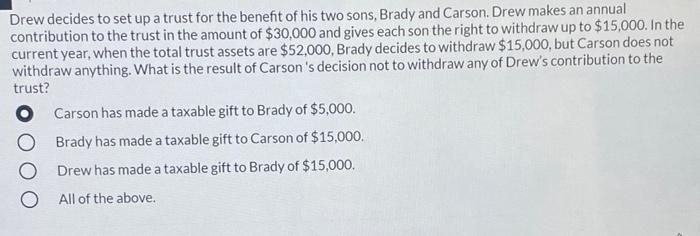

Question: Drew decides to set up a trust for the benefit of his two sons, Brady and Carson. Drew makes an annual contribution to the trust

Drew decides to set up a trust for the benefit of his two sons, Brady and Carson. Drew makes an annual contribution to the trust in the amount of $30,000 and gives each son the right to withdraw up to $15,000. In the current year, when the total trust assets are $52,000, Brady decides to withdraw $15,000, but Carson does not withdraw anything. What is the result of Carson's decision not to withdraw any of Drew's contribution to the trust? O Carson has made a taxable gift to Brady of $5,000. Brady has made a taxable gift to Carson of $15,000. Drew has made a taxable gift to Brady of $15,000. All of the above

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock