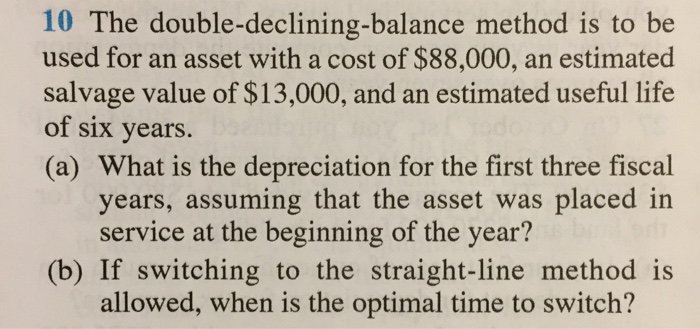

Question: Double-Declining Method and Straight Line Methods The double-declining-balance method is to be used for an asset with a cost of $ 88,000, an estimated salvage

The double-declining-balance method is to be used for an asset with a cost of $ 88,000, an estimated salvage value of $ 13,000, and an estimated useful life of six years. What is the depreciation for the first three fiscal years, assuming that the asset was placed in service at the beginning of the year? If switching to the straight-line method is allowed, when is the optimal time to switch

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts