Question: drop down 1 options: 1.42, 1.55, 1.48, 1.37, 1.62 drop down 2 options: 2.74, 2.93, 2.56, 2.39, 2.12, 1.98, 2.23 drop down 3 options: 3.69,

drop down 1 options: 1.42, 1.55, 1.48, 1.37, 1.62

drop down 2 options: 2.74, 2.93, 2.56, 2.39, 2.12, 1.98, 2.23

drop down 3 options: 3.69, 4.00, 3.79, 3.54, 3.45, 3.60, 3.89

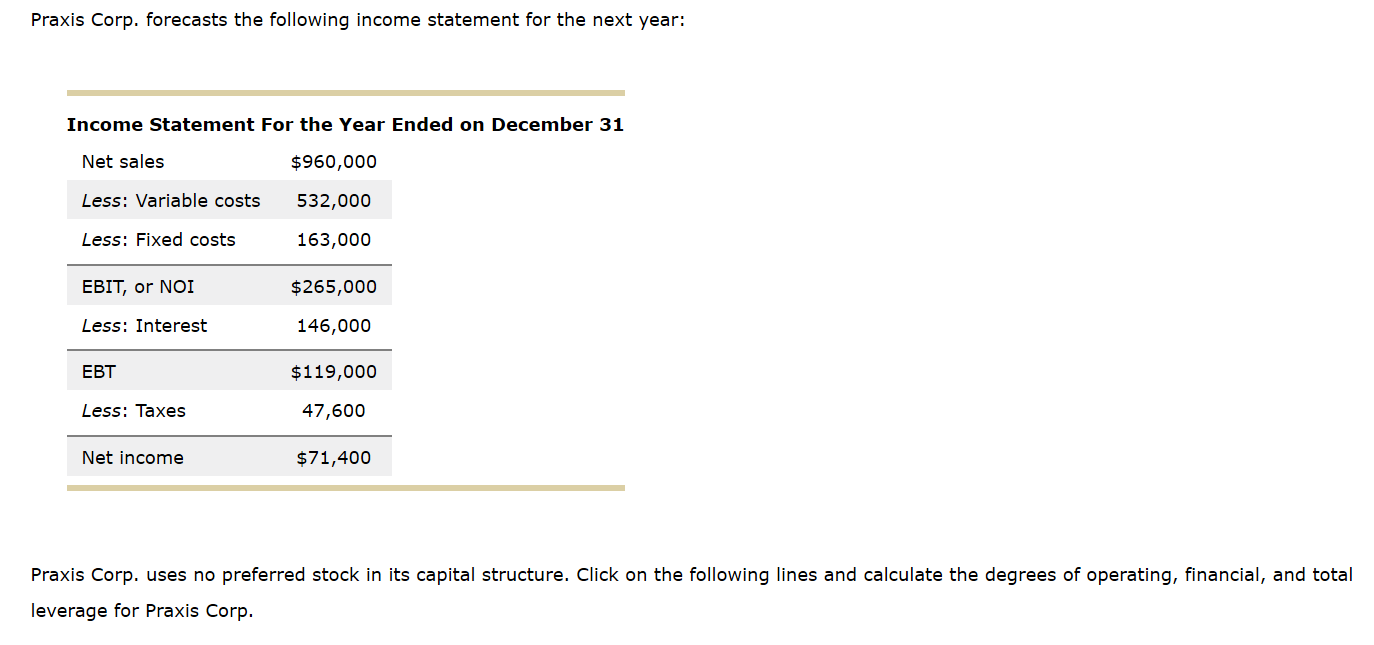

Praxis Corp. forecasts the following income statement for the next year: Income Statement For the Year Ended on December 31 Net sales $960,000 Less: Variable costs Less: Fixed costs 532,000 163,000 EBIT, or NOI $265,000 Less: Interest 146,000 EBT $119,000 47,600 Less: Taxes Net income $71,400 Praxis Corp. uses no preferred stock in its capital structure. Click on the following lines and calculate the degrees of operating, financial, and total leverage for Praxis Corp. | DOL DFL DTL ||

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts