Question: Drag the words into the correct boxes - A tangible resource that is held for resale in the normal course of operations. A recording system

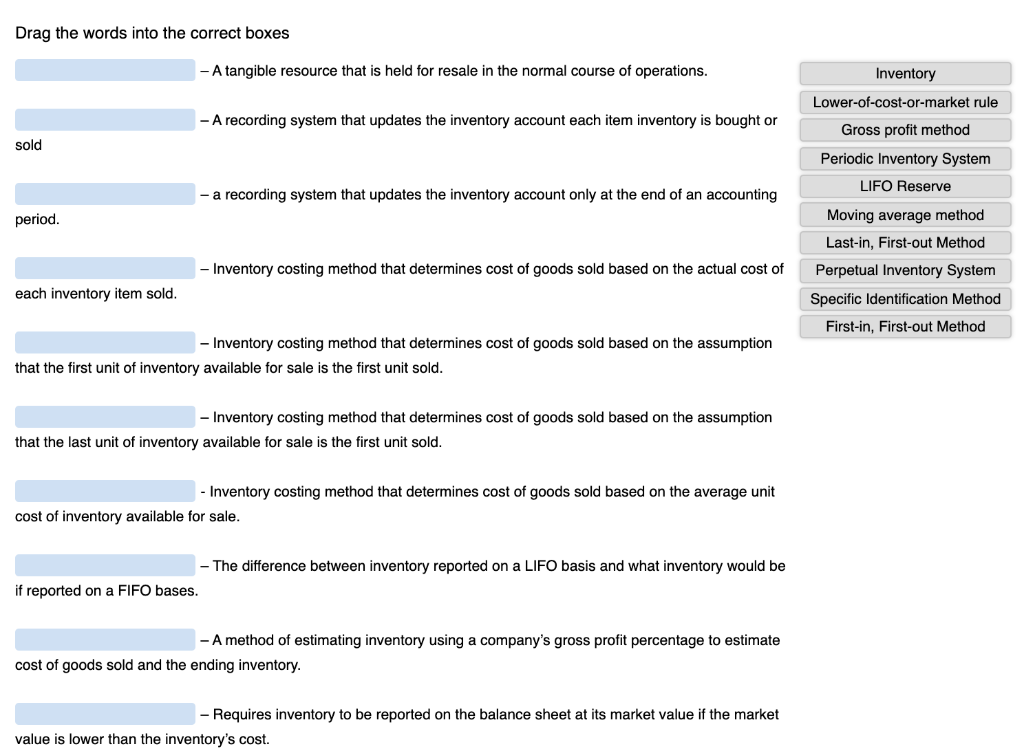

Drag the words into the correct boxes - A tangible resource that is held for resale in the normal course of operations. A recording system that updates the inventory account each item inventory is bought or Inventory Lower-of-cost-or-market rule Gross profit method Periodic Inventory System LIFO Reserve sold - a recording system that updates the inventory account only at the end of an accounting period. Moving average method Last-in, First-out Method Perpetual Inventory System Specific Identification Method - Inventory costing method that determines cost of goods sold based on the actual cost of each inventory item sold. First-in, First-out Method - Inventory costing method that determines cost of goods sold based on the assumption that the first unit of inventory available for sale is the first unit sold. - Inventory costing method that determines cost of goods sold based on the assumption that the last unit of inventory available for sale is the first unit sold. - Inventory costing method that determines cost of goods sold based on the average unit cost of inventory available for sale. - The difference between inventory reported on a LIFO basis and what inventory would be if reported on a FIFO bases. - A method of estimating inventory using a company's gross profit percentage to estimate cost of goods sold and the ending inventory. - Requires inventory to be reported on the balance sheet at its market value if the market value is lower than the inventory's cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts