Question: Drop down 1: A, B, C, A&B, A&C Drop down 2: A, B, C, A&B, A&C Drop down 3: A, B, C, A&B, A&C Drop

Drop down 1: A, B, C, A&B, A&C

Drop down 1: A, B, C, A&B, A&C

Drop down 2: A, B, C, A&B, A&C

Drop down 3: A, B, C, A&B, A&C

Drop down 4: A, B, C, A&B, A&C

Please answer all parts of the question.

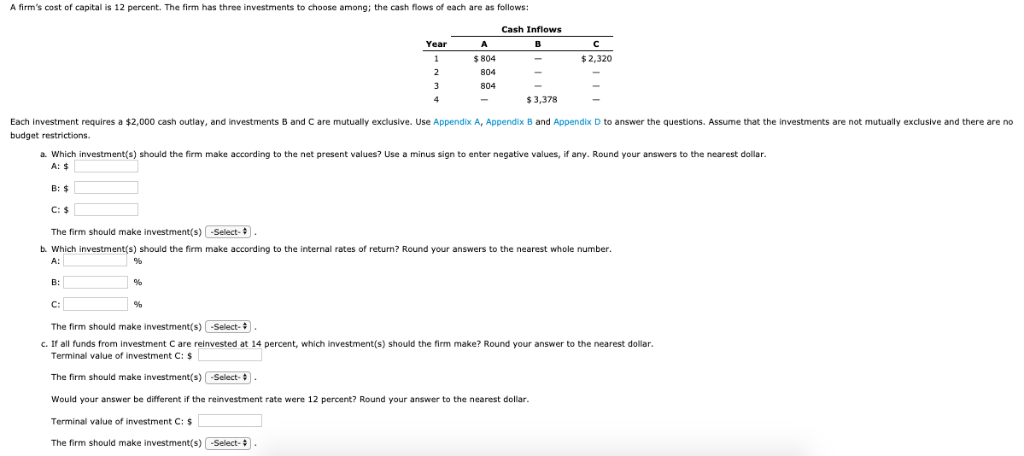

A firm's cost of capital is 12 percent. The firm has three investments to choose among; the cash flows of each are as follows: Cash Inflows Year $ 804 804 804 2,320 3,378 Each investment requires a budget restrictions. 2,000 cash outlay, and investments B and C are mutually exclusive. Use Appendix A Appendix B and Appendix D to answer the questions. Assume that the investments are not mutually exclusive and there are no a. Which investment(s) should the firm make according to the net present values? Use a minus sign to enter negative values, if any. Round your answers to the nearest dollar A: $ C: $ The firm should make investment(s) Select- b. Which investment(s) should the firm make according to the internal rates of return? Round your answers to the nearest whole number A: B: C: The firm should make investment(s) [-Select- c. If all funds from investmen C are reinvested at 14 percent, which investment(s) should the firm make? Round your answer to the nearest dollar Terminal value of investment C: $ The firm should make investment(s) Select Would your answer be different if the reinvestment rate were 12 percent? Round your answer to the nearest dollar Terminal value of investment C: $ The firm should make investment(s) Select- A firm's cost of capital is 12 percent. The firm has three investments to choose among; the cash flows of each are as follows: Cash Inflows Year $ 804 804 804 2,320 3,378 Each investment requires a budget restrictions. 2,000 cash outlay, and investments B and C are mutually exclusive. Use Appendix A Appendix B and Appendix D to answer the questions. Assume that the investments are not mutually exclusive and there are no a. Which investment(s) should the firm make according to the net present values? Use a minus sign to enter negative values, if any. Round your answers to the nearest dollar A: $ C: $ The firm should make investment(s) Select- b. Which investment(s) should the firm make according to the internal rates of return? Round your answers to the nearest whole number A: B: C: The firm should make investment(s) [-Select- c. If all funds from investmen C are reinvested at 14 percent, which investment(s) should the firm make? Round your answer to the nearest dollar Terminal value of investment C: $ The firm should make investment(s) Select Would your answer be different if the reinvestment rate were 12 percent? Round your answer to the nearest dollar Terminal value of investment C: $ The firm should make investment(s) Select

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts