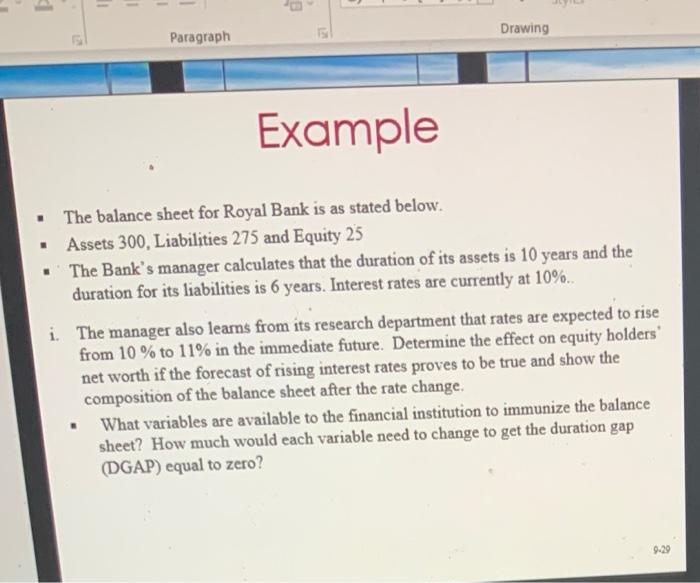

Question: - Drawing Paragraph Example . . The balance sheet for Royal Bank is as stated below. Assets 300, Liabilities 275 and Equity 25 The Bank's

- Drawing Paragraph Example . . The balance sheet for Royal Bank is as stated below. Assets 300, Liabilities 275 and Equity 25 The Bank's manager calculates that the duration of its assets is 10 years and the duration for its liabilities is 6 years. Interest rates are currently at 10%. i. The manager also learns from its research department that rates are expected to rise from 10 % to 11% in the immediate future. Determine the effect on equity holders' net worth if the forecast of rising interest rates proves to be true and show the composition of the balance sheet after the rate change. What variables are available to the financial institution to immunize the balance sheet? How much would each variable need to change to get the duration gap (DGAP) equal to zero? 9.29

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts