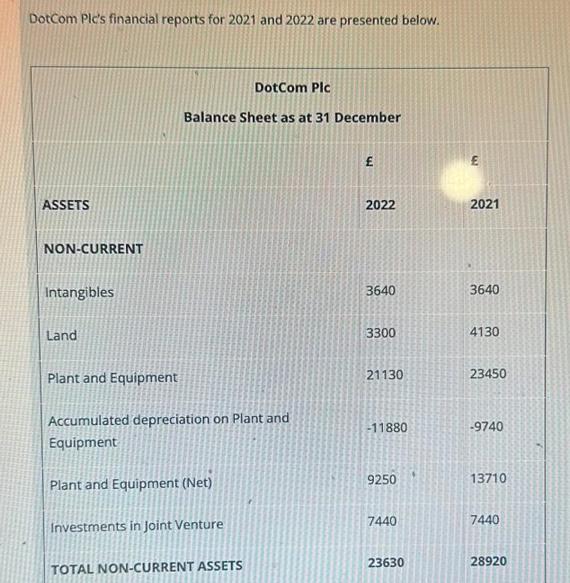

Question: DotCom Ple's financial reports for 2021 and 2022 are presented below. ASSETS NON-CURRENT Intangibles Land Plant and Equipment DotCom Pic Balance Sheet as at

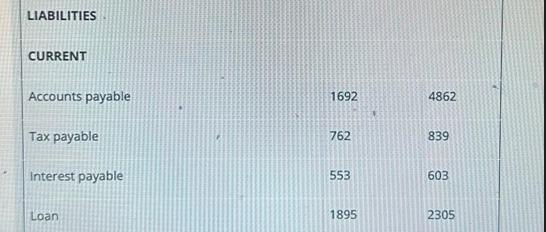

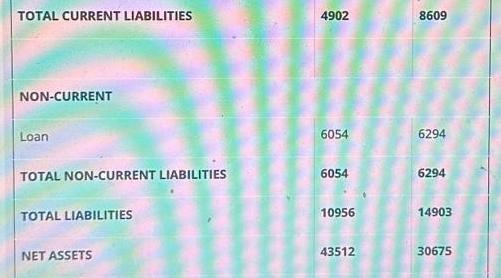

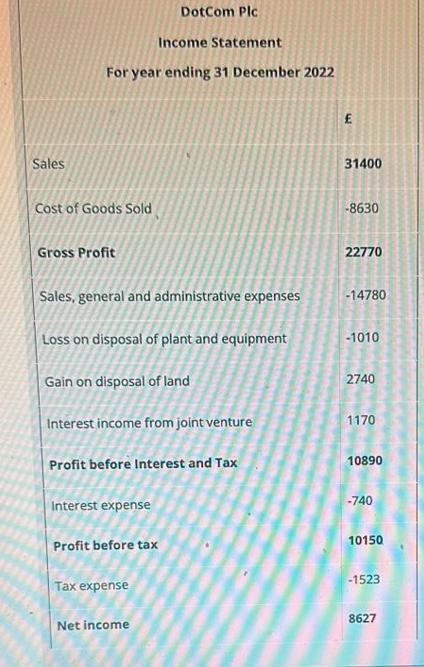

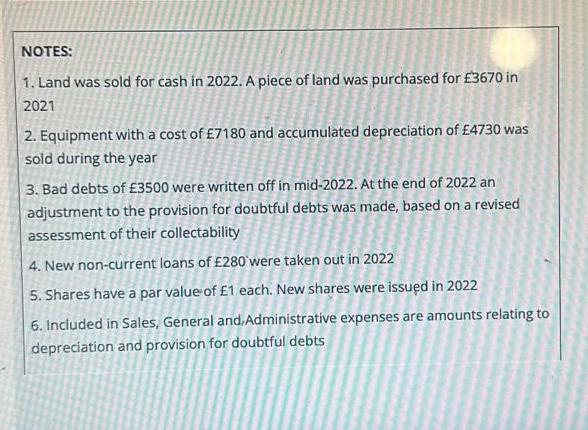

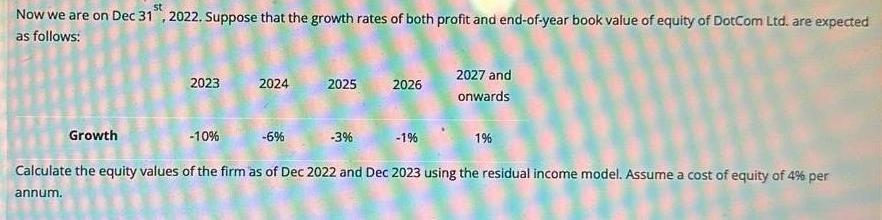

DotCom Ple's financial reports for 2021 and 2022 are presented below. ASSETS NON-CURRENT Intangibles Land Plant and Equipment DotCom Pic Balance Sheet as at 31 December Accumulated depreciation on Plant and Equipment Plant and Equipment (Net) Investments in Joint Venture TOTAL NON-CURRENT ASSETS 2022 3640 3300 21130 -11880 9250 7440 23630 E 2021 3640 4130 23450 -9740 13710 7440 28920 LIABILITIES CURRENT Accounts payable Tax payable Interest payable Loan 1692 762 553 1895 4862 839 603 2305 TOTAL CURRENT LIABILITIES NON-CURRENT Loan TOTAL NON-CURRENT LIABILITIES TOTAL LIABILITIES NET ASSETS 4902 6054 6054 10956 43512 8609 6294 6294 14903 30675 SHAREHOLDER EQUITY Share Capital Share Premium Reserve Shares held in Treasury Retained Earnings TOTAL SHAREHOLDER EQUITY 19143 10400 0 13969 43512 17943 6800 0 5932 30675 Sales DotCom Plc Income Statement For year ending 31 December 2022 Cost of Goods Sold Gross Profit Sales, general and administrative expenses Loss on disposal of plant and equipment Gain on disposal of land Interest income from joint venture Profit before Interest and Tax Interest expense Profit before tax Tax expense Net income 31400 -8630 22770 -14780 -1010 2740 1170 10890 -740 10150 -1523 8627 NOTES: 1. Land was sold for cash in 2022. A piece of land was purchased for 3670 in 2021 2. Equipment with a cost of 7180 and accumulated depreciation of 4730 was sold during the year 3. Bad debts of 3500 were written off in mid-2022. At the end of 2022 an adjustment to the provision for doubtful debts was made, based on a revised assessment of their collectability 4. New non-current loans of 280 were taken out in 2022 5. Shares have a par value of 1 each. New shares were issued in 2022 6. Included in Sales, General and Administrative expenses are amounts relating to depreciation and provision for doubtful debts Now we are on Dec 31, 2022. Suppose that the growth rates of both profit and end-of-year book value of equity of DotCom Ltd. are expected as follows: 2023 2024 -10% 2025 -6% Growth Calculate the equity values of the firm as of Dec 2022 and Dec 2023 using the residual income model. Assume a cost of equity of 4% per annum. 2026 -3% 2027 and onwards -1% 1%

Step by Step Solution

3.35 Rating (155 Votes )

There are 3 Steps involved in it

SOLUTION The residual income model is a method of valuing a company based on the amount of equity it has adjusted for the cost of that equity The mode... View full answer

Get step-by-step solutions from verified subject matter experts