Question: Drill Maker Sdn Bhd has developed a new hand drill that would be used for woodwork and carpentry activities. It would cost RM1 million to

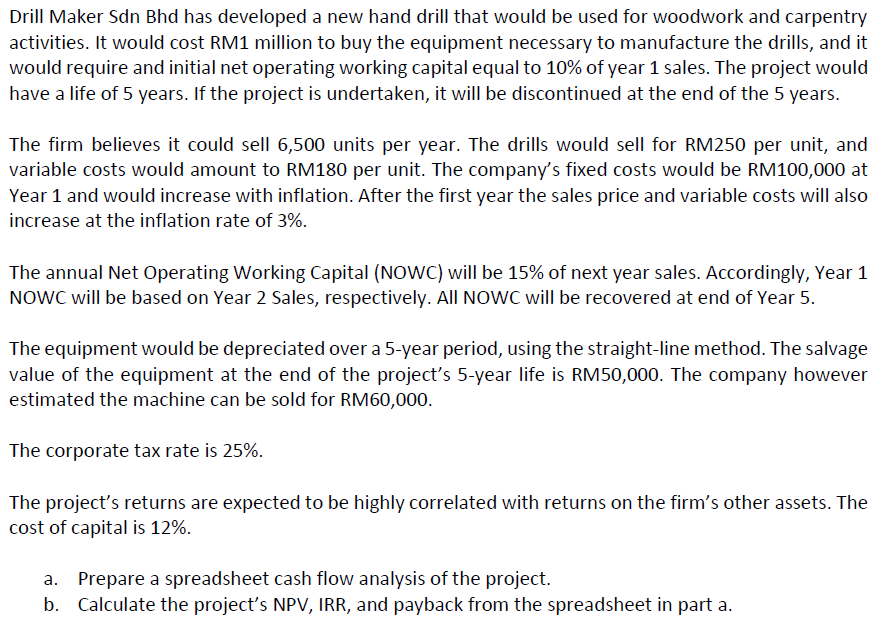

Drill Maker Sdn Bhd has developed a new hand drill that would be used for woodwork and carpentry activities. It would cost RM1 million to buy the equipment necessary to manufacture the drills, and it would require and initial net operating working capital equal to 10% of year 1 sales. The project would have a life of 5 years. If the project is undertaken, it will be discontinued at the end of the 5 years. The firm believes it could sell 6,500 units per year. The drills would sell for RM250 per unit, and variable costs would amount to RM180 per unit. The company's fixed costs would be RM100,000 at Year 1 and would increase with inflation. After the first year the sales price and variable costs will also increase at the inflation rate of 3%. The annual Net Operating Working Capital (NOWC) will be 15% of next year sales. Accordingly, Year 1 NOWC will be based on Year 2 Sales, respectively. All NOWC will be recovered at end of Year 5. The equipment would be depreciated over a 5-year period, using the straight-line method. The salvage value of the equipment at the end of the project's 5-year life is RM50,000. The company however estimated the machine can be sold for RM60,000. The corporate tax rate is 25%. The project's returns are expected to be highly correlated with returns on the firm's other assets. The cost of capital is 12%. a. Prepare a spreadsheet cash flow analysis of the project. b. Calculate the project's NPV, IRR, and payback from the spreadsheet in part a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts