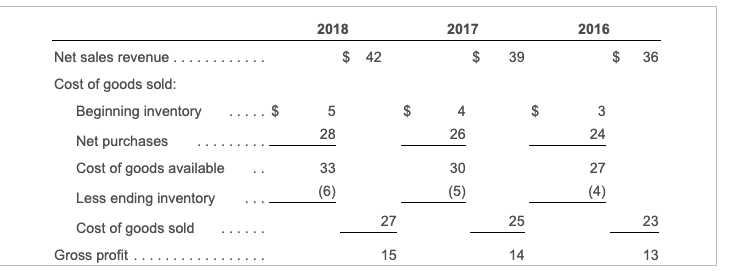

Question: Drop down: 2018 2017 2016 $ 42 $ 39 $ 36 $ $ 4 $ 5 28 3 24 26 Net sales revenue Cost of

Drop down:

Drop down:

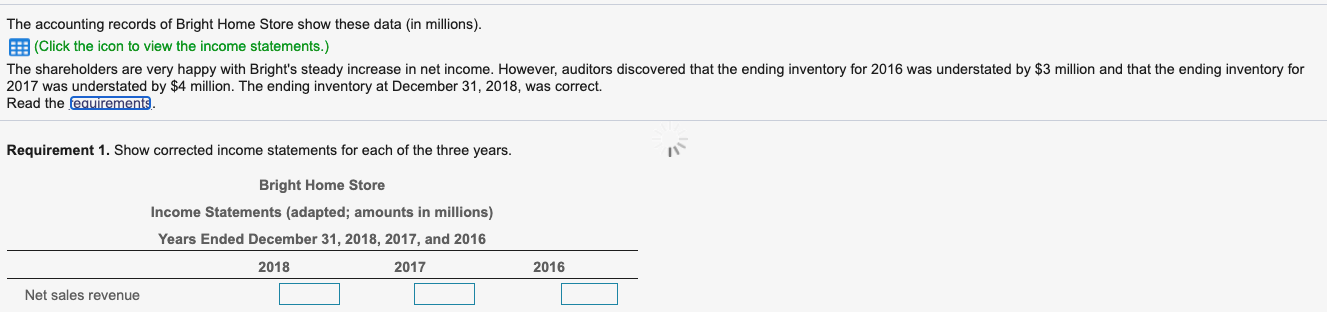

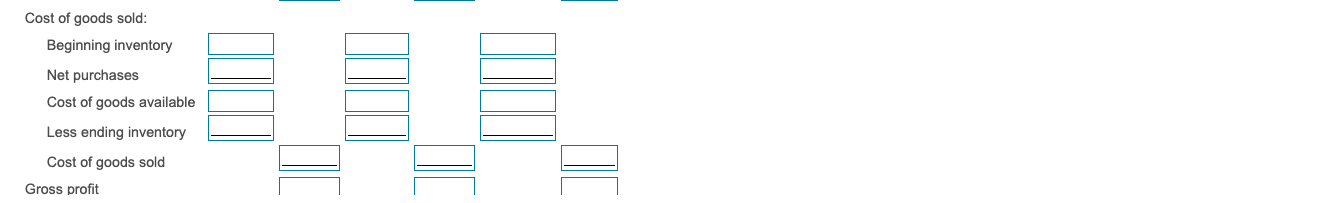

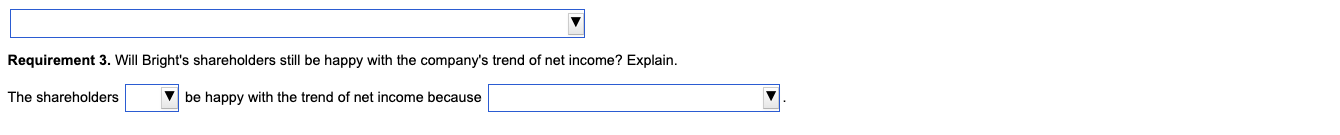

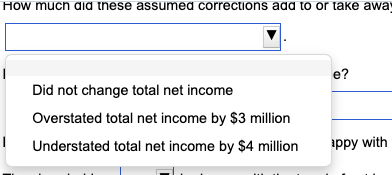

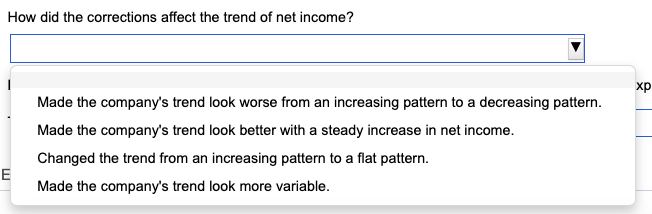

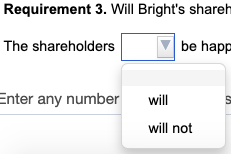

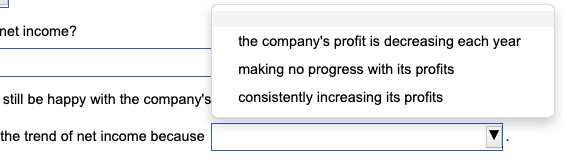

2018 2017 2016 $ 42 $ 39 $ 36 $ $ 4 $ 5 28 3 24 26 Net sales revenue Cost of goods sold: Beginning inventory Net purchases Cost of goods available Less ending inventory Cost of goods sold Gross profit 33 (6) 30 (5) 27 (4) 27 25 23 15 14 13 1. Show corrected income statements for each of the three years. 2. How much did these assumed corrections add to or take away from Bright's total net income over the three-year period? How did the corrections affect the trend of net income? 3. Will Bright's shareholders still be happy with the company's trend of net income? Explain. Cost of goods sold: Beginning inventory Net purchases Cost of goods available IM HI Less ending inventory Cost of goods sold = 1 Gross profit Operating expenses II II II Net income Requirement 2. How much did these assumed corrections add to or take away from Bright's total net income over the three-year period? How did the corrections affect the trend of net income? How much did these assumed corrections add to or take away from Bright's total net income over the three-year period? How did the corrections affect the trend of net income? Requirement 3. Will Bright's shareholders still be happy with the company's trend of net income? Explain. The shareholders V be happy with the trend of net income because How much did these assumed corrections add to or take awa e? Did not change total net income Overstated total net income by $3 million Understated total net income by $4 million appy with How did the corrections affect the trend of net income? Made the company's trend look worse from an increasing pattern to a decreasing pattern. Made the company's trend look better with a steady increase in net income. Changed the trend from an increasing pattern to a flat pattern. Made the company's trend look more variable. E Requirement 3. Will Bright's shareh The shareholders be happ Enter any number will 5 will not net income? the company's profit is decreasing each year making no progress with its profits consistently increasing its profits still be happy with the company's the trend of net income because

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts