Question: drop down options: 1. 93%, 112%, 84%, 102% 2. 0.93x, 1.16x, 0.81x, 1.04x 3. more risky, less risky, equally risky 5. Operating leverage The following

drop down options: 1. 93%, 112%, 84%, 102% 2. 0.93x, 1.16x, 0.81x, 1.04x 3. more risky, less risky, equally risky

drop down options: 1. 93%, 112%, 84%, 102% 2. 0.93x, 1.16x, 0.81x, 1.04x 3. more risky, less risky, equally risky

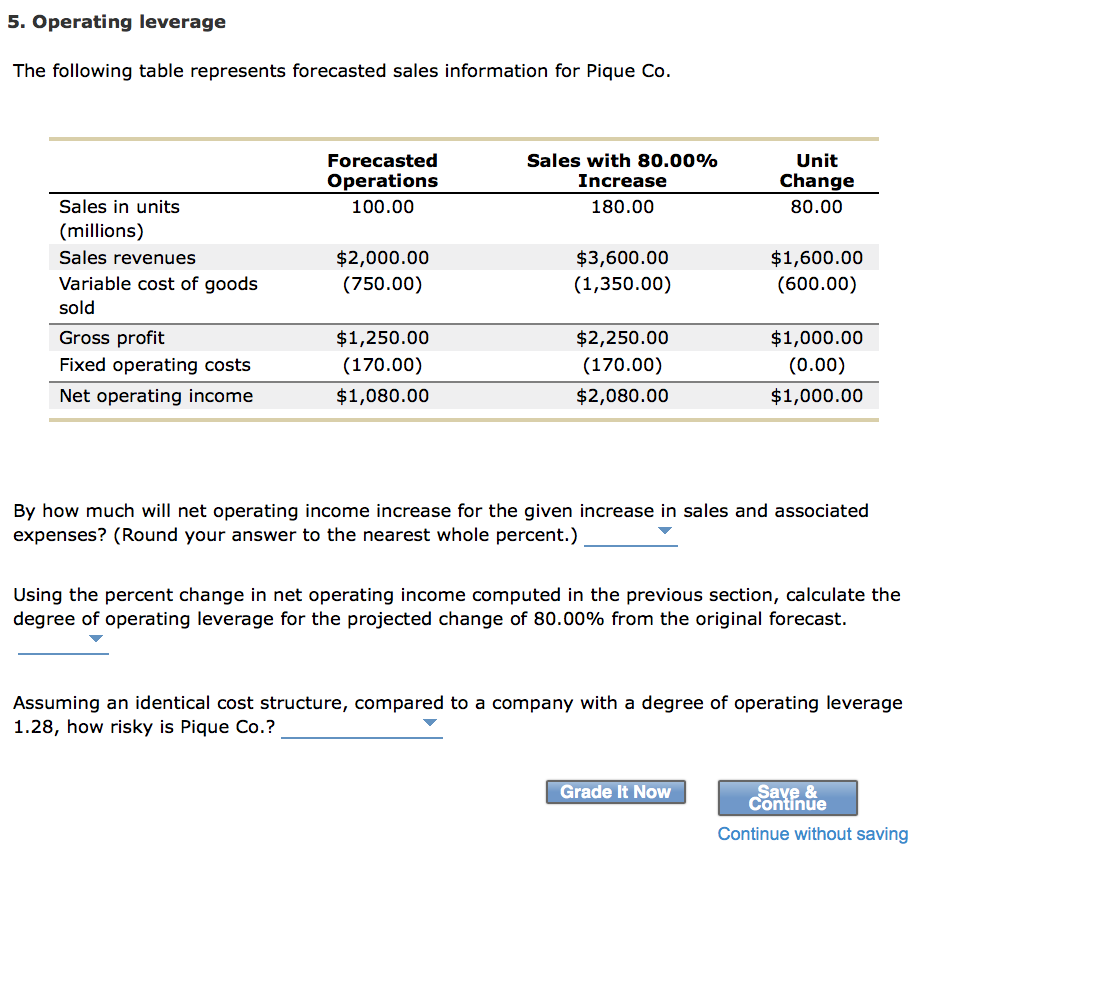

5. Operating leverage The following table represents forecasted sales information for Pique Co. Forecasted Operations 100.00 Sales with 80.00% Increase 180.00 Unit Change 80.00 $2,000.00 (750.00) $3,600.00 (1,350.00) $1,600.00 (600.00) Sales in units (millions) Sales revenues Variable cost of goods sold Gross profit Fixed operating costs Net operating income $1,250.00 (170.00) $1,080.00 $2,250.00 (170.00) $2,080.00 $1,000.00 (0.00) $1,000.00 By how much will net operating income increase for the given increase in sales and associated expenses? (Round your answer to the nearest whole percent.) Using the percent change in net operating income computed in the previous section, calculate the degree of operating leverage for the projected change of 80.00% from the original forecast. Assuming an identical cost structure, compared to a company with a degree of operating leverage 1.28, how risky is Pique Co.? Grade It Now Save & Continue Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts