Question: DROP DOWN OPTIONS 1. (an aggressive / a moderate / a conservative) 2. (6 to 10 years / 11 or more years / 0 to

DROP DOWN OPTIONS

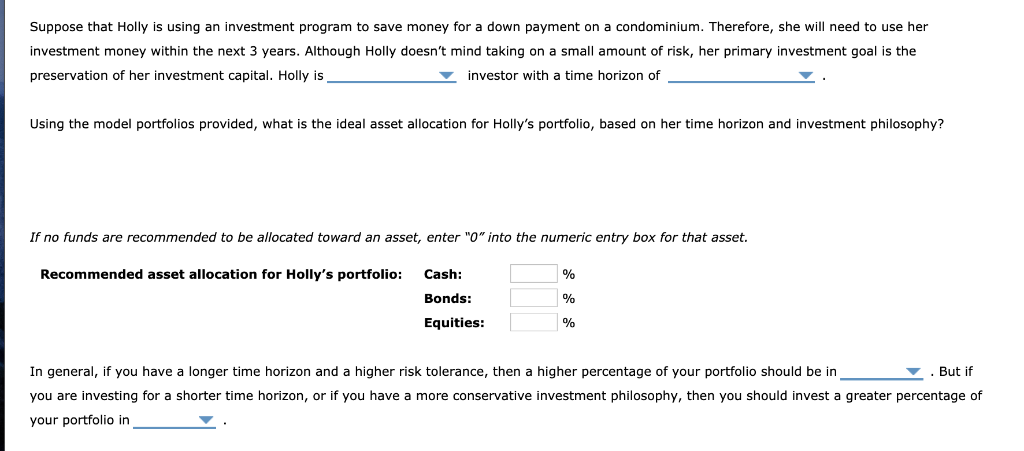

1. (an aggressive / a moderate / a conservative)

2. (6 to 10 years / 11 or more years / 0 to 5 years)

3. (bonds / equities)

4. (bonds / equities)

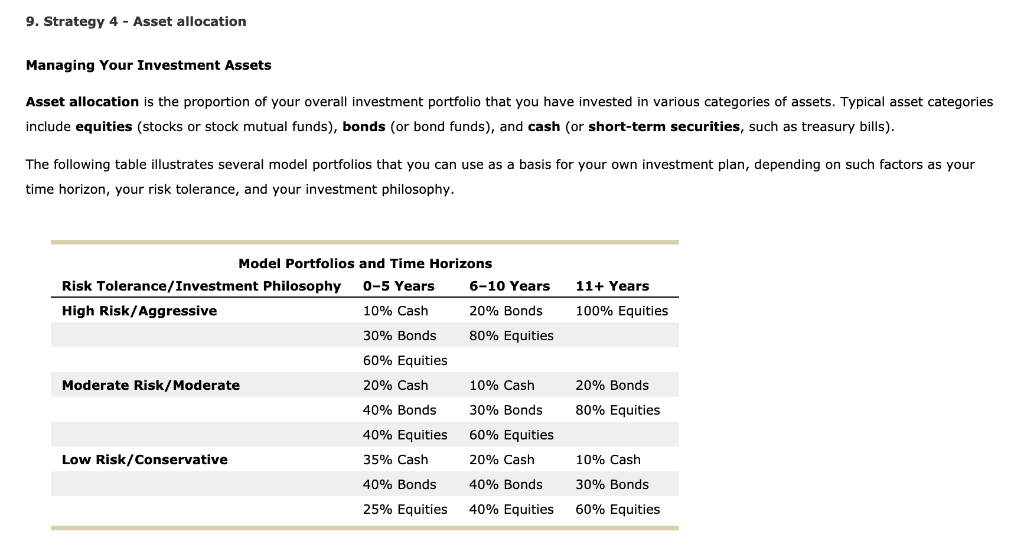

9. Strategy 4 - Asset allocation Managing Your Investment Assets Asset allocation is the proportion of your overall investment portfolio that you have invested in various categories of assets. Typical asset categories include equities (stocks or stock mutual funds), bonds (or bond funds), and cash (or short-term securities, such as treasury bills) The following table illustrates several model portfolios that you can use as basis for your own investment plan, depending on such factors as your time horizon, your risk tolerance, and your investment philosophy. Model Portfolios and Time Horizons 0-5 Years 11+ Years Risk Tolerance/Investment Philosophy 6-10 Years 10% Cash 100% Equities High Risk/Aggressive 20% Bonds 30% Bonds 80% Equities 60% Equities 20% Bonds Moderate Risk/Moderate 20% Cash 10% Cash 30% Bonds 80% Equities 40% Bonds 40% Equities 60% Equities 35% Cash Low Risk/Conservative 20% Cash 10% Cash 40% Bonds 30% Bonds 40% Bonds 40% Equities 60% Equities 25% Equities Suppose that Holly is using an investment program to save money for a down payment on condominium. Therefore, she will need to use her investment money within the next 3 years. Although Holly doesn't mind taking on a small amount of risk, her primary investment goal is the preservation of her investment capital. Holly is investor with a time horizon of Using the model portfolios provided, what is the ideal asset allocation for Holly's portfolio, based on her time horizon and investment philosophy? f no funds are recommended to be allocated toward an asset, enter "0" into the numeric entry box for that asset. Recommended asset allocation for Holly's portfolio: Cash: % Bonds: Equities: But it In general, if you have a longer time horizon and a higher risk tolerance, then a higher percentage of your portfolio should be in you are investing for a shorter time horizon, or if you have a more conservative investment philosophy, then you should invest a greater percentage of your portfolio in

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts