Question: Drill Exercises E5.1. Forecasting Return on Common Equity and Residual Earnings (Easy) The following are earnings and dividend forecasts made at the end of 2012

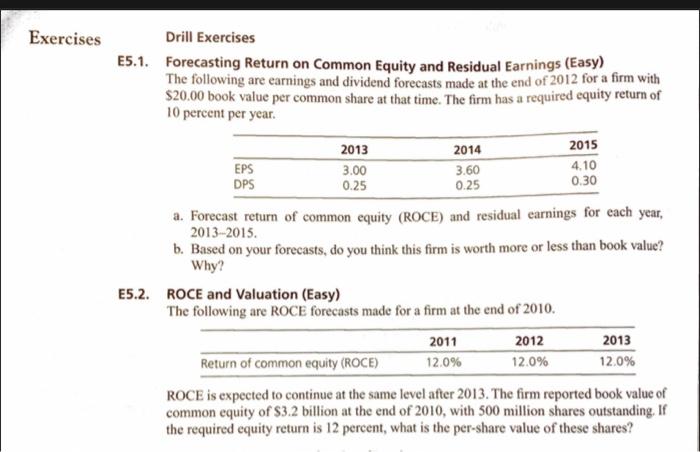

Drill Exercises E5.1. Forecasting Return on Common Equity and Residual Earnings (Easy) The following are earnings and dividend forecasts made at the end of 2012 for a firm with $20.00 book value per common share at that time. The firm has a required equity return of 10 percent per year. a. Forecast return of common equity (ROCE) and residual earnings for each year, 2013-2015. b. Based on your forecasts, do you think this firm is worth more or less than book value? Why? E5.2. ROCE and Valuation (Easy) The following are ROCE forecasts made for a firm at the end of 2010. ROCE is expected to continue at the same level after 2013. The firm reported book value of common equity of $3.2 billion at the end of 2010 , with 500 million shares outstanding. If the required equity return is 12 percent, what is the per-share value of these shares

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts