Question: DR . E . Brown Enterprises offers 2 4 hour scientific services and is in need of new equipment. Use the following dashboard to answer

DREBrown Enterprises offers hour scientific services and is in need of new equipment. Use the following dashboard to answer the questions based on the tax rules. In order to update the model, change the variables as follows:

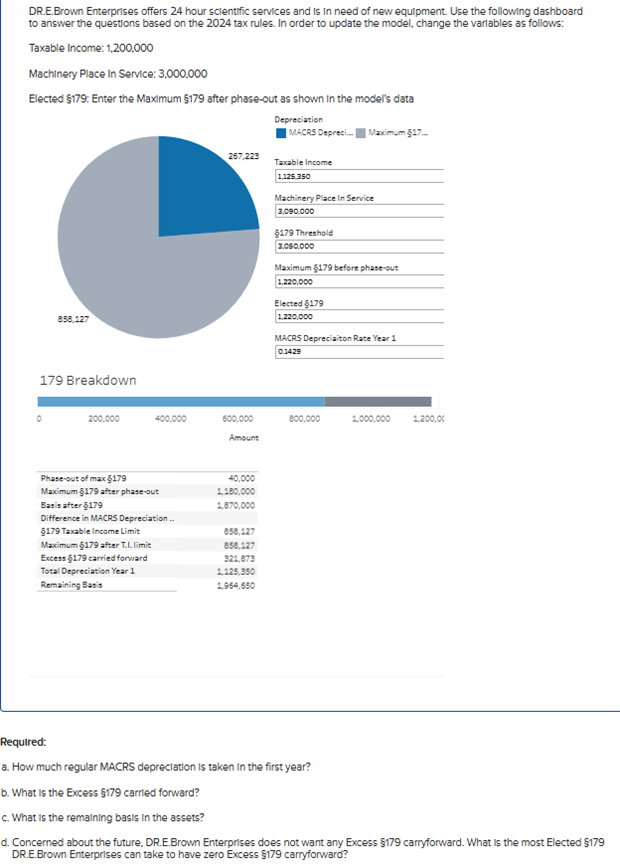

Taxable Income:

Machinery Place In Service:

Elected : Enter the Maximum after phaseout as shown in the model's data

Required:

a How much regular MACRS depreciation is taken in the first year?

b What is the Excess carried forward?

c What is the remaining basis in the assets?

d Concerned about the future, DREBrown Enterprises does not want any Excess carryforward. What is the most Elected DREBrown Enterprises can take to have zero Excess carryforward?

DREBrown Enterprises offers hour scientific services and is in need of new equipment. Use the following dashboard to answer the questions based on the tax rules. In order to update the model, change the varlables as follows:

Taxable Income:

Machinery Place In Service:

Elected $: Enter the Maximum $ after phaseout as shown In the model's data

Depreciation

square MACRS Depreci Maximum

Taxable Income

Machinery Place In Service

Threshold

Maximum $ before phaseou:

Elected $

MACRS Depreciaiton Rate Year

Breakdown

Required:

a How much regular MACRS depreciation is taken in the first year?

b What is the Excess $ carried forward?

c What is the remaining basis in the assets?

d Concerned about the future, DREBrown Enterprises does not want any Excess $ carryforward. What is the most Elected $ DREBrown Enterprises can take to have zero Excess $ carryforward?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock