Question: DROP DOWN OPTIONS 1. (market / limit) 2. (carried over to the next day / canceled / executed at the last trade price) 3. (fell

DROP DOWN OPTIONS

1. (market / limit)

2. (carried over to the next day / canceled / executed at the last trade price)

3. (fell by $135.6 / fell by $113 / rose by $135.6 / fell by $465 / fell by $101.7)

4. (market / limit)

5. (lost $465 in value / lost $418.5 in value / gained $534.75 in value / gained $418.5 in value / gained $150 in value)

6. (a good-til-canceled order / an indefinite order / a fill-or-cancel order)

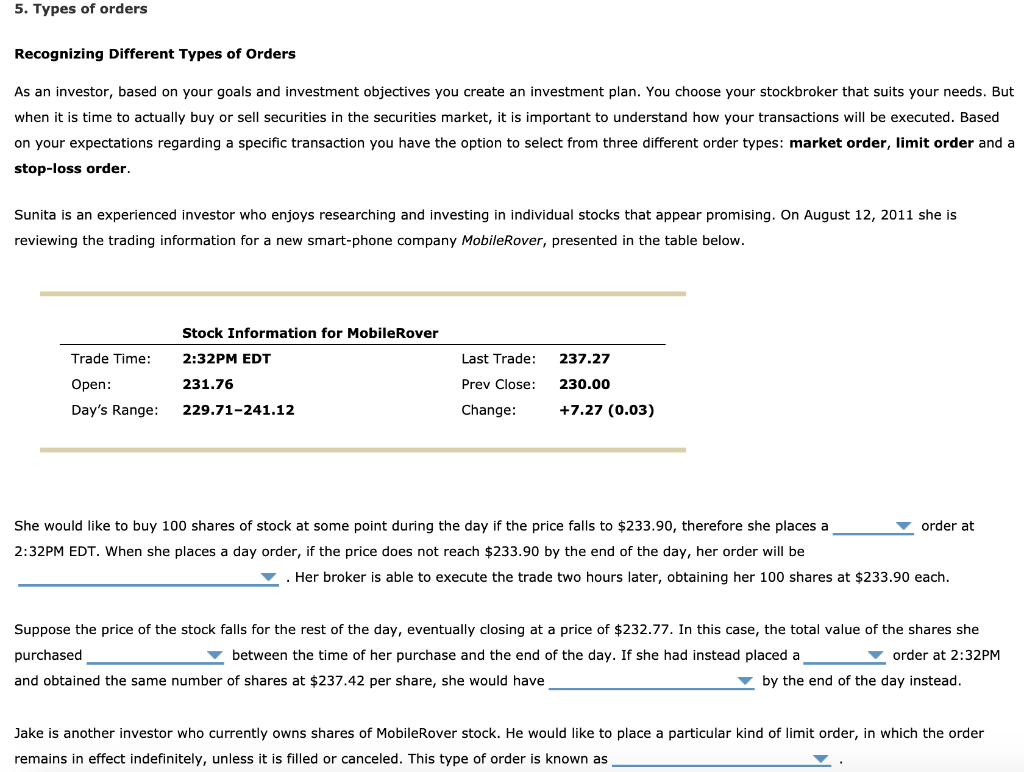

5. Types of orders Recognizing Different Types of Orders As an investor, based on your goals and investment objectives you create an investment plan. You choose your stockbroker that suits your needs. But when it is time to actually buy or sell securities in the securities market, it is important to understand how your transactions will be executed. Based on your expectations regarding a specific transaction you have the option to select from three different order types: market order, limit order and a stop-loss order. Sunita an experienced investor who enjoys researching and investing in individual stocks that appear promising. On August 12, 2011 she is reviewing the trading information for a new smart-phone company MobileRover, presented in the table below. Stock Information for MobileRover Trade Time: 2:32PM EDT Last Trade: 237.27 230.00 Prev Close: Open: 231.76 +7.27 (0.03) Day's Range: Change: 229.71-241.12 She would like to buy 100 shares of stock at some point during the day if the price falls to $233.90, therefore she places a order at 2:32PM EDT. When she places a day order, if the price does not reach $233.90 by the end of the day, her order will be Her broker is able to execute the trade two hours later, obtaining her 100 shares at $233.90 each. Suppose the price of the stock falls for the rest of the day, eventually closing at a price of $232.77. In this case, the total value of the shares she between the time of her purchase and the end of the day. If she had instead placed a purchased order at 2:32PM by the end of the day instead. and obtained the same number of shares at $237.42 per share, she would have Jake is another investor who currently owns shares of MobileRover stock. He would like to place a particular kind of limit order, in which the order remains in effect indefinitely, unless it is filled or canceled. This type of order is known as

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts