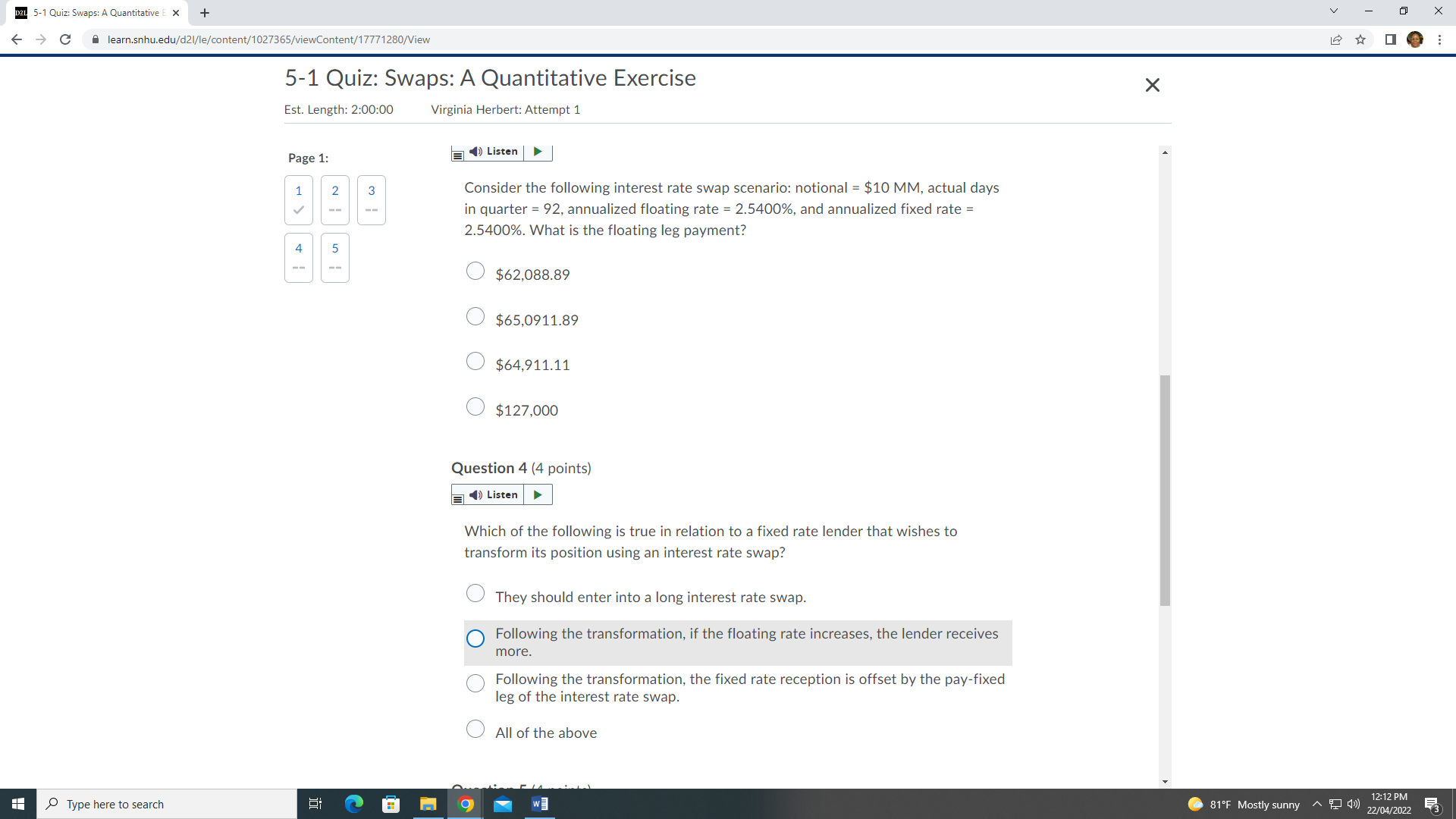

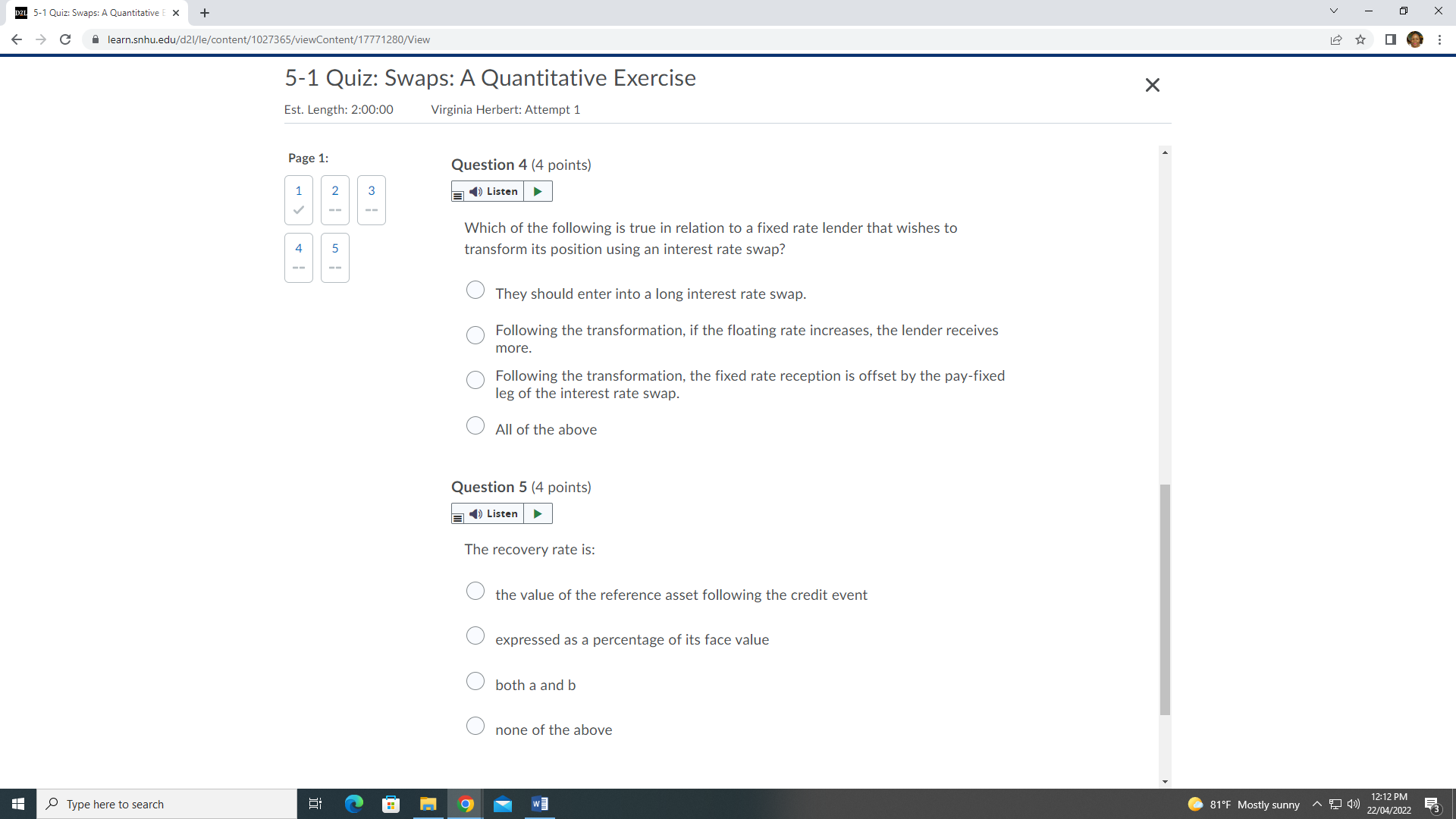

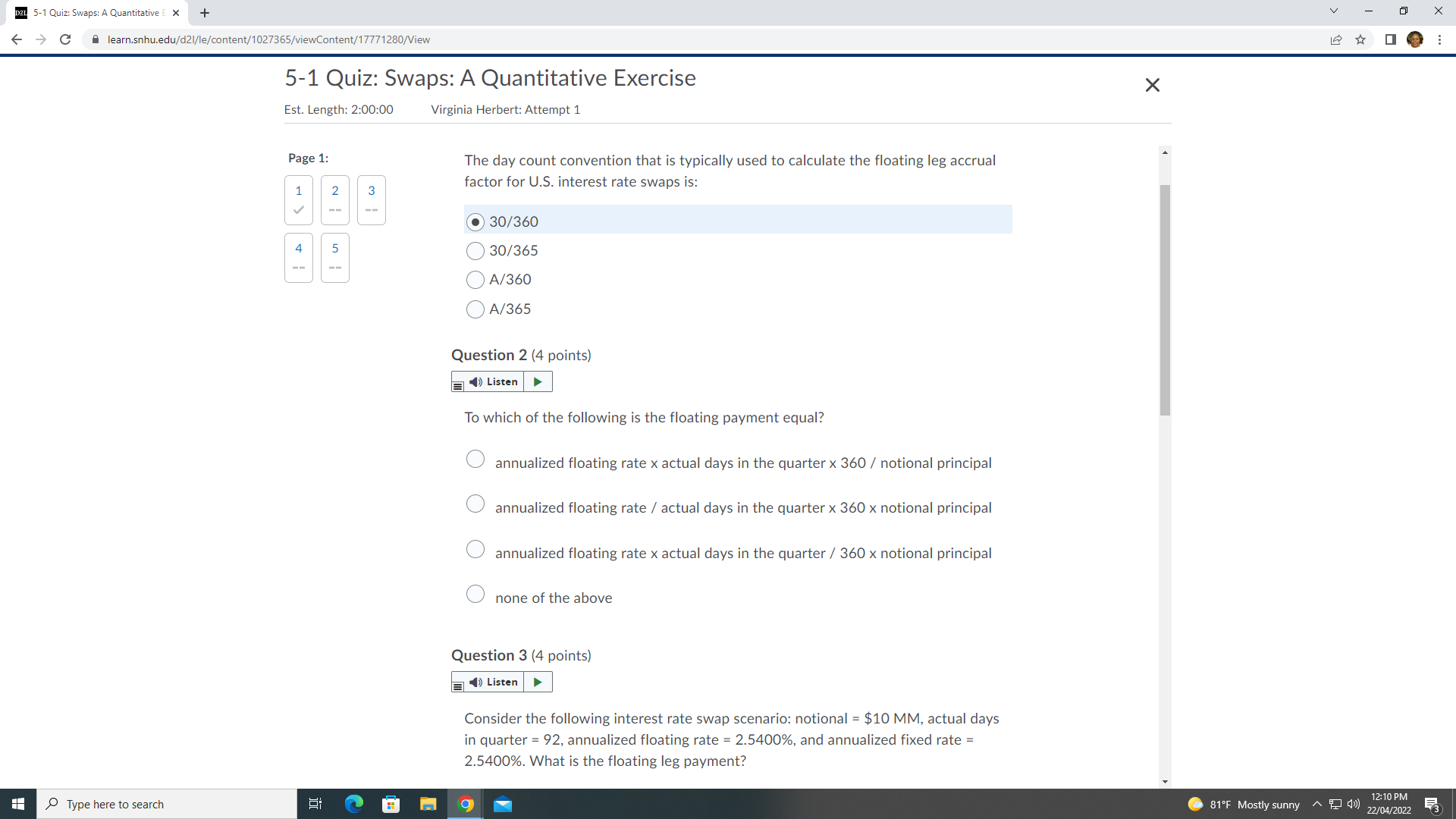

Question: DRL 5-1 Quiz: Swaps: A Quantitative E X + X - -> C A learn.snhu.edu/d21/le/content/1027365/viewContent/17771280/View 5-1 Quiz: Swaps: A Quantitative Exercise X Est. Length: 2:00:00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts