Question: Draw the efficient frontier with different weights in the two risky assets. Draw in the CAL using the 6-month short term Treasury bill as the

-

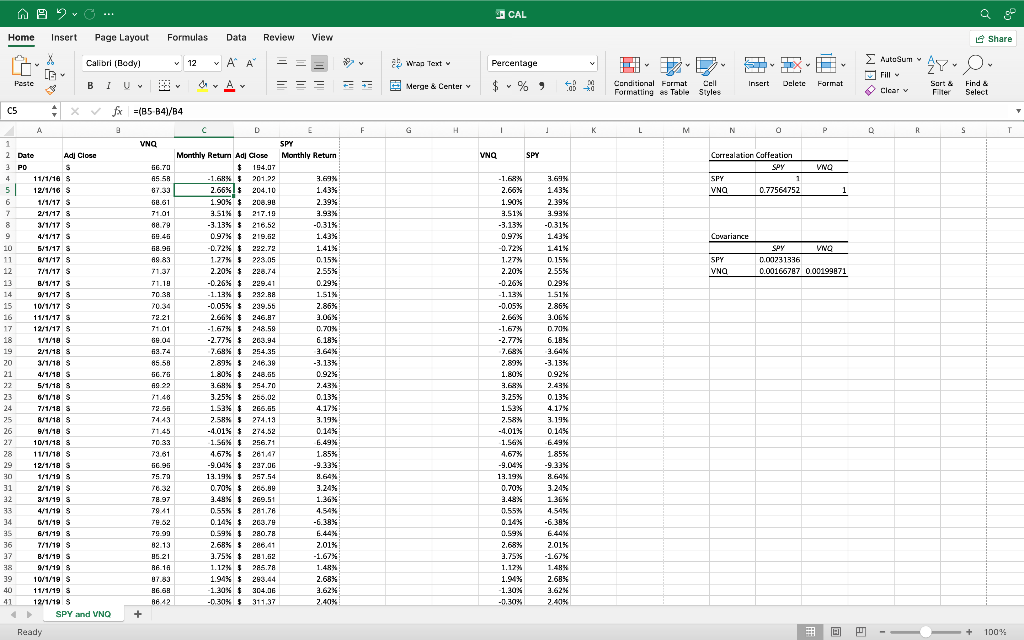

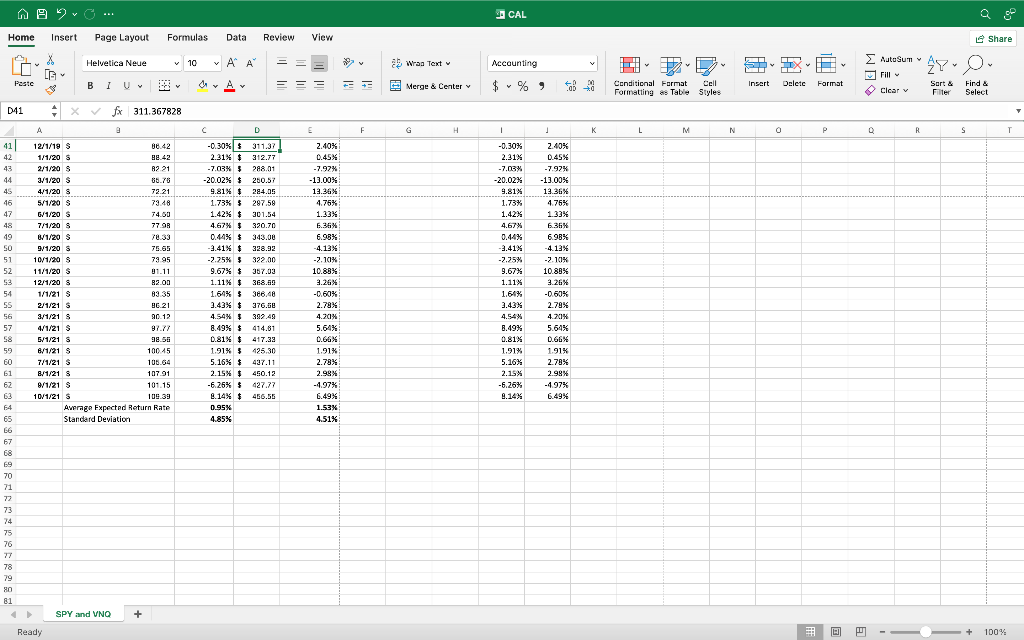

Draw the efficient frontier with different weights in the two risky assets.

-

Draw in the CAL using the 6-month short term Treasury bill as the risk free rate.

-

Obtain the OPTIMAL risky portfolio asset mix using the formula on og.162. That results in the steepest CAL slope.

-

Calculate the available risk premium to variance ratio of the risky portfolio.

-

Decide where you want to be on the CAL given your risk aversion. That is calculate the proportion of wealth invested in the risky portfolio. This will depend on your coefficient of risk aversion

-

Find the breakdown of the complete portfolio.

O... CAL ow Home Insert Page Layout Formulas Data Review View Share X Calibri (body) 12 v AP A 92 a Wran Text v Percentage Autosun . SB V V Pasto B 1 A - Merge & Center Insert Delete Format Conditional Format Cell Formatting as Table Styles Cicar v Sort & Fler Find & Select C5 fx =(85 B4)/B4 9 F H H 1 K L M N o P R S T VNO VNO SPY VNO 66.70 AS 5R Correalation Coffeation Spy SPY VNG 0.77564752 1 Covariance SPY VNG Spy VNG 0.001231336 0.00166787 0.00199871 A 1 2 Date Adj Close 3 PO 3 S 4. 11/1/16 $ 5 5 12/1/16 S $ 6 1/1/17 S 7 2/1/17 $ 8 3/1/17 S 9 4/1/17 S 10 5/1/17 S 11 8/1/17 S 12 7/1/17 S 13 B/1/17 S 14 9/1/17 S 15 10/1/17 S 16 11/1/17 S 12/1/17 S 18 1/1/18 $ 19 2/1/18 8 20 3/1/18 $ 21 4/1/18 22 5/1/18 S 23 8/1/18 S 24 7/1/18 S 25 8/1/18 S 26 9/1/18 $ 27 10/1/18 S 28 11/1/18 S 29 12/1/18 $ 30 1/1/19 $ 31 2/1/19 $ 32 3/1/19 33 4/1/19 8 34 5/1/19 S 35 6/1/19 8 36 7/1/19 S 37 B/1/195 38 9/1/9 S 39 10/1/19 S 40 11/1/198 41 12/1/19 8 SPY and VNO 68.61 71.01 88.79 69.46 E 68.95 A8 83 71.37 71.19 70. SR 70.34 72.21 71.01 06.04 62.74 85 58 66.76 A9 22 71.48 72.53 74.43 71.45 70.33 73.81 66.98 75 70 C D E SPY Monthly Return Ad Close Monthly Return $ 194.07 -1.68% $201.09 3.69% 2.66% 204.10 1.43% 1.90% $ 208.90 2.39% 3.51% $ 217.18 2.93 -3.13% $ % $ 216.52 -0.31% 0.97% $ 219.02 1.43% -0.72% $ 292.72 1.41% 1.27% 5 223.05 0.15% 2.20% $ 228.74 2.55% -0.26% $299,41 $ 0.29% -1.13% $ 292.28 $ 1.51% -0.05% 1 239.55 2.86% 2.6GX $ 246.87 3.0GX -1.67% 3 248.59 0.71% -2.77% $ 6.13% 7.68% $ 254.35 3.64% 2.89% $ 246.38 -3.13% 1.80% $ 248.55 0.92% 3.68% 254.70 2.43% % 3.25% $ 250.02 0.13% 1.53% $ 266.55 4.17% 2.58% % % 274.13 3.19% -4.01% $ 274.52 0.14% 1.56% $ 256.71 6.49% 4.67% 5 281.47 1.85% -9.04% $ $ 227.06 -9.33% 13.19% 257.54 8.64% 0.70% $ 200.0 3.24% 3.49% $ 269.51 1.36X 0.55% 281.786 4.54% 0.14% $ 263.79 -6.38% 0.59% $ 280.78 E.44 2.68% $ 286.41 2.01% 3.75% $ 201.02 -1.67% 1.12% 285.78 1.48% 1.94% $ 293.44 2.68% -1.30% $ 304.DE 2.62% 311,37 2.40% -1.68% 2.66% 1.90% 3.51% -3.13% 0.97% -0.72% 1.27% 2.20% -0.26% -1.13% -0.05% 2.66% -1.67% -2.77% 7.68% 2.89% 1.80% 3.68% 3.25% 1.53% 2.58% -4.01% 1.56% 4.67% -9.04% 13.19% 0.70% 3.49% 0.55% 0.14% 0.59% 2.68% 3.75% 1.17% 1.94% -1.30% -0,30% 3.69% 1.43% 2.39% 3.93% -0.31% 1.43% % 1.41% 0.15% 2.55% 0.29% 1.51% 2.86% 9.06% 0.70% 6.18% 3.64% -3.13% % 0.92% 2.43% 0.13% 4.174 3.19% 0.14% 6.49% 1.85% -9.33% 8.64% 3.24% 1.364 4.54% -6.38% 6.44% 2.01% -1.67% 1.48% 2.68% 3.62% 2.40% 78.97 79 41 76.62 79.99 82.13 35.21 RE 1A 07.83 B6.68 BF:12 + Ready 3 + 100% % O... CAL ow Home Insert Page Layout Formulas Data Review View Share X LG Helvetica Neue v 10 v AP A a Wran Text v Autosun Accounting S V V Paste BIUM A = = - - Merge & Center v $ % , Insert Delete Format Conditional Format Cell Formatting as Table Styles Clear v Sort & Fler Find & Select 141 fx 311.367828 A 9 C D F H 1 K L M M N 0 P R S T 41] 42 43 44 45 46 47 48 49 SO 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 12/1/19 $ 88.42 1/1/20 S 8.42 2/1/20 S R2 21 3/1/20 S 68.78 4/1/20 72.21 5/1/20 S 73.48 G/1/20 S 74.60 7/1/20 S 77.9 W/1/20 S 78.33 9/1/20 S 75.65 10/1/20 S 73 95 11/1/20$ / 91.11 12/1/20 82.00 1/1/21 S 83 35 2/1/21 S 96.21 3/1/21 S 90.12 4/1/21 S 97.77 5/1/21 S 98.53 8/1/21 S 10045 7/1/21 108.64 8/1/21 107.91 9/1/21 $ 101.15 10/1/21 $ 109.39 Average Expected Return Rate Standard Deviation -0.30% $ 311.37 2.31% $ 312.77 -7.03% 3 298.01 -20.02% 250.57 9.81% $ 284.05 1.73% $ 297.58 1.42% $ 301.54 4.67% 5 320.70 0.44% $ 343.00 -3.41% $ 328,92 -2.25% % 322.00 9.67% $ 357.03 1.11% 368.69 1.64% S 366.48 3.43% 3 376.50 4.54% $ 392.49 8.49% $ 414.81 0.81% $ 417.33 1.91% 425.30 5.16% $ 437.11 2.15% $ 450.12 -6.25% $ 427.77 2.14% $ 456.55 0.95% 4.85% E 2.40% % 0.45% -7.92% -13.00% 13.36% 4.75% 1.33% 6.36% 6.98% -4.13% -2.10% 10.88% 3.26% -0.60% 2.79% 4.2014 5.64% 0.66% 1.91% 2.78% 2.98% -4.97% 6.49% 1.53% 4.51% -0.30% 2.31% -7.03% % -20.02% 9.81% 1.73% 1.42% 4.67% 0.44% -3.41% -2.25% 9.67% 1.11% 1.64% 3.43x 4.54% 8.49% 0.81% 1.91% 5.16% 2.15% -6.26% 9.14% 2.40% 0.45% % -7.97% -13.00% 13.36% 4.75% 1.33% 6.36 698% -4.13% -2.10% 10.88% 3.26% -0.60% 2.79% 4.2018 5.64% 0.66% 1.91% 2.78% 2.98% -1.97% 6.49% % SPY and VNO + Ready ITE + 100% O... CAL ow Home Insert Page Layout Formulas Data Review View Share X Calibri (body) 12 v AP A 92 a Wran Text v Percentage Autosun . SB V V Pasto B 1 A - Merge & Center Insert Delete Format Conditional Format Cell Formatting as Table Styles Cicar v Sort & Fler Find & Select C5 fx =(85 B4)/B4 9 F H H 1 K L M N o P R S T VNO VNO SPY VNO 66.70 AS 5R Correalation Coffeation Spy SPY VNG 0.77564752 1 Covariance SPY VNG Spy VNG 0.001231336 0.00166787 0.00199871 A 1 2 Date Adj Close 3 PO 3 S 4. 11/1/16 $ 5 5 12/1/16 S $ 6 1/1/17 S 7 2/1/17 $ 8 3/1/17 S 9 4/1/17 S 10 5/1/17 S 11 8/1/17 S 12 7/1/17 S 13 B/1/17 S 14 9/1/17 S 15 10/1/17 S 16 11/1/17 S 12/1/17 S 18 1/1/18 $ 19 2/1/18 8 20 3/1/18 $ 21 4/1/18 22 5/1/18 S 23 8/1/18 S 24 7/1/18 S 25 8/1/18 S 26 9/1/18 $ 27 10/1/18 S 28 11/1/18 S 29 12/1/18 $ 30 1/1/19 $ 31 2/1/19 $ 32 3/1/19 33 4/1/19 8 34 5/1/19 S 35 6/1/19 8 36 7/1/19 S 37 B/1/195 38 9/1/9 S 39 10/1/19 S 40 11/1/198 41 12/1/19 8 SPY and VNO 68.61 71.01 88.79 69.46 E 68.95 A8 83 71.37 71.19 70. SR 70.34 72.21 71.01 06.04 62.74 85 58 66.76 A9 22 71.48 72.53 74.43 71.45 70.33 73.81 66.98 75 70 C D E SPY Monthly Return Ad Close Monthly Return $ 194.07 -1.68% $201.09 3.69% 2.66% 204.10 1.43% 1.90% $ 208.90 2.39% 3.51% $ 217.18 2.93 -3.13% $ % $ 216.52 -0.31% 0.97% $ 219.02 1.43% -0.72% $ 292.72 1.41% 1.27% 5 223.05 0.15% 2.20% $ 228.74 2.55% -0.26% $299,41 $ 0.29% -1.13% $ 292.28 $ 1.51% -0.05% 1 239.55 2.86% 2.6GX $ 246.87 3.0GX -1.67% 3 248.59 0.71% -2.77% $ 6.13% 7.68% $ 254.35 3.64% 2.89% $ 246.38 -3.13% 1.80% $ 248.55 0.92% 3.68% 254.70 2.43% % 3.25% $ 250.02 0.13% 1.53% $ 266.55 4.17% 2.58% % % 274.13 3.19% -4.01% $ 274.52 0.14% 1.56% $ 256.71 6.49% 4.67% 5 281.47 1.85% -9.04% $ $ 227.06 -9.33% 13.19% 257.54 8.64% 0.70% $ 200.0 3.24% 3.49% $ 269.51 1.36X 0.55% 281.786 4.54% 0.14% $ 263.79 -6.38% 0.59% $ 280.78 E.44 2.68% $ 286.41 2.01% 3.75% $ 201.02 -1.67% 1.12% 285.78 1.48% 1.94% $ 293.44 2.68% -1.30% $ 304.DE 2.62% 311,37 2.40% -1.68% 2.66% 1.90% 3.51% -3.13% 0.97% -0.72% 1.27% 2.20% -0.26% -1.13% -0.05% 2.66% -1.67% -2.77% 7.68% 2.89% 1.80% 3.68% 3.25% 1.53% 2.58% -4.01% 1.56% 4.67% -9.04% 13.19% 0.70% 3.49% 0.55% 0.14% 0.59% 2.68% 3.75% 1.17% 1.94% -1.30% -0,30% 3.69% 1.43% 2.39% 3.93% -0.31% 1.43% % 1.41% 0.15% 2.55% 0.29% 1.51% 2.86% 9.06% 0.70% 6.18% 3.64% -3.13% % 0.92% 2.43% 0.13% 4.174 3.19% 0.14% 6.49% 1.85% -9.33% 8.64% 3.24% 1.364 4.54% -6.38% 6.44% 2.01% -1.67% 1.48% 2.68% 3.62% 2.40% 78.97 79 41 76.62 79.99 82.13 35.21 RE 1A 07.83 B6.68 BF:12 + Ready 3 + 100% % O... CAL ow Home Insert Page Layout Formulas Data Review View Share X LG Helvetica Neue v 10 v AP A a Wran Text v Autosun Accounting S V V Paste BIUM A = = - - Merge & Center v $ % , Insert Delete Format Conditional Format Cell Formatting as Table Styles Clear v Sort & Fler Find & Select 141 fx 311.367828 A 9 C D F H 1 K L M M N 0 P R S T 41] 42 43 44 45 46 47 48 49 SO 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 12/1/19 $ 88.42 1/1/20 S 8.42 2/1/20 S R2 21 3/1/20 S 68.78 4/1/20 72.21 5/1/20 S 73.48 G/1/20 S 74.60 7/1/20 S 77.9 W/1/20 S 78.33 9/1/20 S 75.65 10/1/20 S 73 95 11/1/20$ / 91.11 12/1/20 82.00 1/1/21 S 83 35 2/1/21 S 96.21 3/1/21 S 90.12 4/1/21 S 97.77 5/1/21 S 98.53 8/1/21 S 10045 7/1/21 108.64 8/1/21 107.91 9/1/21 $ 101.15 10/1/21 $ 109.39 Average Expected Return Rate Standard Deviation -0.30% $ 311.37 2.31% $ 312.77 -7.03% 3 298.01 -20.02% 250.57 9.81% $ 284.05 1.73% $ 297.58 1.42% $ 301.54 4.67% 5 320.70 0.44% $ 343.00 -3.41% $ 328,92 -2.25% % 322.00 9.67% $ 357.03 1.11% 368.69 1.64% S 366.48 3.43% 3 376.50 4.54% $ 392.49 8.49% $ 414.81 0.81% $ 417.33 1.91% 425.30 5.16% $ 437.11 2.15% $ 450.12 -6.25% $ 427.77 2.14% $ 456.55 0.95% 4.85% E 2.40% % 0.45% -7.92% -13.00% 13.36% 4.75% 1.33% 6.36% 6.98% -4.13% -2.10% 10.88% 3.26% -0.60% 2.79% 4.2014 5.64% 0.66% 1.91% 2.78% 2.98% -4.97% 6.49% 1.53% 4.51% -0.30% 2.31% -7.03% % -20.02% 9.81% 1.73% 1.42% 4.67% 0.44% -3.41% -2.25% 9.67% 1.11% 1.64% 3.43x 4.54% 8.49% 0.81% 1.91% 5.16% 2.15% -6.26% 9.14% 2.40% 0.45% % -7.97% -13.00% 13.36% 4.75% 1.33% 6.36 698% -4.13% -2.10% 10.88% 3.26% -0.60% 2.79% 4.2018 5.64% 0.66% 1.91% 2.78% 2.98% -1.97% 6.49% % SPY and VNO + Ready ITE + 100%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts