generate the following cash flows:

Dont use excel

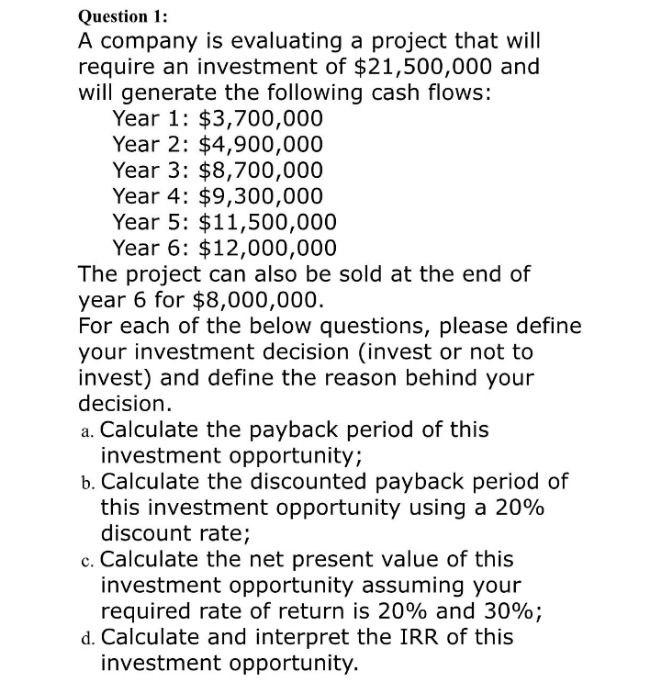

Question 1: A company is evaluating a project that will require an investment of $21,500,000 and will generate the following cash flows: Year 1: $3,700,000 Year 2: $4,900,000 Year 3: $8,700,000 Year 4: $9,300,000 Year 5: $11,500,000 Year 6: $12,000,000 The project can also be sold at the end of year 6 for $8,000,000. For each of the below questions, please define your investment decision (invest or not to invest) and define the reason behind your decision. a. Calculate the payback period of this investment opportunity; b. Calculate the discounted payback period of this investment opportunity using a 20% discount rate; c. Calculate the net present value of this investment opportunity assuming your required rate of return is 20% and 30%; d. Calculate and interpret the IRR of this investment opportunity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts