Question: Draw and label the Efficient Frontier and CAL for this case in the space below. And also label the following points A. All Bonds B.

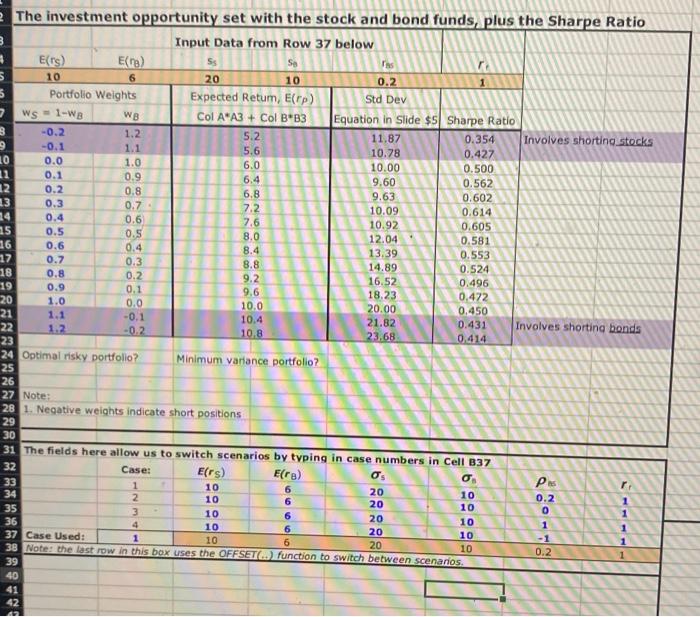

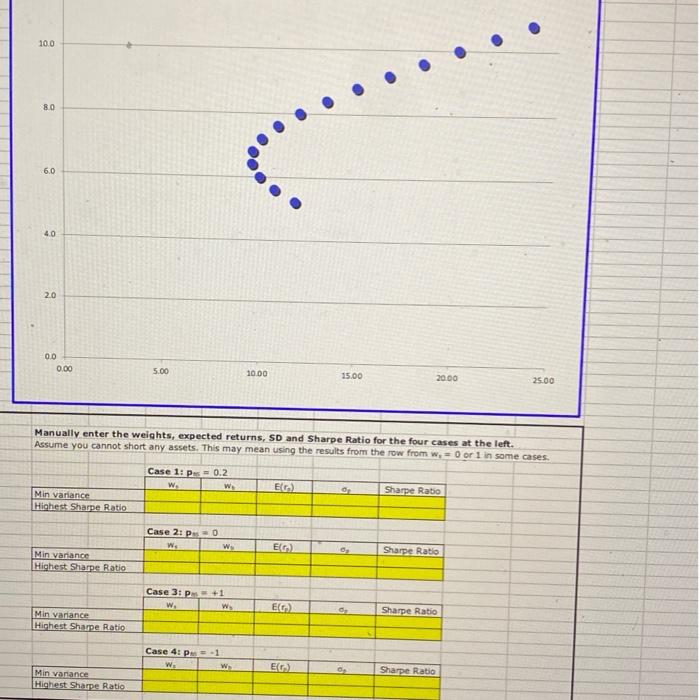

Draw and label the Efficient Frontier and CAL for this case in the space below. And also label the following points A. All Bonds B. All Stocks C. Risk-free rate D. Optimal Risky Portfolio B. Capital Allocation Line (30 points) The investment opportunity set with the stock and bond funds, plus the Sharpe Ratio Input Data from Row 37 below Optimai risky portfolio? Minimum variance portfolio? Note: 1. Negative weights indicate short positions The fields here allow us to switch scenarios by typing in case numbers in Cell B37 \begin{tabular}{|l|c|c|c|c|c|} \hline & Case: & E(rS) & E(rB) & 5 & B \\ \hline & 1 & 10 & 6 & 20 & 10 \\ \hline & 2 & 10 & 6 & 20 & 10 \\ \hline & 3 & 10 & 6 & 20 & 10 \\ \hline & 4 & 10 & 6 & 20 & 10 \\ \hline Case Used: & 1 & 10 & 6 & 20 & 10 \\ \hline \end{tabular} Manually enter the weights, expected returns, SD and Sharpe Ratio for the four cases at the left. Assume you cannot short any assets. This may mean using the results from the row from w, =0 or 1 in some cases

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts