Question: Download the attached excel template. You will require it for the next three questions. Excel file download: Lending to Complex Structures - Liquidation_Scenerio (BLANK).xlsx Assume

Download the attached excel template. You will require it for the next three questions. Excel file download: Lending to Complex Structures - Liquidation_Scenerio (BLANK).xlsx Assume a net realizable value of 50% on the liquidation of assets for the chained group. Also, assume that the liabilities would be paid out pari passu upon liquidation.

Assuming you were to lend into Real Estate Ltd., which of the following would likely be the most effective credit risk mitigation strategy?

Requiring no security on the loan.

Requiring the assets of Real Estate Ltd. to be pledged as security.

A cross-stream guarantee from Assembler Ltd.

A personal guarantee from Parental Ltd.s sole shareholder, who resides in a foreign jurisdiction.

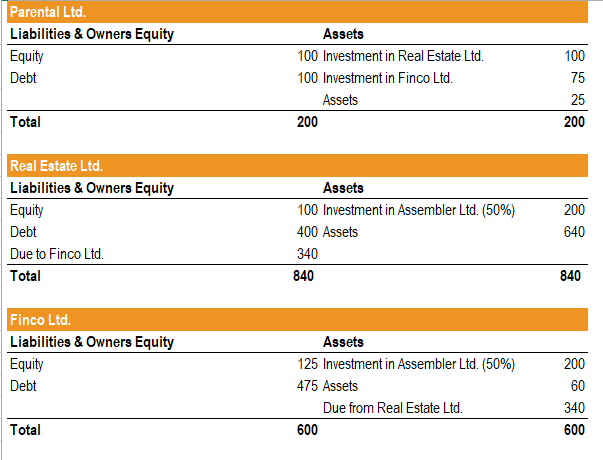

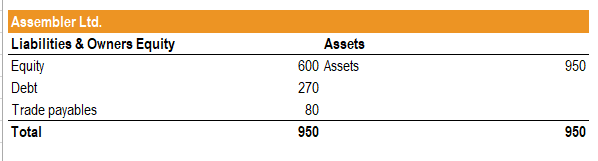

Parental Ltd. Liabilities & Owners Equity Equity Debt Assets 100 Investment in Real Estate Ltd. 100 Investment in Finco Ltd. Assets 200 100 75 25 200 Total Real Estate Ltd. Liabilities & Owners Equity Equity Debt Due to Finco Ltd. Total Assets 100 Investment in Assembler Ltd. (50%) 400 Assets 340 840 200 640 840 Finco Ltd. Liabilities & Owners Equity Equity Debt Assets 125 Investment in Assembler Ltd. (50%) 475 Assets Due from Real Estate Ltd. 200 60 340 600 Total 600 950 Assembler Ltd. Liabilities & Owners Equity Equity Debt Trade payables Total Assets 600 Assets 270 80 950 950

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts