Question: DONT USE EXCEL TO SOLVE NO EXCEL SOLUTIONS Please use the following information to answer the next TWO questions. Your firm is unlevered and pays

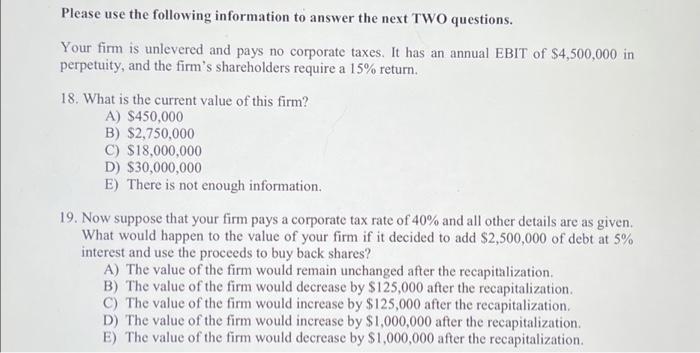

Please use the following information to answer the next TWO questions. Your firm is unlevered and pays no corporate taxes. It has an annual EBIT of $4,500,000 in perpetuity, and the firm's shareholders require a 15% return. 18. What is the current value of this firm? A) $450,000 B) $2,750,000 C) $18,000,000 D) $30,000,000 E) There is not enough information. 19. Now suppose that your firm pays a corporate tax rate of 40% and all other details are as given. What would happen to the value of your firm if it decided to add $2,500,000 of debt at 5% interest and use the proceeds to buy back shares? A) The value of the firm would remain unchanged after the recapitalization. B) The value of the firm would decrease by $125,000 after the recapitalization. C) The value of the firm would increase by $125,000 after the recapitalization. D) The value of the firm would increase by $1,000,000 after the recapitalization. E) The value of the firm would decrease by $1,000,000 after the recapitalization

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts