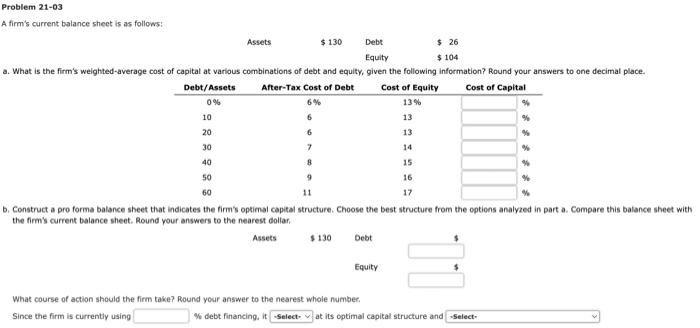

Question: Don't worry about the drop downs! $ 104 Problem 21-03 A firm's current balance sheet is as follows: Assets $ 130 Debt $ 26 Equity

$ 104 Problem 21-03 A firm's current balance sheet is as follows: Assets $ 130 Debt $ 26 Equity a. What is the firm's weighted-average cost of capital at various combinations of debt and equity, given the following information? Round your answers to one decimal place. Debt/Assets After-Tax Cost of Debt Cost of Equity Cost of Capital 0% 6% 13% 10 13 20 13 30 7 14 40 15 50 16 60 17 b. Construct a pro forma balance sheet that indicates the firm's optimal capital structure. Choose the best structure from the options analyzed in part a. Compare this balance sheet with the firm's current balance sheet. Round your answers to the nearest dollar Assets $ 130 Debt 6 Equity What course of action should the firm take? Round your answer to the nearest whole number Since the firm is currently using debt financing.it Select at its optimal capital structure and Select

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts