Question: Doohicky Devices. Doohicky Devices, Inc., manu- factures design components for personal computers. Until the present, manufacturing has been subcon- tracted to other companies, but for

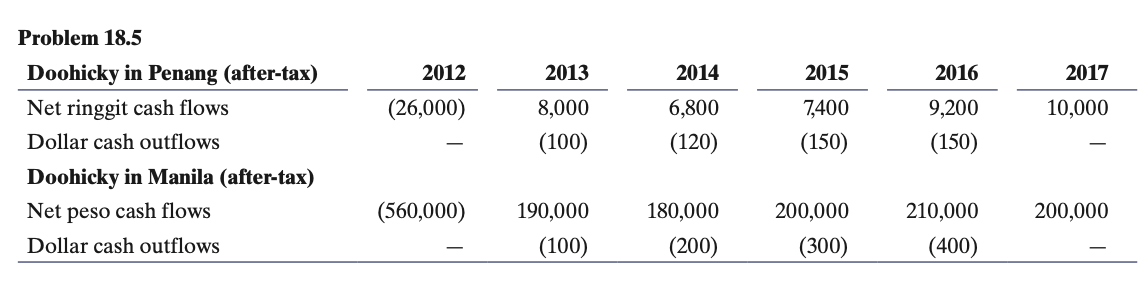

Doohicky Devices. Doohicky Devices, Inc., manu- factures design components for personal computers. Until the present, manufacturing has been subcon- tracted to other companies, but for reasons of qual- ity control Doohicky has decided to manufacture itself in Asia. Analysis has narrowed the choice to two possibilities, Penang, Malaysia, and Manila, the Philippines. At the moment only the summary of expected, after-tax, cash flows displayed at the bottom of this page is available. Although most operating outflows would be in Malaysian ringgit or Philippine pesos, some additional U.S. dollar cash outflows would be necessary, as shown in the table at the top of the next page.

The Malaysia ringgit currently trades at RM3.80/$ and the Philippine peso trades at Ps50.00/$. Doohicky expects the Malaysian ringgit to appreciate 2.0% per ear against the dollar, and the Philippine peso to depreciate 5.0% per year against the dollar. If the weighted average cost of capital for Doohicky Devices is 14.0%, which project looks most promising?

Problem 18.5 Problem 18.5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts