Question: Dr. Atsu.pdf - Adobe Acrobat Reader DC (64-bit) File Edit View Sign Window Help Home Tools ustom... design ... division ... 216 Year 2018 2019

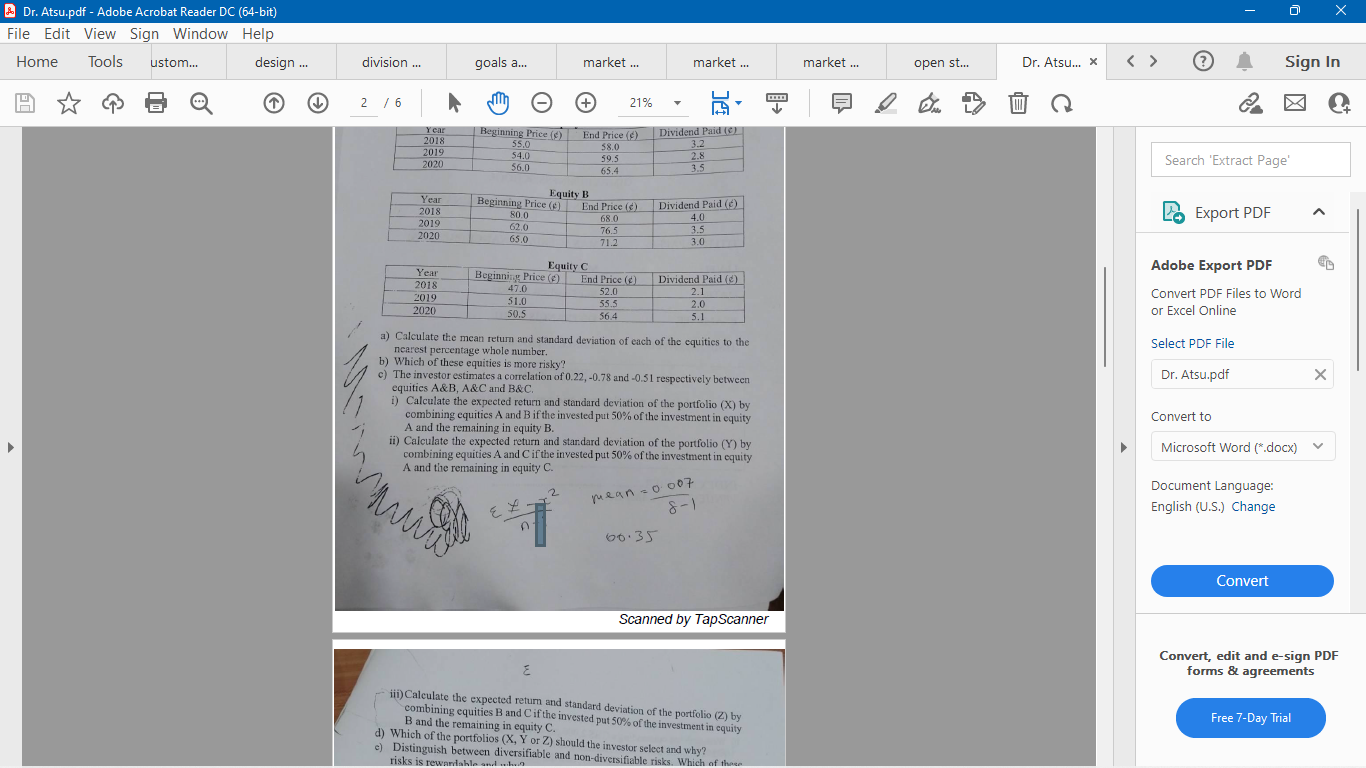

Dr. Atsu.pdf - Adobe Acrobat Reader DC (64-bit) File Edit View Sign Window Help Home Tools ustom... design ... division ... 216 Year 2018 2019 2020 Year 2018 2019 2020 Year 2018 2019 2020 goals a... | Beginning Price (e) End Price () 58.0 59.5 65.4 55.0 54.0 56.0 Equity B Beginning Price (e) End Price () 68.0 76.5 71.2 80.0 62.0 65.0 market... Beginning Price (e) 47.0 51.0 50.5 www 21% Equity C End Price () 52.0 55.5 56.4 market... H Dividend Paid (e) 3.2 2.8 3.5 Dividend Paid (e) 4.0 3.5 3.0 a) Calculate the mean return and standard deviation of each of the equities to the nearest percentage whole number. b) Which of these equities is more risky? Dividend Paid (e) 2.1 2.0 5.1 c) The investor estimates a correlation of 0.22, -0.78 and -0.51 respectively between equitics A&B, A&C and B&C. 60.35 i) Calculate the expected return and standard deviation of the portfolio (X) by combining equities A and B if the invested put 50% of the investment in equity A and the remaining in equity B. ii) Calculate the expected return and standard deviation of the portfolio (Y) by combining equities A and C if the invested put 50% of the investment in equity A and the remaining in equity C. 1 mean = 0007 8-1 Scanned by TapScanner E iii) Calculate the expected return and standard deviation of the portfolio (2) by combining equities B and C if the invested put 50% of the investment in equity B and the remaining in equity C. d) Which of the portfolios (X, Y or Z) should the investor select and why? e) Distinguish between diversifiable and non-diversifiable risks. Which of these risks is rewardable and Je market... D open st... Dr. Atsu... x Search 'Extract Page' PExport PDF Adobe Export PDF Convert PDF Files to Word or Excel Online Select PDF File Dr. Atsu.pdf Sign In Convert to Microsoft Word (*.docx) Document Language: English (U.S.) Change Convert X Free 7-Day Trial x V Convert, edit and e-sign PDF forms & agreements Dr. Atsu.pdf - Adobe Acrobat Reader DC (64-bit) File Edit View Sign Window Help Home Tools ustom... design ... division ... 216 Year 2018 2019 2020 Year 2018 2019 2020 Year 2018 2019 2020 goals a... | Beginning Price (e) End Price () 58.0 59.5 65.4 55.0 54.0 56.0 Equity B Beginning Price (e) End Price () 68.0 76.5 71.2 80.0 62.0 65.0 market... Beginning Price (e) 47.0 51.0 50.5 www 21% Equity C End Price () 52.0 55.5 56.4 market... H Dividend Paid (e) 3.2 2.8 3.5 Dividend Paid (e) 4.0 3.5 3.0 a) Calculate the mean return and standard deviation of each of the equities to the nearest percentage whole number. b) Which of these equities is more risky? Dividend Paid (e) 2.1 2.0 5.1 c) The investor estimates a correlation of 0.22, -0.78 and -0.51 respectively between equitics A&B, A&C and B&C. 60.35 i) Calculate the expected return and standard deviation of the portfolio (X) by combining equities A and B if the invested put 50% of the investment in equity A and the remaining in equity B. ii) Calculate the expected return and standard deviation of the portfolio (Y) by combining equities A and C if the invested put 50% of the investment in equity A and the remaining in equity C. 1 mean = 0007 8-1 Scanned by TapScanner E iii) Calculate the expected return and standard deviation of the portfolio (2) by combining equities B and C if the invested put 50% of the investment in equity B and the remaining in equity C. d) Which of the portfolios (X, Y or Z) should the investor select and why? e) Distinguish between diversifiable and non-diversifiable risks. Which of these risks is rewardable and Je market... D open st... Dr. Atsu... x Search 'Extract Page' PExport PDF Adobe Export PDF Convert PDF Files to Word or Excel Online Select PDF File Dr. Atsu.pdf Sign In Convert to Microsoft Word (*.docx) Document Language: English (U.S.) Change Convert X Free 7-Day Trial x V Convert, edit and e-sign PDF forms & agreements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts