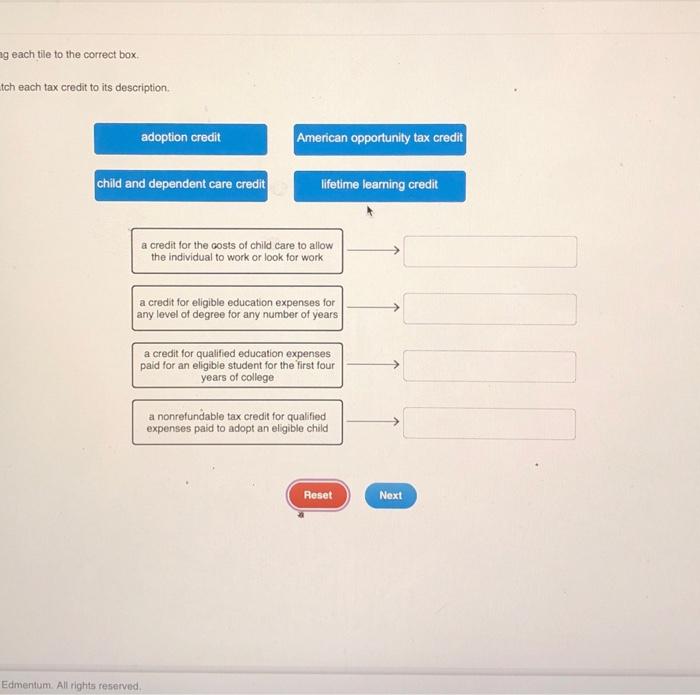

Question: Drag each tile to the correct box. tch each tax credit to its description. adoption credit child and dependent care credit American opportunity tax credit

Drag each tile to the correct box. tch each tax credit to its description. adoption credit child and dependent care credit American opportunity tax credit lifetime learning credit a credit for the costs of child care to allow the individual to work or look for work a credit for eligible education expenses for any level of degree for any number of years Edmentum. All rights reserved. a credit for qualified education expenses paid for an eligible student for the first four years of college a nonrefundable tax credit for qualified expenses paid to adopt an eligible child Reset Next

ig each tile to the correct box. tch each tax credit to its description. a credit for qualified education expenses paid for an eligible student for the first four years of college a nonrefundable tax credit for qualified expenses paid to adopt an eligible child ig each tile to the correct box. tch each tax credit to its description. a credit for qualified education expenses paid for an eligible student for the first four years of college a nonrefundable tax credit for qualified expenses paid to adopt an eligible child

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock