Question: Dr. Wang Part I: Multiple Choice. Choose the one alternative that best completes the statement or answers the question. (1.5 7-10.5) 1. Titans has 7

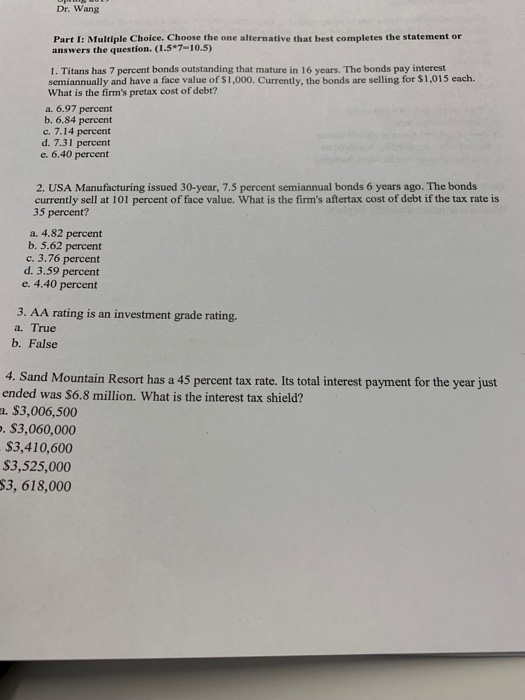

Dr. Wang Part I: Multiple Choice. Choose the one alternative that best completes the statement or answers the question. (1.5 7-10.5) 1. Titans has 7 percent bonds outstanding that mature in 16 years. The bonds pay interest semiannually and have a face value of $1,000. Currently, the bonds are selling for $1,015 each. What is the firm's pretax cost of debt? a. 6.97 percent b. 6.84 percent c. 7.14 percent d. 7.31 percent e. 6.40 percent 2. USA Manufacturing issued 30-year, 7.5 percent semiannual bonds 6 years ago. The bonds currently sell at 101 percent of face value. What is the firm's aftertax cost of debt if the tax rate is 35 percent? a. 4.82 percent b. 5.62 percent c. 3.76 percent d. 3.59 percent e. 4.40 percent 3. AA rating is an investment grade rating. a. True b. False 4. Sand Mountain Resort has a 45 percent tax rate. Its total interest payment for the year just ended was $6.8 million. What is the interest tax shield? a. $3,006,500 . $3,060,000 $3,410,600 $3,525,000 3, 618,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts