Question: DQuestion 7 1.5 pts Hedgers always keep their position open until the contract delivery date, not the date they buy the commodity if they engage

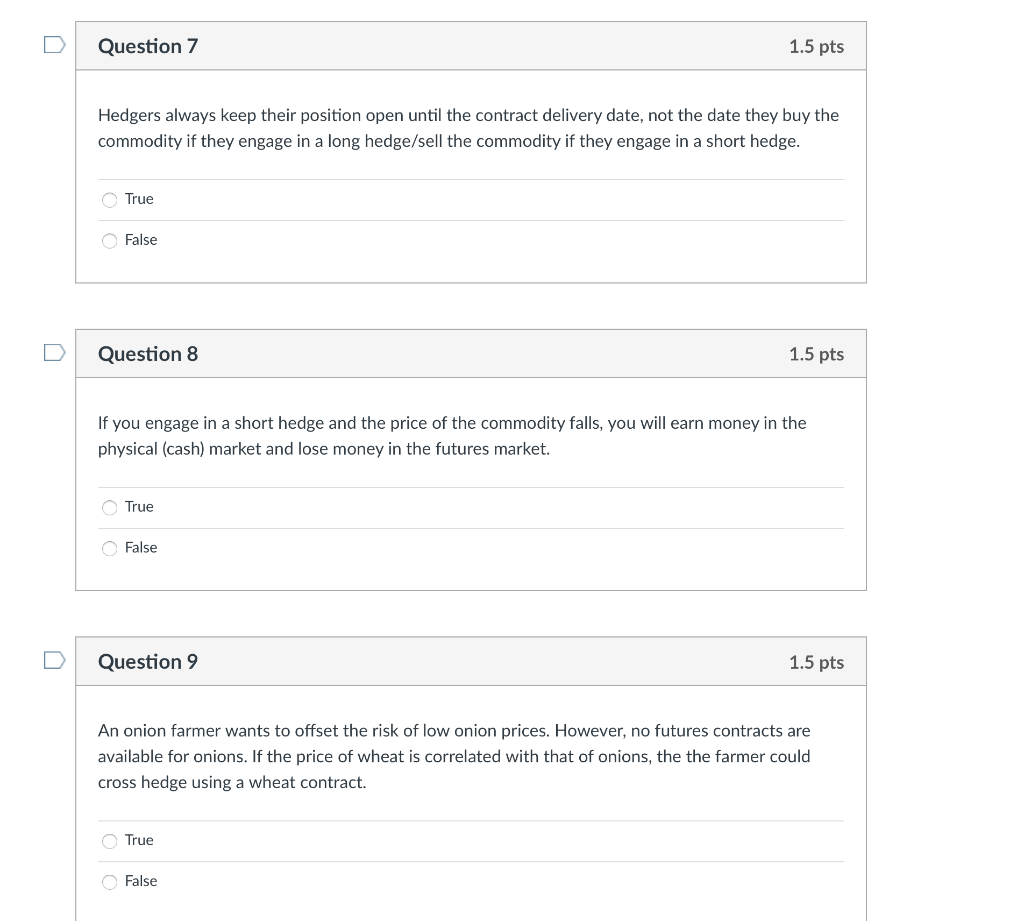

DQuestion 7 1.5 pts Hedgers always keep their position open until the contract delivery date, not the date they buy the commodity if they engage in a long hedge/sell the commodity if they engage in a short hedge. True False D Question 8 1.5 pts If you engage in a short hedge and the price of the commodity falls, you will earn money in the physical (cash) market and lose money in the futures market. True False D Question 9 1.5 pts An onion farmer wants to offset the risk of low onion prices. However, no futures contracts are available for onions. If the price of wheat is correlated with that of onions, the the farmer could cross hedge using a wheat contract. True False D Question 10 1.5 pts A food processor who needs to offset the risk of high corn prices should open a short position in the futures market. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts