Question: draw cashflow diagram please Q4) (20 Points) Three mutually exclusive alterative are being considered Initial Cost Benefit at the end of the first Year Uniform

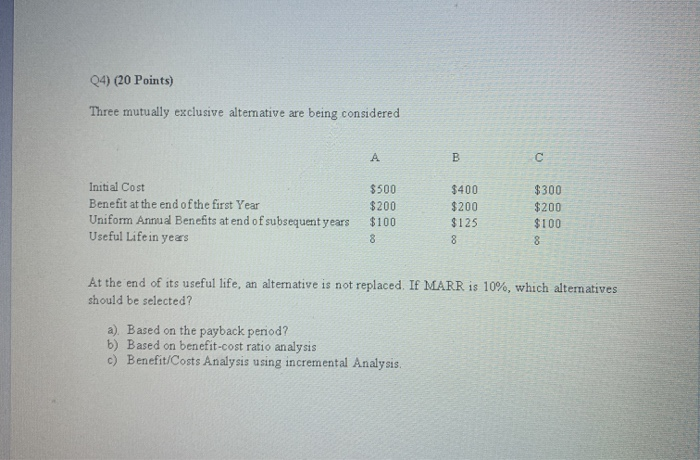

Q4) (20 Points) Three mutually exclusive alterative are being considered Initial Cost Benefit at the end of the first Year Uniform Annual Benefits at end of subsequent years Useful Life in years $500 $200 $100 $400 $200 $125 $300 $200 $100 At the end of its useful life, an alternative is not replaced. If MARR is 10%, which alternatives should be selected? a). Based on the payback period? b) Based on benefit-cost ratio analysis c) Benefit Costs Analysis using incremental Analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts