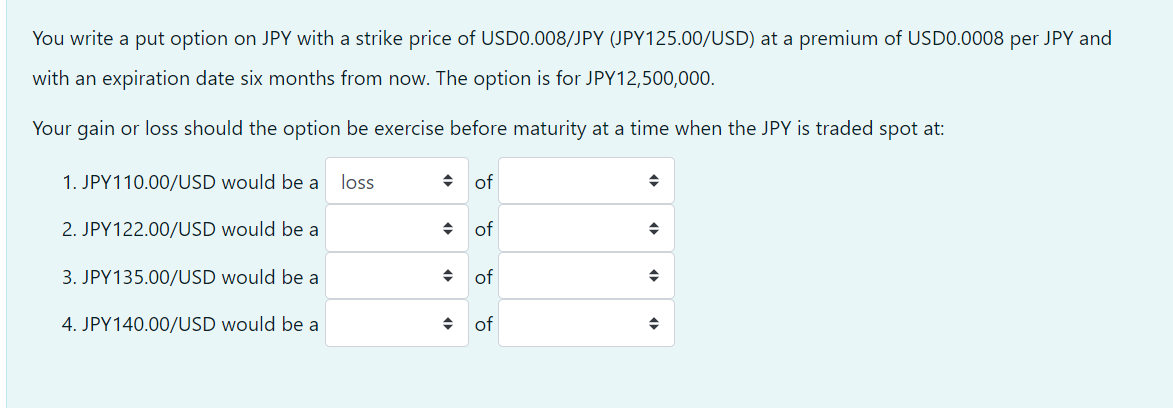

Question: Drop down for the first row is loss, gain; or breakeven Drop down for the second row is USD10,000; USD2,592.59; USD714.29; USD0; USD2,459.02; USD7,407.41; JPY12,500,000;

Drop down for the first row is loss, gain; or breakeven

Drop down for the second row is USD10,000; USD2,592.59; USD714.29; USD0; USD2,459.02; USD7,407.41; JPY12,500,000; USD10,714.29; USD89,285.71

You write a put option on JPY with a strike price of USD0.008/JPY (JPY125.00/USD) at a premium of USD0.0008 per JPY and with an expiration date six months from now. The option is for JPY12,500,000. Your gain or loss should the option be exercise before maturity at a time when the JPY is traded spot at: 1. JPY110.00/USD would be a loss of 2. JPY122.00/USD would be a of 3. JPY135.00/USD would be a of 4. JPY140.00/USD would be a of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts