Question: Dont use Excel, type it out, show all work. You are given the following information concerning Baron Co. Calculate the WACC for Baron Co. Debt:

Dont use Excel, type it out, show all work.

Dont use Excel, type it out, show all work.

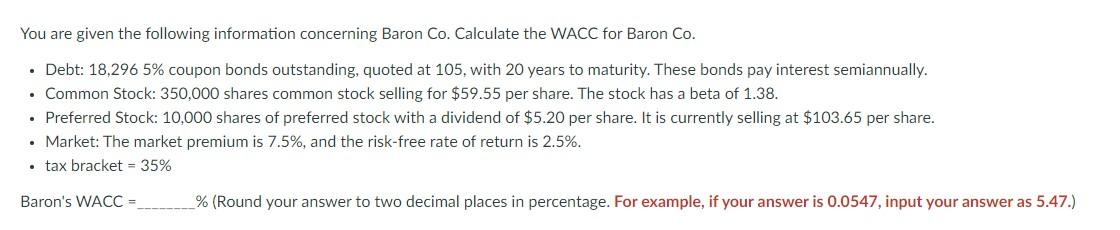

You are given the following information concerning Baron Co. Calculate the WACC for Baron Co. Debt: 18,296 5% coupon bonds outstanding, quoted at 105, with 20 years to maturity. These bonds pay interest semiannually. Common Stock: 350,000 shares common stock selling for $59.55 per share. The stock has a beta of 1.38. Preferred Stock: 10,000 shares of preferred stock with a dividend of $5.20 per share. It is currently selling at $103.65 per share. Market: The market premium is 7.5%, and the risk-free rate of return is 2.5%. tax bracket = 35% Baron's WACC = % (Round your answer to two decimal places in percentage. For example, if your answer is 0.0547, input your answer as 5.47.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts