Question: Drogba plc is operating in a highly competitive gaming industry. The industry is technologically and innovatively driven and has not been impacted negatively by Covid

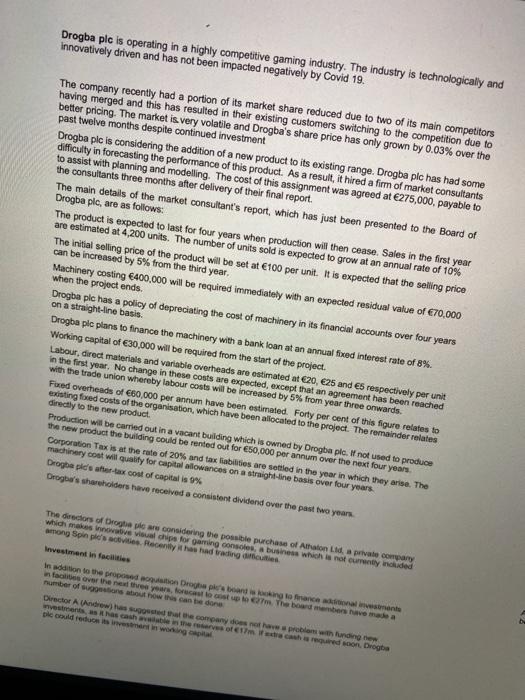

Drogba plc is operating in a highly competitive gaming industry. The industry is technologically and innovatively driven and has not been impacted negatively by Covid 19. The company recently had a portion of its market share reduced due to two of its main competitors having merged and this has resulted in their existing customers switching to the competition due to better pricing. The market is very volatile and Drogba's share price has only grown by 0.03% over the past twelve months despite continued investment Drogba pic is considering the addition of a new product to its existing range. Drogba plc has had some difficulty in forecasting the performance of this product. As a result, it hired a firm of market consultants to assist with planning and modelling. The cost of this assignment was agreed at 275,000, payable to the consultants three months after delivery of their final report. The main details of the market consultant's report, which has just been presented to the Board of Drogba pic, are as follows: The product is expected to last for four years when production will then cease. Sales in the first year are estimated at 4,200 units. The number of units sold is expected to grow at an annual rate of 10% The initial selling price of the product will be set at 100 per unit. It is expected that the selling price can be increased by 5% from the third year. Machinery costing 400,000 will be required immediately with an expected residual value of 70,000 when the project ends Drogba pic has a policy of depreciating the cost of machinery in its financial accounts over four years on a straight-line basis. Drogba pic plans to finance the machinery with a bank loan at an annual food interest rate of 8%. Working capital of 30.000 will be required from the start of the project. Labour, direct materials and variable overheads are estimated at 20, 25 and Es respectively per unit in the first year. No change in these costs are expected, except that an agreement has been reached with the trade union whereby labour costs will be increased by 5% from year three onwards. Fixed overheads of 60,000 per annum have been estimated Forty per cent of this figure relates to existing foxed costs of the organisation, which have been allocated to the project. The remainder relates directly to the new product Production will be carried out in a vacant building which is owned by Drogba plo. If not used to produce the new product the building could be rented out for 50,000 per annum over the next four years Corporation Tax is at the rate of 20% and tax liabilities are settled in the year in which they are. The machinery cost will qualify for capital allowances on a straight-line basis over four years Drogba plic's after-tax cost of capital is 9% Drogba's shareholders have received a consistent dividend over the past two years The directors of Droge considering the possible purchase of Atalon Lid a private company which makes in this for gaming console business which is not currently indded mong Spin pic's viis Recently has had trading is Investment in facilities In addition to the proposion Draga bang to finance facros over the new year forecast loost up to the board members have a number of suggestions about how can the one Director A Andrew the company does ha problem with funding woments as it has cashmere om cash red soon. Drogba Drogba plc is operating in a highly competitive gaming industry. The industry is technologically and innovatively driven and has not been impacted negatively by Covid 19. The company recently had a portion of its market share reduced due to two of its main competitors having merged and this has resulted in their existing customers switching to the competition due to better pricing. The market is very volatile and Drogba's share price has only grown by 0.03% over the past twelve months despite continued investment Drogba pic is considering the addition of a new product to its existing range. Drogba plc has had some difficulty in forecasting the performance of this product. As a result, it hired a firm of market consultants to assist with planning and modelling. The cost of this assignment was agreed at 275,000, payable to the consultants three months after delivery of their final report. The main details of the market consultant's report, which has just been presented to the Board of Drogba pic, are as follows: The product is expected to last for four years when production will then cease. Sales in the first year are estimated at 4,200 units. The number of units sold is expected to grow at an annual rate of 10% The initial selling price of the product will be set at 100 per unit. It is expected that the selling price can be increased by 5% from the third year. Machinery costing 400,000 will be required immediately with an expected residual value of 70,000 when the project ends Drogba pic has a policy of depreciating the cost of machinery in its financial accounts over four years on a straight-line basis. Drogba pic plans to finance the machinery with a bank loan at an annual food interest rate of 8%. Working capital of 30.000 will be required from the start of the project. Labour, direct materials and variable overheads are estimated at 20, 25 and Es respectively per unit in the first year. No change in these costs are expected, except that an agreement has been reached with the trade union whereby labour costs will be increased by 5% from year three onwards. Fixed overheads of 60,000 per annum have been estimated Forty per cent of this figure relates to existing foxed costs of the organisation, which have been allocated to the project. The remainder relates directly to the new product Production will be carried out in a vacant building which is owned by Drogba plo. If not used to produce the new product the building could be rented out for 50,000 per annum over the next four years Corporation Tax is at the rate of 20% and tax liabilities are settled in the year in which they are. The machinery cost will qualify for capital allowances on a straight-line basis over four years Drogba plic's after-tax cost of capital is 9% Drogba's shareholders have received a consistent dividend over the past two years The directors of Droge considering the possible purchase of Atalon Lid a private company which makes in this for gaming console business which is not currently indded mong Spin pic's viis Recently has had trading is Investment in facilities In addition to the proposion Draga bang to finance facros over the new year forecast loost up to the board members have a number of suggestions about how can the one Director A Andrew the company does ha problem with funding woments as it has cashmere om cash red soon. Drogba

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts