Question: don't write down the answer on paper Question 1 Consider the following information: Rate of return Stock A Stock B State of Economy Recession Normal

don't write down the answer on paper

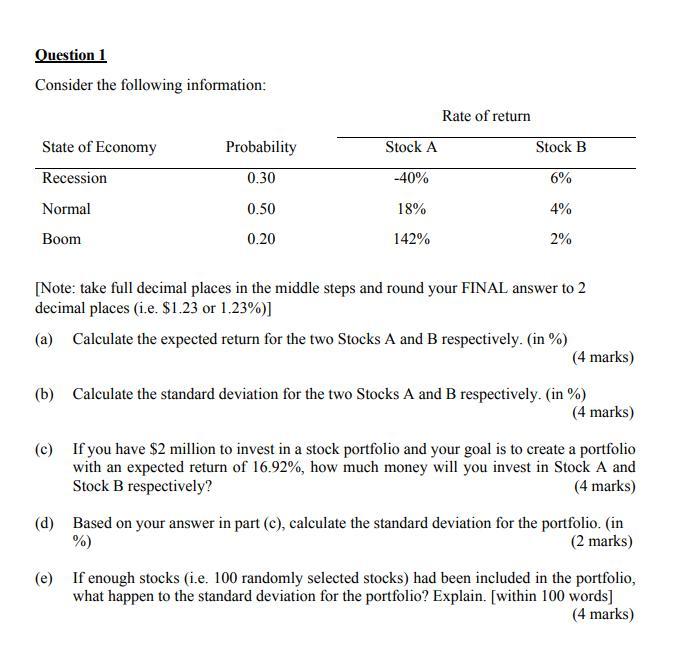

Question 1 Consider the following information: Rate of return Stock A Stock B State of Economy Recession Normal Probability 0.30 -40% 6% 0.50 18% 4% Boom 0.20 142% 2% [Note: take full decimal places in the middle steps and round your FINAL answer to 2 decimal places (i.e. $1.23 or 1.23%)] (a) Calculate the expected return for the two Stocks A and B respectively. (in %) (4 marks) (b) Calculate the standard deviation for the two Stocks A and B respectively. (in %) (4 marks) (c) If you have $2 million to invest in a stock portfolio and your goal is to create a portfolio with an expected return of 16.92%, how much money will you invest in Stock A and Stock B respectively? (4 marks) (d) Based on your answer in part (c), calculate the standard deviation for the portfolio. (in %) (2 marks) (e) If enough stocks (i.e. 100 randomly selected stocks) had been included in the portfolio, what happen to the standard deviation for the portfolio? Explain. [within 100 words] (4 marks) Question 1 Consider the following information: Rate of return Stock A Stock B State of Economy Recession Normal Probability 0.30 -40% 6% 0.50 18% 4% Boom 0.20 142% 2% [Note: take full decimal places in the middle steps and round your FINAL answer to 2 decimal places (i.e. $1.23 or 1.23%)] (a) Calculate the expected return for the two Stocks A and B respectively. (in %) (4 marks) (b) Calculate the standard deviation for the two Stocks A and B respectively. (in %) (4 marks) (c) If you have $2 million to invest in a stock portfolio and your goal is to create a portfolio with an expected return of 16.92%, how much money will you invest in Stock A and Stock B respectively? (4 marks) (d) Based on your answer in part (c), calculate the standard deviation for the portfolio. (in %) (2 marks) (e) If enough stocks (i.e. 100 randomly selected stocks) had been included in the portfolio, what happen to the standard deviation for the portfolio? Explain. [within 100 words] (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts