Question: Drop down box selection on left side. Numerical input right side for all fields 2 Required information The following information applies to the questions displayed

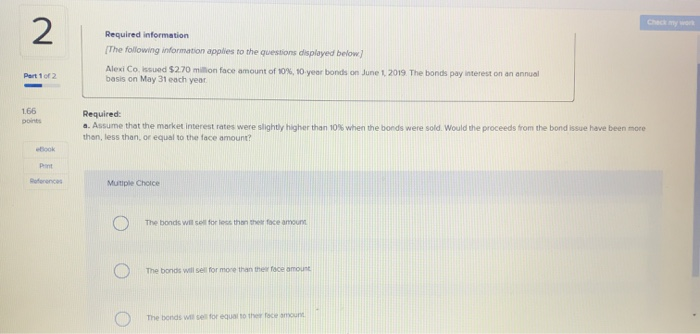

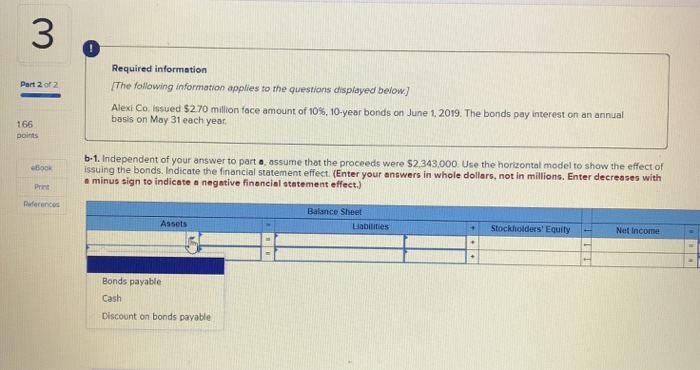

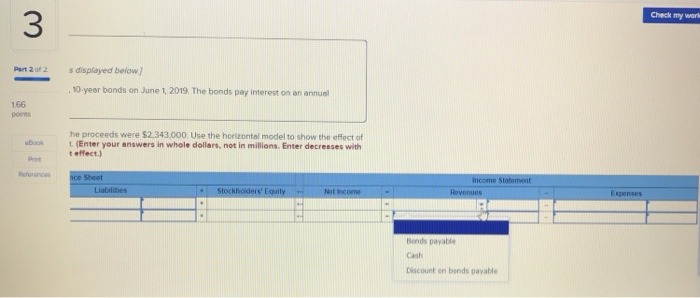

2 Required information The following information applies to the questions displayed below Alexi Co. Issued $2.70 milion face amount of 10%, 10 year bonds on June 1 2019. The bonds pay interest on an annual basis on May 31 each year. Part 1 of 2 1.66 point Required: a. Assume that the market interest rates were slightly higher than 10% when the bonds were sold. Would the proceeds from the bond issue have been more thon, less than or equal to the face amount Pant forces Multiple Choice The bonds will set for less than the face amount The bonds will be for more than the face amount The bonds wise for equal to the ocean 3 Part 2 of 2 Required information [The following information applies to the questions displayed below.) Alexi Co. Issued $2.70 million face amount of 10%, 10-year bonds on June 1, 2019. The bonds pay interest on an annual basis on May 31 each year. 166 points Book b-1. Independent of your answer to part a assume that the proceeds were $2.343,000. Use the horizontal model to show the effect of issuing the bonds. Indicate the financial statement effect (Enter your answers in whole dollars, not in millions. Enter decreases with a minus sign to indicate a negative financial statement effect.) Print References Balance Sheet Liabilities Assets Stockholders' Equity Net Income Bonds payable Cash Discount on bonds payable Check my world 3 Part 2 of 2 s displayed below) 10-year bonds on June 1, 2019. The bonds pay interest on an annual 166 be he proceeds were $2.343,000 Use the horizontal model to show the effect of t(Enter your answers in whole dollars, not in millions. Enter decreases with teffect.) forces 100 Sheet Liabilities Income Statement Revenues Stockholders' Equity Nitecore Expenses Bonds payable Cash Discount on bonds payable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts