Question: Double checking these to see if the answer circled is correct or not. Use the following information for the next 3 questions. Here is an

Double checking these to see if the answer circled is correct or not.

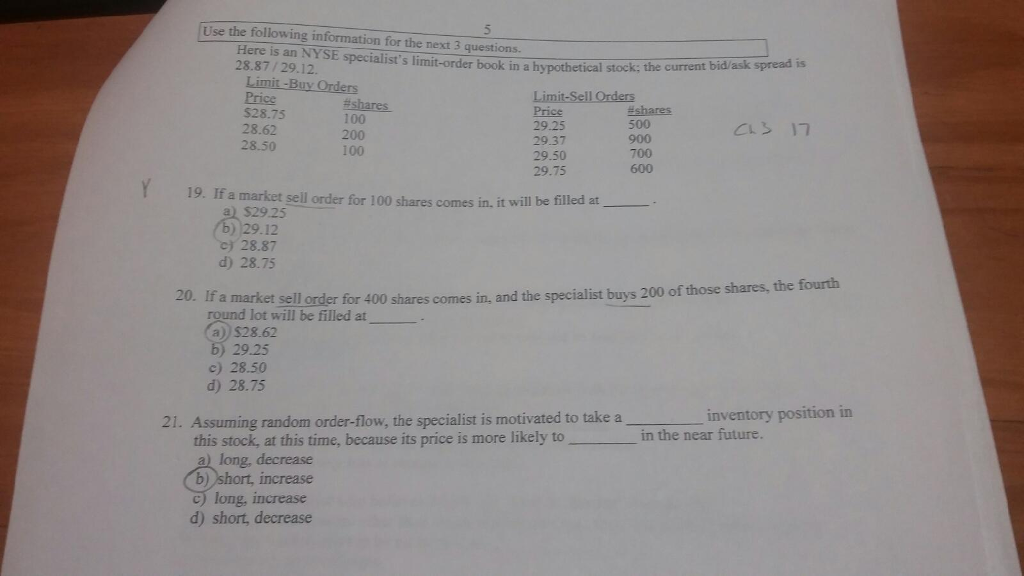

Use the following information for the next 3 questions. Here is an NYSE specialist's limit-order book in a hypothetical stock; the current 28.87/29.12. bid/ask spread is Buy Orders Price $28.75 28.62 28.50 shares- 100 200 100 Limit-Sell Orders Price 29.25 29.37 29.50 29.75 eshares 900 700 600 19. If a market sell order for 100 shares comes in. it will be filled at- a) $2925 ) 129.12 c) 28.87 d) 28.75 sell order for 400 shares comes in, and the specialist buvs 200 of those shares, the fourth round lot will be filled at a)) $28.62 b) 29.25 c) 28.50 d) 28.75 21. Assuming random order-flow, the specialist is motivated to take a inventory position in the near future. this stock, at this time, because its price is more likely toin a) long, decrease b) short, increase ) long, increase d) short, decrease

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts