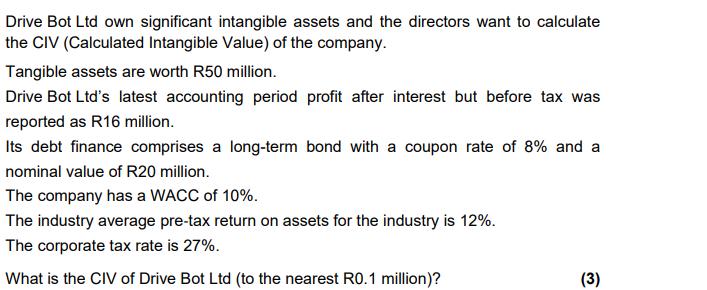

Question: Drive Bot Ltd own significant intangible assets and the directors want to calculate the CIV (Calculated Intangible Value) of the company. Tangible assets are

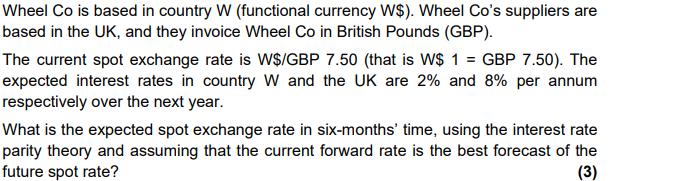

Drive Bot Ltd own significant intangible assets and the directors want to calculate the CIV (Calculated Intangible Value) of the company. Tangible assets are worth R50 million. Drive Bot Ltd's latest accounting period profit after interest but before tax was reported as R16 million. Its debt finance comprises a long-term bond with a coupon rate of 8% and a nominal value of R20 million. The company has a WACC of 10%. The industry average pre-tax return on assets for the industry is 12%. The corporate tax rate is 27%. What is the CIV of Drive Bot Ltd (to the nearest R0.1 million)? (3) What is the current share price? Wheel Co is based in country W (functional currency W$). Wheel Co's suppliers are based in the UK, and they invoice Wheel Co in British Pounds (GBP). The current spot exchange rate is W$/GBP 7.50 (that is W$ 1 = GBP 7.50). The expected interest rates in country W and the UK are 2% and 8% per annum respectively over the next year. What is the expected spot exchange rate in six-months' time, using the interest rate parity theory and assuming that the current forward rate is the best forecast of the future spot rate? (3)

Step by Step Solution

There are 3 Steps involved in it

To calculate the Calculated Intangible Value CIV of Drive Bot Ltd we need to determine the value of its intangible assets Given that the tangible asse... View full answer

Get step-by-step solutions from verified subject matter experts