Question: Drop Down - D. RETURN or RISK , REDUCED BY THE COST OF INCOMPLETE or INCREASED BY THE BENEFIT OF PERFECT BETTER or WORSE FUND

Drop Down -

D. RETURN or RISK ,

REDUCED BY THE COST OF INCOMPLETE or INCREASED BY THE BENEFIT OF PERFECT

BETTER or WORSE

FUND 1 or FUND 2

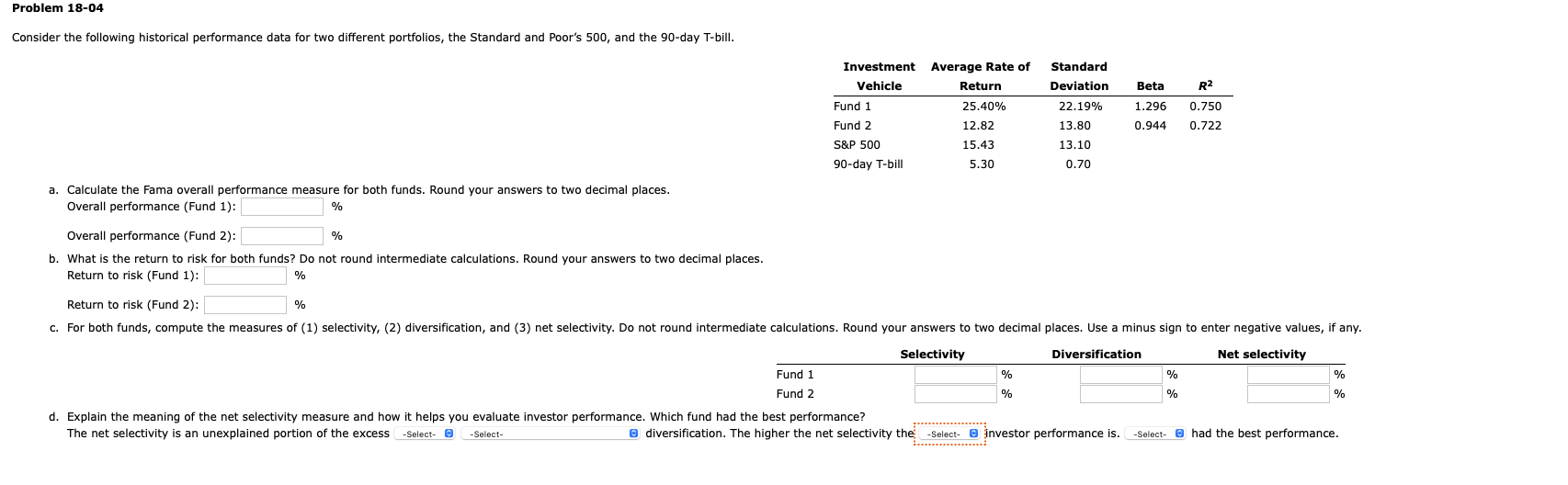

Consider the following historical performance data for two different portfolios, the Standard and Poor's 500, and the 90-day T-bill. a. Calculate the Fama overall performance measure for both funds. Round your answers to two decimal places. Overall performance (Fund 1 ): Overall performance (Fund 2 ): b. What is the return to risk for both funds? Do not round intermediate calculations. Round your answers to two decimal places. Return to risk (Fund 1 ): % Return to risk (Fund 2 ): d. Explain the meaning of the net selectivity measure and how it helps you evaluate investor performance. Which fund had the ucs pea: The net selectivity is an unexplained portion of the excess I diversification. The higher the net selectivity the nvestor performance is. had the best performance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts