Question: Drop down #1= go or no-go Drop down #2= go or no-go Drop down #3 = does or doesn't matter Comparing payback period and discounted

Drop down #1= go or no-go

Drop down #2= go or no-go

Drop down #3 = does or doesn't matter

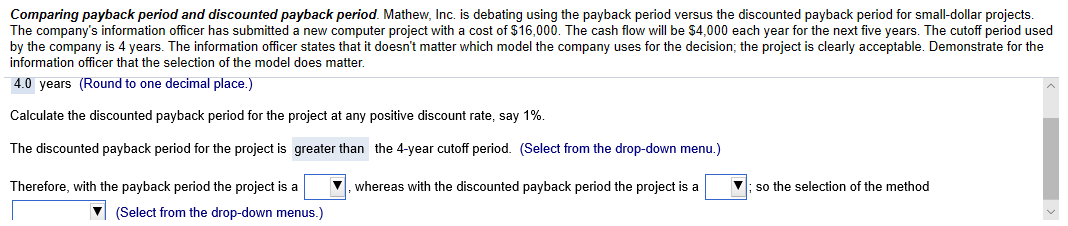

Comparing payback period and discounted payback period. Mathew, Inc. is debating using the payback period versus the discounted payback period for small-dollar projects. The company's information officer has submitted a new computer project with a cost of $16,000. The cash flow will be $4,000 each year for the next five years. The cutoff period used by the company is 4 years. The information officer states that it doesn't matter which model the company uses for the decision, the project is clearly acceptable. Demonstrate for the information officer that the selection of the model does matter. 4.0 years (Round to one decimal place.) Calculate the discounted payback period for the project at any positive discount rate, say 1%. The discounted payback period for the project is greater than the 4-year cutoff period. (Select from the drop-down menu.) , whereas with the discounted payback period the project is a Viso the selection of the method Therefore, with the payback period the project is a I v (Select from the drop-down menus.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts