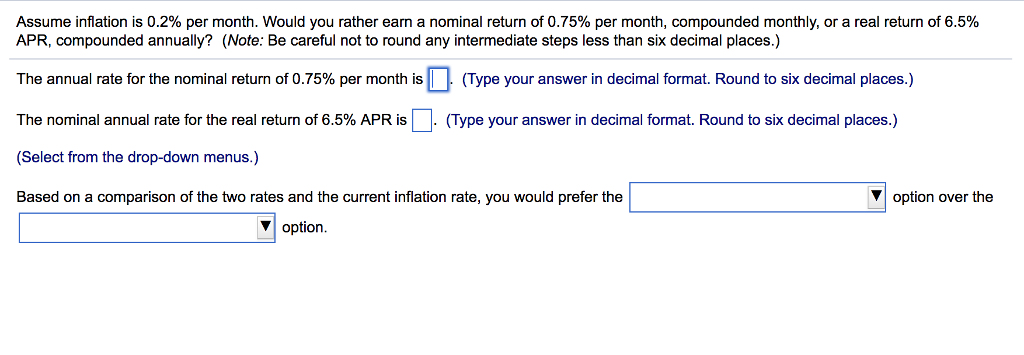

Question: Drop down answer choices are nominal return compounded monthly and real return compounded annually. Assume inflation is 0.2% per month. Would you rather earn a

Drop down answer choices are nominal return compounded monthly and real return compounded annually.

Drop down answer choices are nominal return compounded monthly and real return compounded annually.

Assume inflation is 0.2% per month. Would you rather earn a nominal return of 0.75% per month, compounded monthly, or a real return of 6.5% APR, compounded annually? (Note: Be careful not to round any intermediate steps less than six decimal places.) The annual rate or the nominal return of 0.75% per month sD The nominal annual rate for the real return of 6.5% APR is . (Type your answer in decimal format. Round to six decimal places.) (Select from the drop-down menus.) Based on a comparison of the two rates and the current inflation rate, you would prefer the Type your answer in decimal format. Round to six decimal places ?| option over the ?| option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts