Question: Draw a suitable columnar form and, using appropriate basis, distribute the overhead costs over the cost centers. percentages as follows: Question: COST CENTRES A factory

Draw a suitable columnar form and, using appropriate basis, distribute the overhead costs over the cost centers.

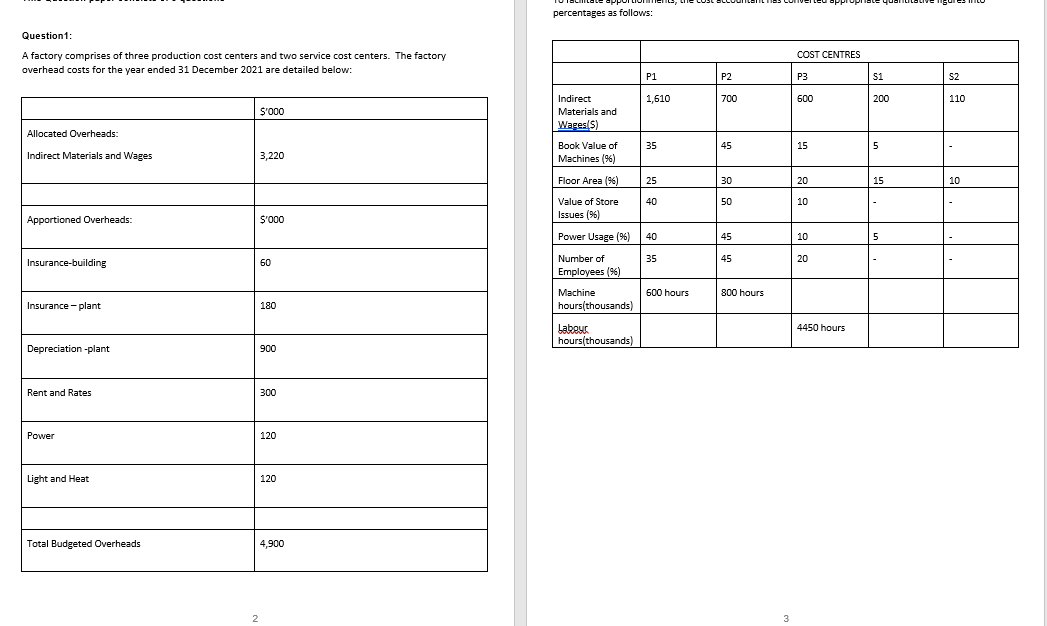

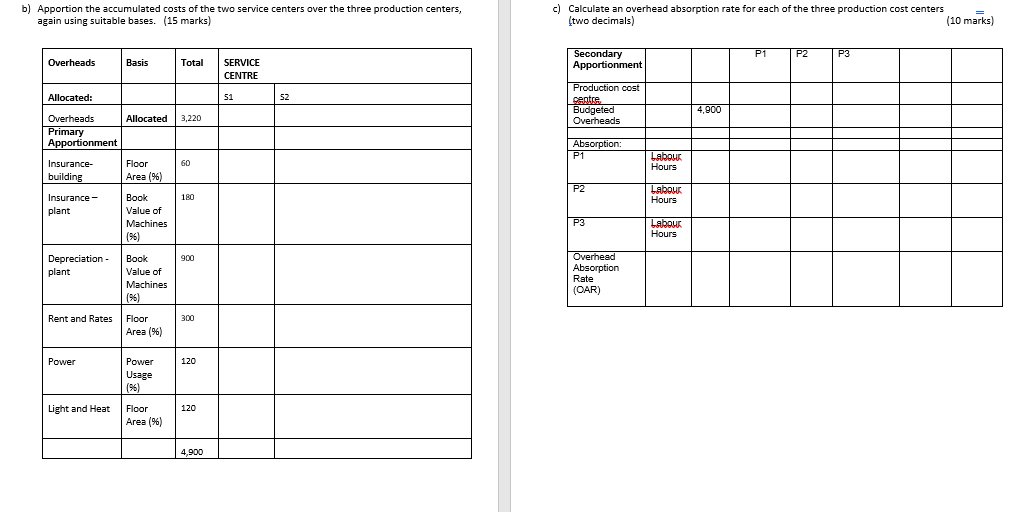

percentages as follows: Question: COST CENTRES A factory comprises of three production cost centers and two service cost centers. The factory overhead costs for the year ended 31 December 2021 are detailed below: P1 P2 P3 S1 S2 1,610 700 600 200 110 S'000 Allocated Overheads: Indirect Materials and Wages/s) Book Value of Machines (96) 35 45 15 5 Indirect Materials and Wages 3,220 Floor Area 96) 25 30 20 15 10 40 50 10 Value of Store Issues (96) Apportioned Overheads: S'000 Power Usage (%) 40 45 10 5 Insurance-building 60 35 45 20 Number of Employees (96) Machine hours thousands 600 hours 800 hours Insurance-plant 180 4450 hours Labour hours(thousands) Depreciation -plant 900 Rent and Rates 300 Power 120 Light and Heat 120 Total Budgeted Overheads 4,900 2 3 b) Apportion the accumulated costs of the two service centers over the three production centers, again using suitable bases. (15 marks) c) Calculate an overhead absorption rate for each of the three production cost centers (two decimals) (10 marks) P1 P2 P3 Overheads Basis Total SERVICE CENTRE Secondary Apportionment Allocated: 51 SZ Production cost centre Budgeted Overheads 4,900 Allocated 3,220 Overheads Primary Apportionment Insurance building Absorption: P1 60 Floor Area(96) Labour Hours P2 180 Insurance plant Labour Hours Book Value of Machines (96) P3 Labour Hours 900 Depreciation - plant Book Value of Machines (95) Overhead Absorption Rate (OAR) Rent and Rates 300 Floor Area (%) Power 120 Power Usage (96) Light and Heat 120 Floor Area (%) 4,900 percentages as follows: Question: COST CENTRES A factory comprises of three production cost centers and two service cost centers. The factory overhead costs for the year ended 31 December 2021 are detailed below: P1 P2 P3 S1 S2 1,610 700 600 200 110 S'000 Allocated Overheads: Indirect Materials and Wages/s) Book Value of Machines (96) 35 45 15 5 Indirect Materials and Wages 3,220 Floor Area 96) 25 30 20 15 10 40 50 10 Value of Store Issues (96) Apportioned Overheads: S'000 Power Usage (%) 40 45 10 5 Insurance-building 60 35 45 20 Number of Employees (96) Machine hours thousands 600 hours 800 hours Insurance-plant 180 4450 hours Labour hours(thousands) Depreciation -plant 900 Rent and Rates 300 Power 120 Light and Heat 120 Total Budgeted Overheads 4,900 2 3 b) Apportion the accumulated costs of the two service centers over the three production centers, again using suitable bases. (15 marks) c) Calculate an overhead absorption rate for each of the three production cost centers (two decimals) (10 marks) P1 P2 P3 Overheads Basis Total SERVICE CENTRE Secondary Apportionment Allocated: 51 SZ Production cost centre Budgeted Overheads 4,900 Allocated 3,220 Overheads Primary Apportionment Insurance building Absorption: P1 60 Floor Area(96) Labour Hours P2 180 Insurance plant Labour Hours Book Value of Machines (96) P3 Labour Hours 900 Depreciation - plant Book Value of Machines (95) Overhead Absorption Rate (OAR) Rent and Rates 300 Floor Area (%) Power 120 Power Usage (96) Light and Heat 120 Floor Area (%) 4,900

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts