Question: Draw precise timelines and work through calculator entries. Answer % with min 3 decimals. 2pts/blank Exercise #1: What rate do you need to earn to

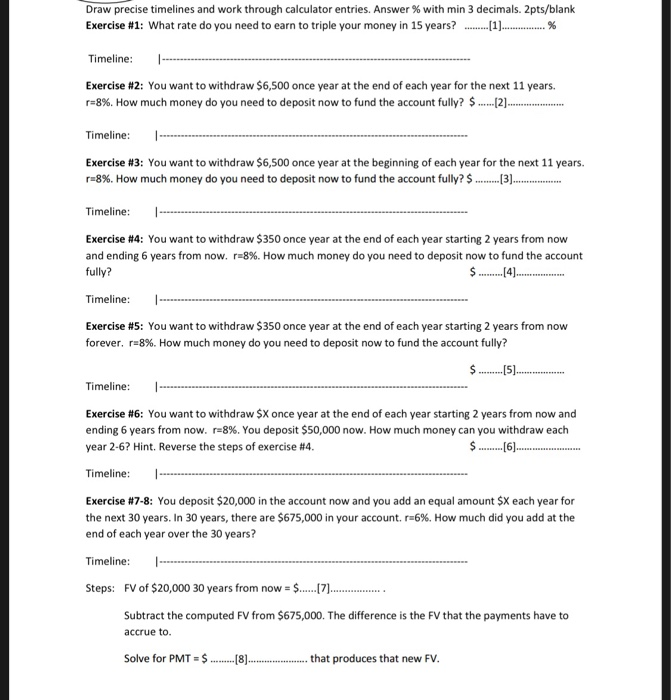

Draw precise timelines and work through calculator entries. Answer % with min 3 decimals. 2pts/blank Exercise #1: What rate do you need to earn to triple your money in 15 years? . % Timeline: Exercise #2: You want to withdraw $6,500 once year at the end of each year for the next 11 years. r=8%. How much money do you need to deposit now to fund the account fully? $ . Timeline: Exercise #3: You want to withdraw $6,500 once year at the beginning of each year for the next 11 years r=8%. How much money do you need to deposit now to fund the account fully? $.3 Timeline: Exercise #4: You want to withdraw $350 once year at the end of each year starting 2 years from now and ending 6 years from now. r-8 % . How much money do you need to deposit now to fund the account fully? Timeline: Exercise #5: You want to withdraw $350 once year at the end of each year starting 2 years from now forever. r-8%. How much money do you need to deposit now to fund the account fully? Timeline: Exercise #6: You want to withdraw $X once year at the end of each year starting 2 years from now and ending 6 years from now. r-8 % . You deposit $50,000 now. How much money can you withdraw each year 2-6? Hint. Reverse the steps of exercise #4 Timeline: Exercise #7-8 : You deposit $20,000 in the account now and you add an equal amount $X each year for the next 30 years. In 30 years, there are $675,000 in your account. r=6 %. How much did you add at the end of each year over the 30 years? Timeline: FV of $20,000 30 years from now = $..... . Steps: Subtract the computed FV from $675,000. The difference is the FV that the payments have to accrue to. Solve for PMT $ that produces that new FV. [8]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts