Question: Dr. Smith started Biotech Inc. (BTE). on October 1, 2020. On October 1, 2020, BTE issued 100 common shares to Dr. Smith in exchange for

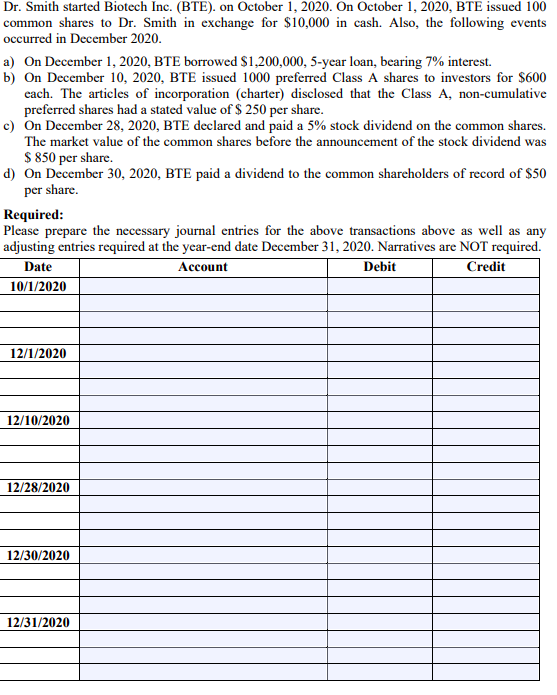

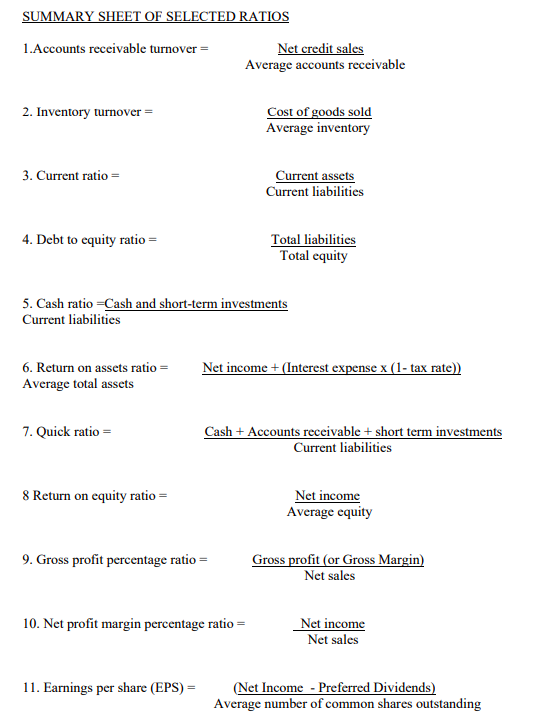

Dr. Smith started Biotech Inc. (BTE). on October 1, 2020. On October 1, 2020, BTE issued 100 common shares to Dr. Smith in exchange for $10,000 in cash. Also, the following events occurred in December 2020. a) On December 1, 2020, BTE borrowed $1,200,000, 5-year loan, bearing 7% interest. b) On December 10, 2020, BTE issued 1000 preferred Class A shares to investors for $600 each. The articles of incorporation (charter) disclosed that the Class A, non-cumulative preferred shares had a stated value of $ 250 per share. c) On December 28, 2020, BTE declared and paid a 5% stock dividend on the common shares. The market value of the common shares before the announcement of the stock dividend was $ 850 per share. d) On December 30, 2020, BTE paid a dividend to the common shareholders of record of $50 per share. Required: Please prepare the necessary journal entries for the above transactions above as well as any adjusting entries required at the year-end date December 31, 2020. Narratives are NOT required. Date Account Debit Credit 10/1/2020 12/1/2020 12/10/2020 12/28/2020 12/30/2020 12/31/2020 SUMMARY SHEET OF SELECTED RATIOS 1.Accounts receivable turnover Net credit sales Average accounts receivable 2. Inventory turnover Cost of goods sold Average inventory 3. Current ratio = Current assets Current liabilities 4. Debt to equity ratio= Total liabilities Total equity 5. Cash ratio=Cash and short-term investments Current liabilities 6. Return on assets ratio = Average total assets Net income + (Interest expense x (1- tax rate)) 7. Quick ratio = Cash + Accounts receivable + short term investments Current liabilities 8 Return on equity ratio = Net income Average equity 9. Gross profit percentage ratio = Gross profit (or Gross Margin) Net sales 10. Net profit margin percentage ratio Net income Net sales 11. Earnings per share (EPS) = (Net Income - Preferred Dividends) Average number of common shares outstanding

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts