Question: Dont worry about answer. just follow proper calculation. mke it ASAP. I will accept your answer. Consider an individual who has the utility function given

Dont worry about answer. just follow proper calculation. mke it ASAP. I will accept your answer.

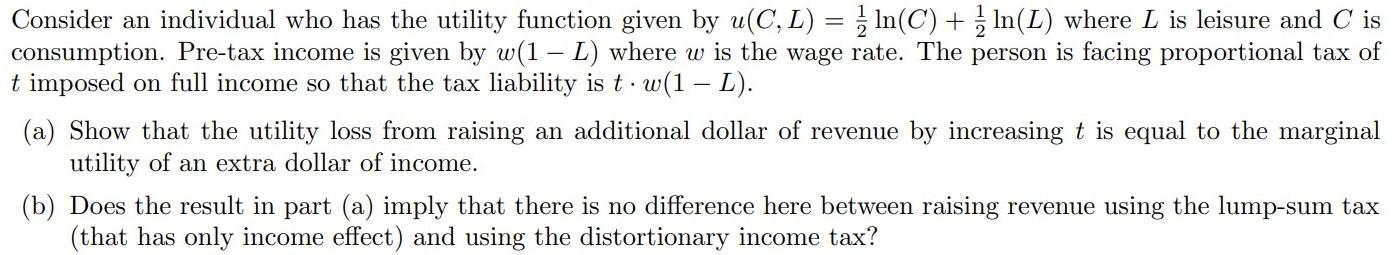

Consider an individual who has the utility function given by MC, L) = %ln(C) + %1n(L) where L is leisure and C is consumption. Pretax income is given by w(1 - L) where 'w is the wage rate. The person is facing proportional tax of t imposed on full income so that the tax liability is t - w(1 L). (a) Show that the utility loss from raising an additional dollar of revenue by increasing t is equal to the marginal utility of an extra dollar of income. (b) Does the result in part (a) imply that there is no difference here between raising revenue using the lumpsum tax (that has only income effect) and using the distortionary income tax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts