Question: DPM 3 2 0 1 Public Programme Planning Worksheet You have the opportunity to purchase office equipment for $ 2 0 0 , 0 0

DPM Public Programme Planning Worksheet

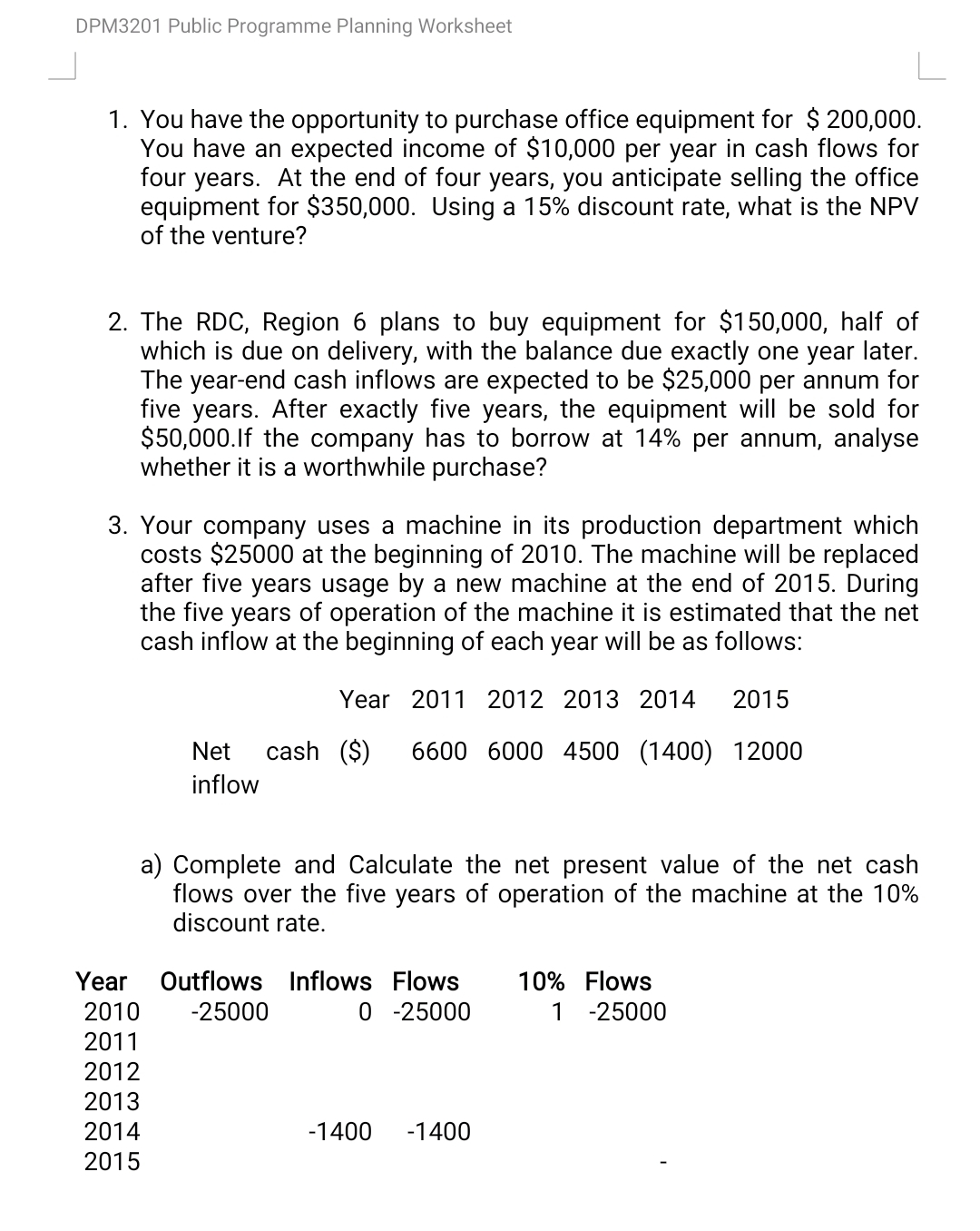

You have the opportunity to purchase office equipment for $ You have an expected income of $ per year in cash flows for four years. At the end of four years, you anticipate selling the office equipment for $ Using a discount rate, what is the NPV of the venture?

The RDC Region plans to buy equipment for $ half of which is due on delivery, with the balance due exactly one year later. The yearend cash inflows are expected to be $ per annum for five years. After exactly five years, the equipment will be sold for $ If the company has to borrow at per annum, analyse whether it is a worthwhile purchase?

Your company uses a machine in its production department which costs $ at the beginning of The machine will be replaced after five years usage by a new machine at the end of During the five years of operation of the machine it is estimated that the net cash inflow at the beginning of each year will be as follows:

tableYear,Net cash $inflow

a Complete and Calculate the net present value of the net cash flows over the five years of operation of the machine at the discount rate.

tableYearOutflows,Inflows,Flows,Flows

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock