Question: Draw Design Layout References Mailings Review View Help Comments 60 Vi Question 1 Samantha was born in the United Kingdom but moved to Australia with

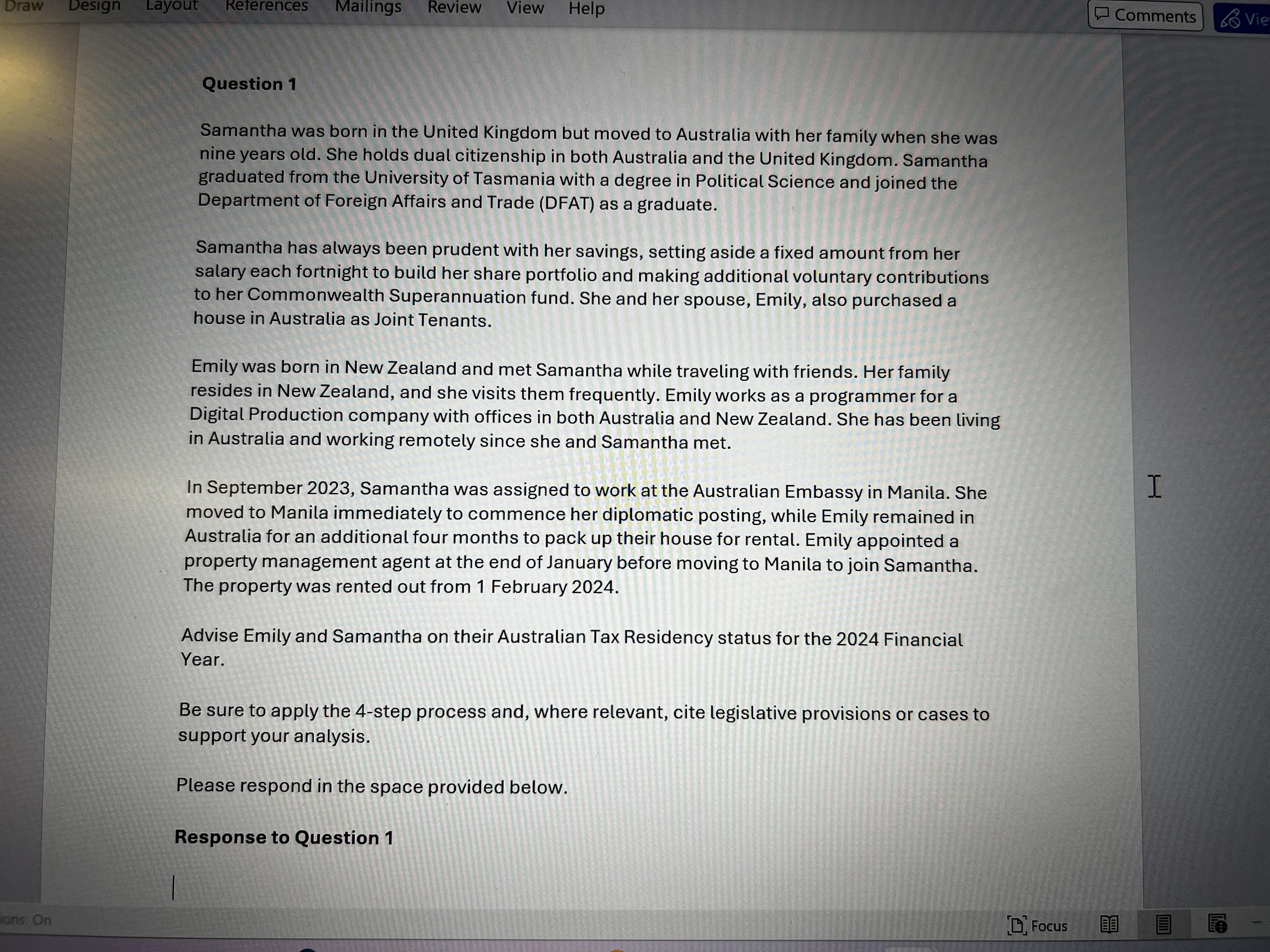

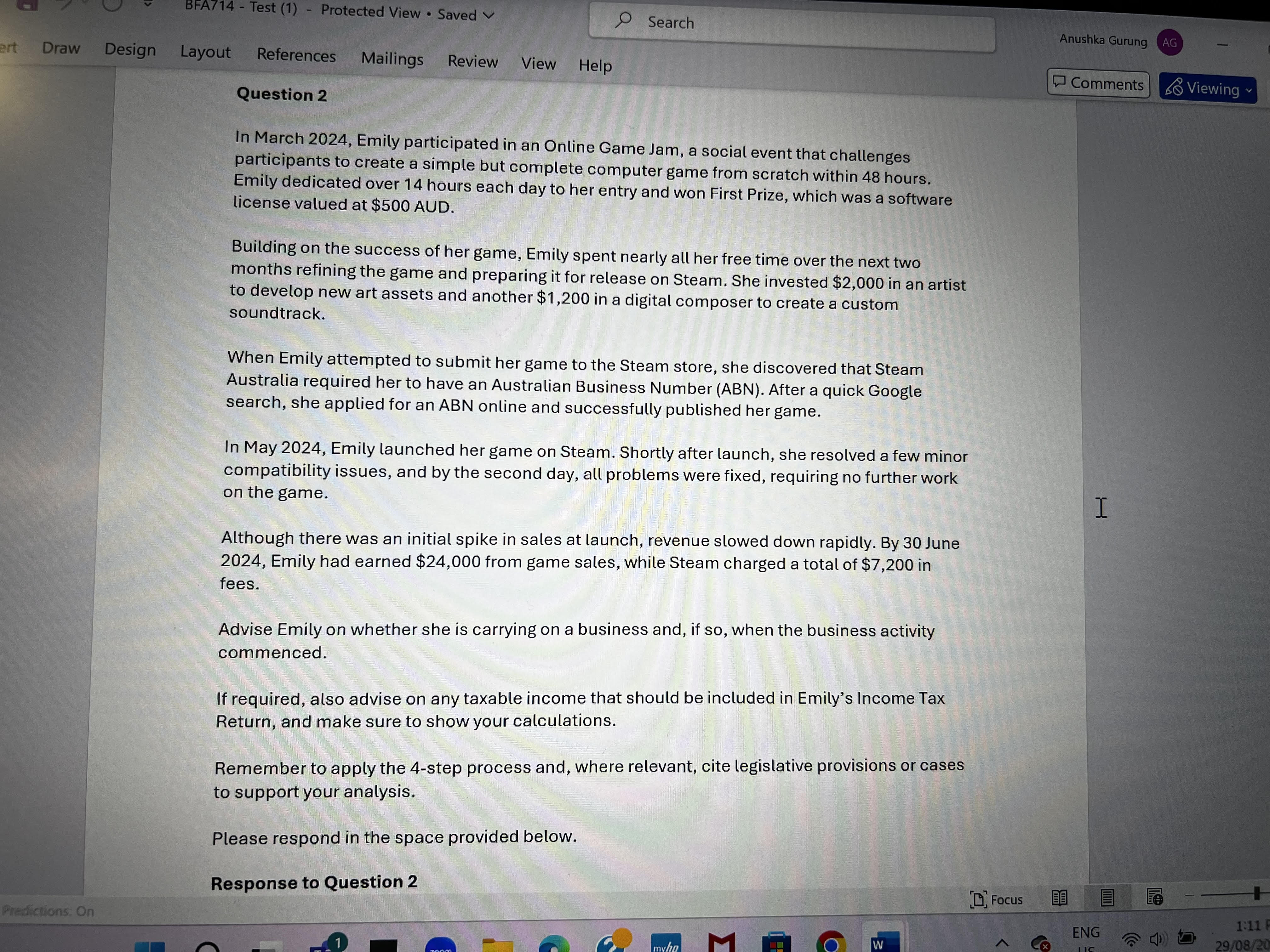

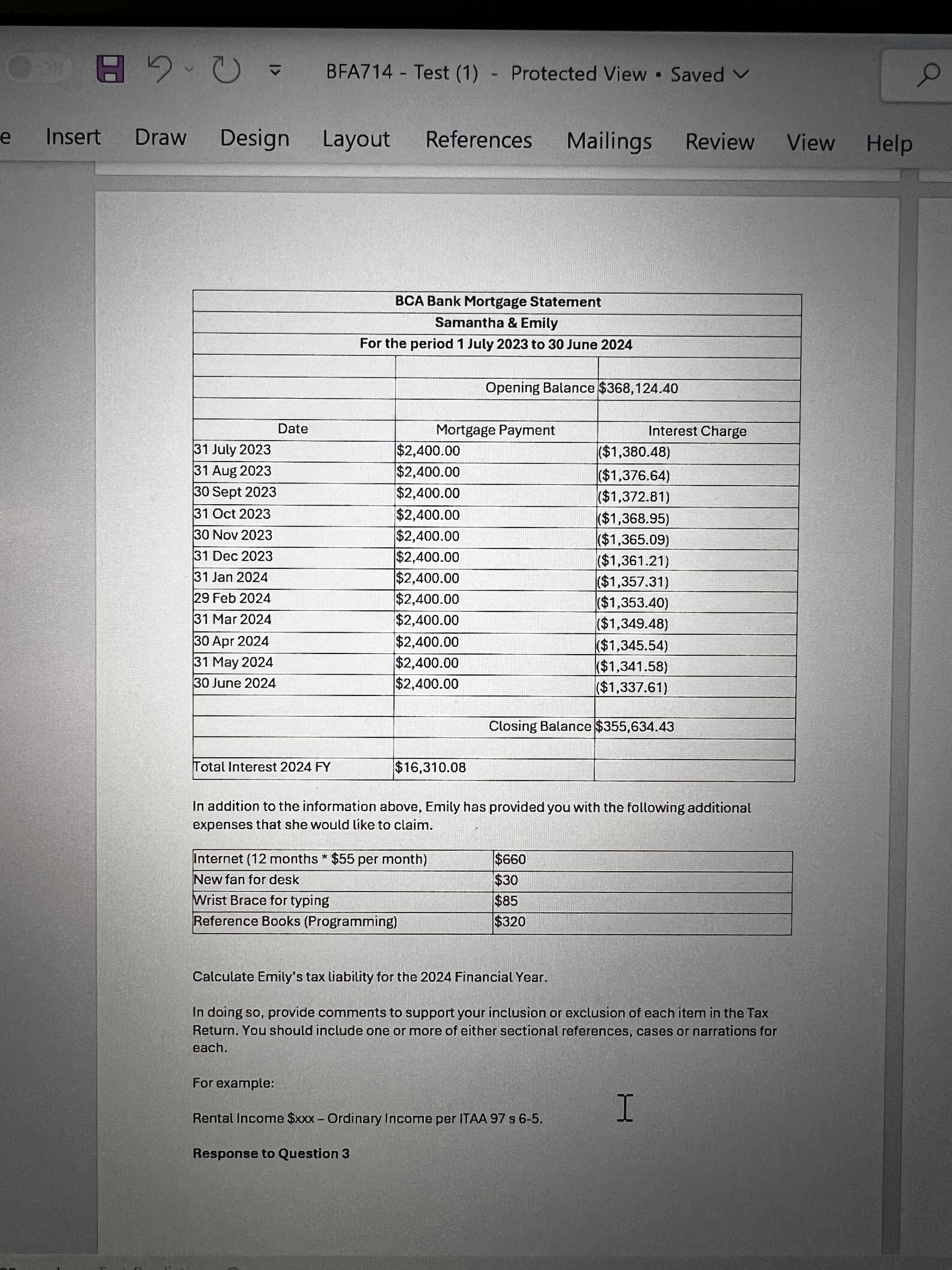

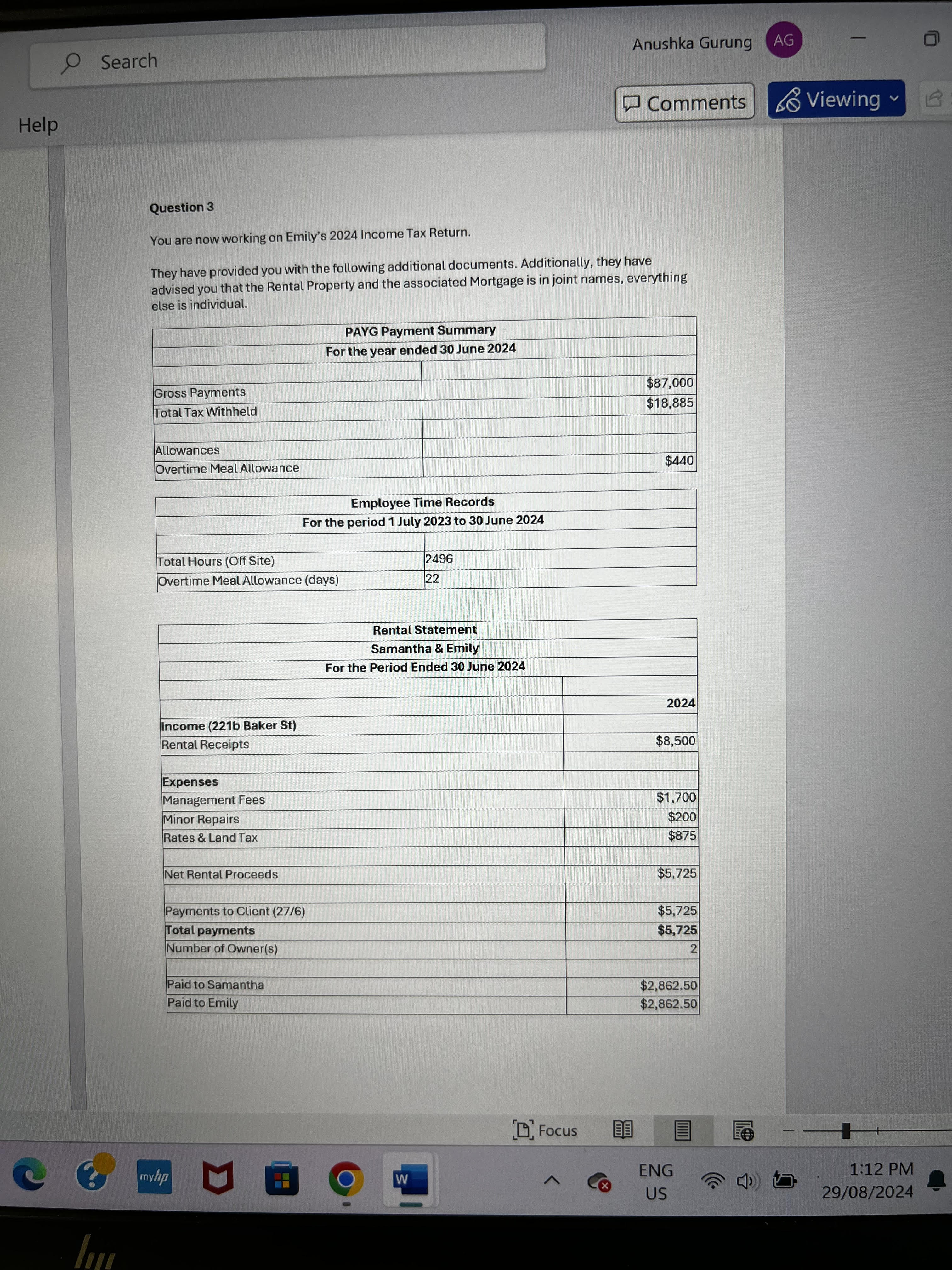

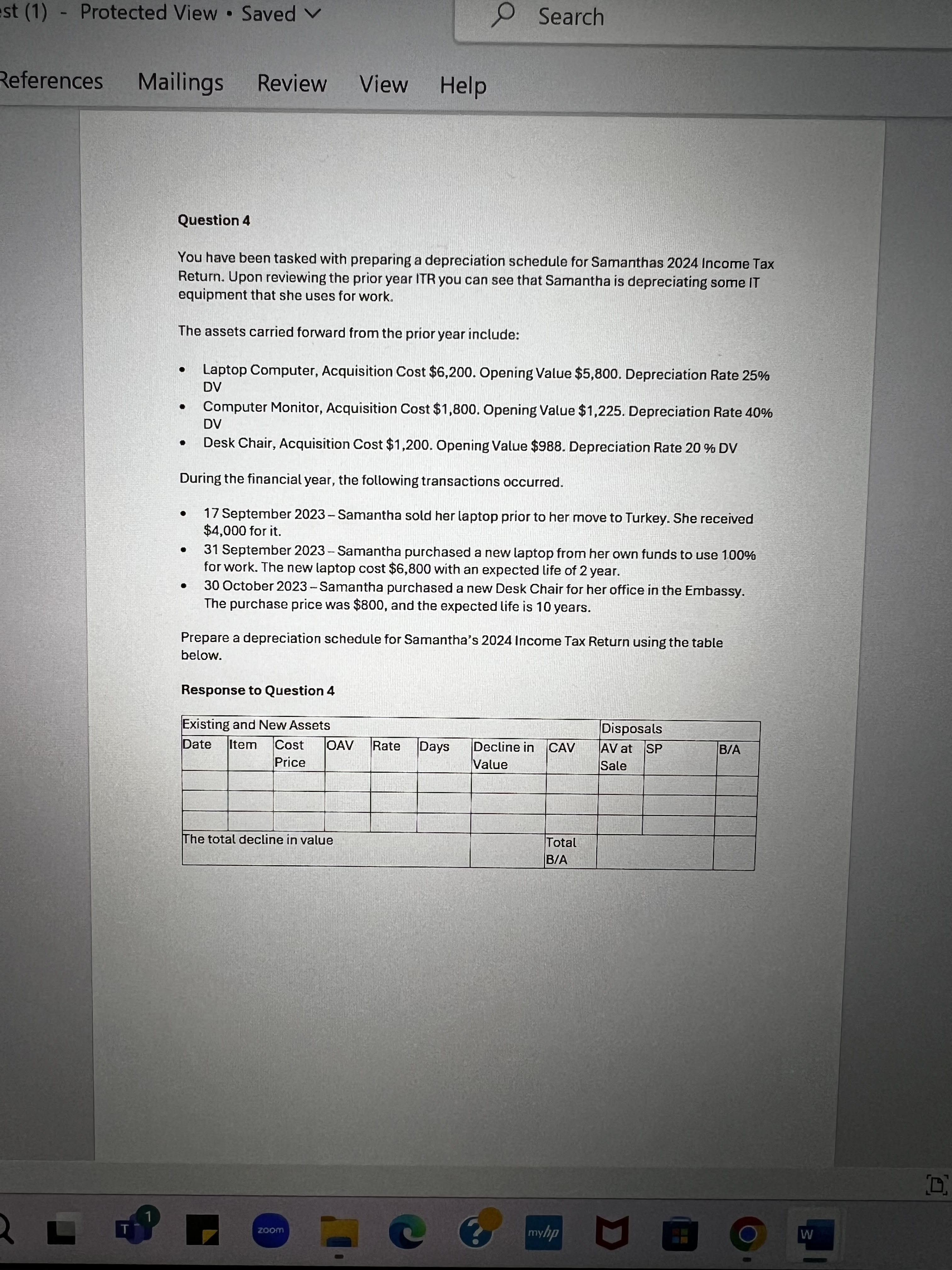

Draw Design Layout References Mailings Review View Help Comments 60 Vi Question 1 Samantha was born in the United Kingdom but moved to Australia with her family when she was nine years old. She holds dual citizenship in both Australia and the United Kingdom. Samantha graduated from the University of Tasmania with a degree in Political Science and joined the Department of Foreign Affairs and Trade (DFAT) as a graduate. Samantha has always been prudent with her savings, setting aside a fixed amount from her salary each fortnight to build her share portfolio and making additional voluntary contributions to her Commonwealth Superannuateon fund. She and her spouse, Emily, also purchased a house in Australia as Joint Tenants. Emily was born in New Zealand and met Samantha while traveling with friends. Her family resides in New Zealand, and she visits them frequently. Emily works as a programmer for a Digital Production company with offices in both Australia and New Zealand. She has been living in Australia and working remotely since she and Samantha met. In September 2023, Samantha was assigned to work at the Australian Embassy in Manila. She I moved to Manila immediately to commence her diplomatic posting, while Emily remained in Australia for an additional four months to pack up their house for rental. Emily appointed a property management agent at the end of January before moving to Manila to join Samantha. The property was rented out from 1 February 2024. Advise Emily and Samantha on their Australian Tax Residency status for the 2024 Financial Year. Be sure to apply the 4-step process and, where relevant, cite legislative provisions or cases to support your analysis. Please respond in the space provided below. Response to Question 1 jons. On FocusBFA714 - Test (1) - Protected View . Saved v Search Anushka Gurung AG art Draw Design Layout References Mailings Review View Help Comments Viewing Question 2 In March 2024, Emily participated in an Online Game Jam, a social event that challenges participants to create a simple but complete computer game from scratch within 48 hours. Emily dedicated over 14 hours each day to her entry and won First Prize, which was a software license valued at $500 AUD. Building on the success of her game, Emily spent nearly all her free time over the next two months refining the game and preparing it for release on Steam. She invested $2,000 in an artist to develop new art assets and another $1,200 in a digital composer to create a custom soundtrack. When Emily attempted to submit her game to the Steam store, she discovered that Steam Australia required her to have an Australian Business Number (ABN). After a quick Google search, she applied for an ABN online and successfully published her game. In May 2024, Emily launched her game on Steam. Shortly after launch, she resolved a few minor compatibility issues, and by the second day, all problems were fixed, requiring no further work on the game. I Although there was an initial spike in sales at launch, revenue slowed down rapidly. By 30 June 2024, Emily had earned $24,000 from game sales, while Steam charged a total of $7,200 in fees. Advise Emily on whether she is carrying on a business and, if so, when the business activity commenced. If required, also advise on any taxable income that should be included in Emily's Income Tax Return, and make sure to show your calculations. Remember to apply the 4-step process and, where relevant, cite legislative provisions or cases to support your analysis. Please respond in the space provided below. Response to Question 2 Focus Predictions: On ENG 1:11 29/08/2H U - BFA714 - Test (1) - Protected View . Saved e Insert Draw Design Layout References Mailings Review View Help BCA Bank Mortgage Statement Samantha & Emily For the period 1 July 2023 to 30 June 2024 Opening Balance $368, 124.40 Date Mortgage Payment Interest Charge 31 July 2023 $2,400.00 ($1,380.48) 31 Aug 2023 $2,400.00 $1,376.64) 30 Sept 2023 $2,400.00 $1,372.81) 31 Oct 2023 $2,400.00 ($1,368.95) 30 Nov 2023 $2,400.00 ($1,365.09) 31 Dec 2023 $2,400.00 $1,361.21) 31 Jan 2024 $2,400.00 ($1,357.31) 29 Feb 2024 $2,400.00 ($1,353.40) 31 Mar 2024 $2,400.00 ($1,349.48) 30 Apr 2024 $2,400.00 ($1,345.54) 31 May 2024 $2,400.00 ($1,341.58) 30 June 2024 $2,400.00 ($1,337.61) Closing Balance $355,634.43 Total Interest 2024 FY $16,310.08 In addition to the information above, Emily has provided you with the following additional expenses that she would like to claim. Internet (12 months * $55 per month) $660 New fan for desk $30 Wrist Brace for typing $85 Reference Books (Programming) $320 Calculate Emily's tax liability for the 2024 Financial Year. In doing so, provide comments to support your inclusion or exclusion of each item in the Tax Return. You should include one or more of either sectional references, cases or narrations for each. For example: H Rental Income $xxx - Ordinary Income per ITAA 97 s 6-5. Response to Question 3Search Anushka Gurung AG Comments LO Viewing Help Question 3 You are now working on Emily's 2024 Income Tax Return. They have provided you with the following additional documents. Additionally, they have advised you that the Rental Property and the associated Mortgage is in joint names, everything else is individual. PAYG Payment For the year ended 30 June 2024 Gross Payments $87,000 Total Tax Withheld $18,885 Allowances Overtime Meal Allowance $440 Employee Time Records For the period 1 July 2023 to 30 June 2024 Total Hours (Off Site) 2496 Overtime Meal Allowance (days) 22 Rental Statement Samantha & Emily For the Period Ended 30 June 2024 2024 Income (221b Baker St) Rental Receipts $8,500 Expenses Management Fees $1,700 Minor Repairs $200 Rates & Land Tax $875 Net Rental Proceeds $5,725 Payments to Client (27/6) $5,725 Total payments $5,725 Number of Owner(s) Paid to Samantha $2,862.50 Paid to Emily $2,862.50 Focus myh W ENG 1:12 PM US 29/08/2024st (1) - Protected View . Saved V Search References Mailings Review View Help Question 4 You have been tasked with preparing a depreciation schedule for Samanthas 2024 Income Tax Return. Upon reviewing the prior year ITR you can see that Samantha is depreciating some IT equipment that she uses for work. The assets carried forward from the prior year include: Laptop Computer, Acquisition Cost $6,200. Opening Value $5,800. Depreciation Rate 25% DV Computer Monitor, Acquisition Cost $1,800. Opening Value $1,225. Depreciation Rate 40% DV Desk Chair, Acquisition Cost $1,200. Opening Value $988. Depreciation Rate 20 % DV During the financial year, the following transactions occurred. 17 September 2023 - Samantha sold her laptop prior to her move to Turkey. She received $4,000 for it. 31 September 2023 - Samantha purchased a new laptop from her own funds to use 100% for work. The new laptop cost $6,800 with an expected life of 2 year. 30 October 2023 -Samantha purchased a new Desk Chair for her office in the Embassy. The purchase price was $800, and the expected life is 10 years. Prepare a depreciation schedule for Samantha's 2024 Income Tax Return using the table below. Response to Question 4 Existing and New Assets Disposals Date Item Cost OAV Rate Days Decline in CAV AV at SP B/A Price Value Sale The total decline in value Total B/A L 200m myhip O W

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts