Question: drop down options below REQUIRED: Homework Chapter 5 Saved Help Save & Exit Submi During 2018, its first year of operations, Pave Construction provides services

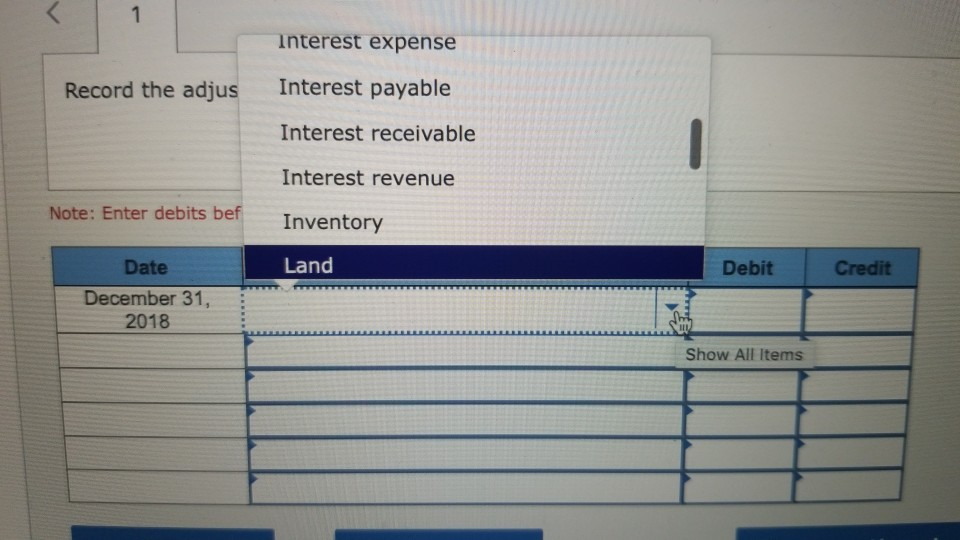

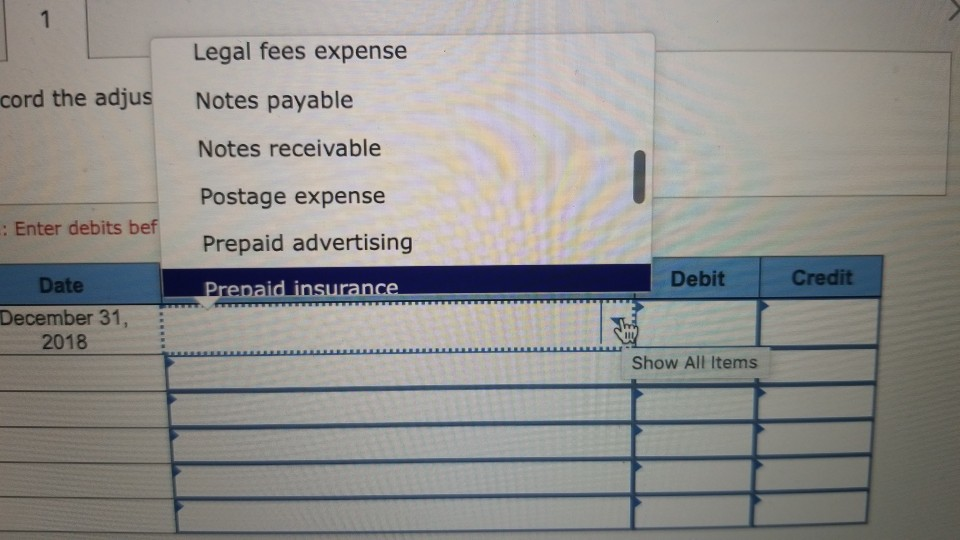

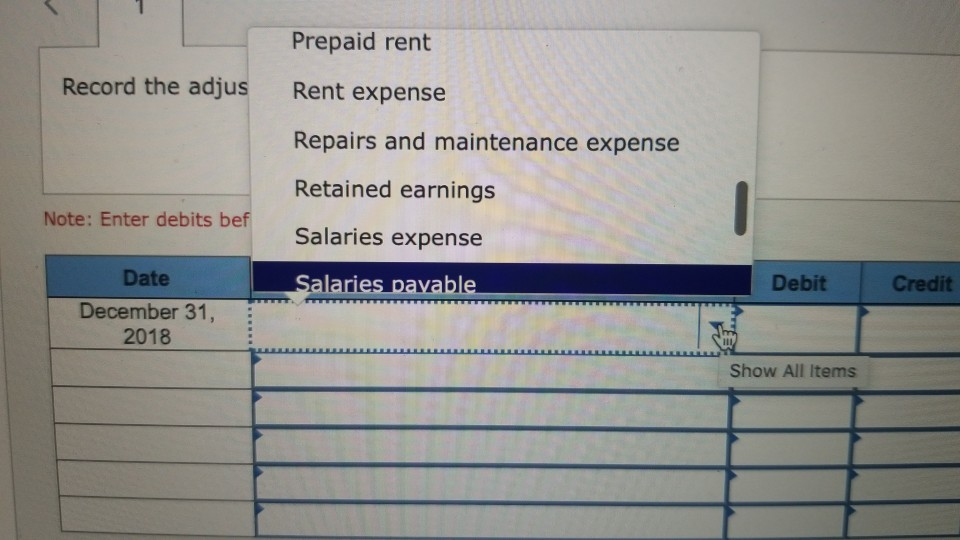

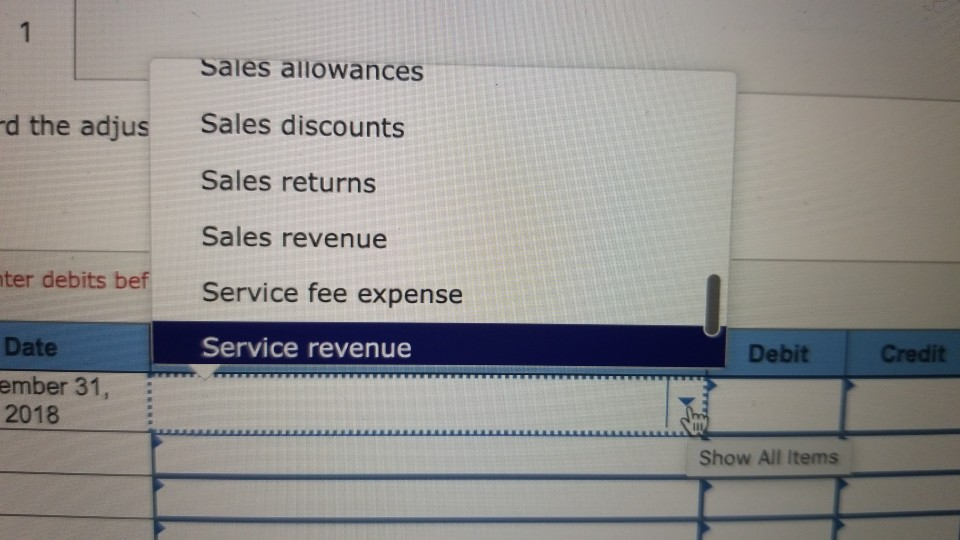

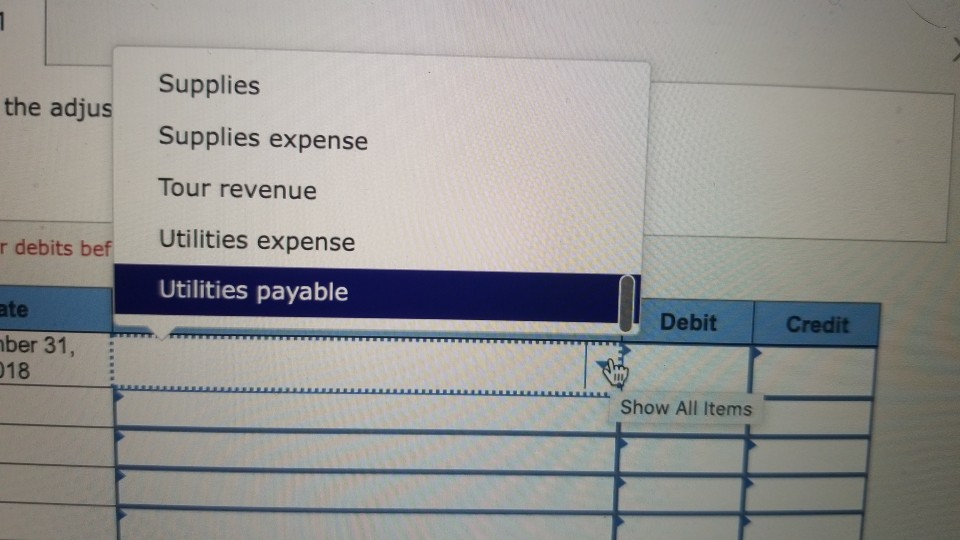

drop down options below

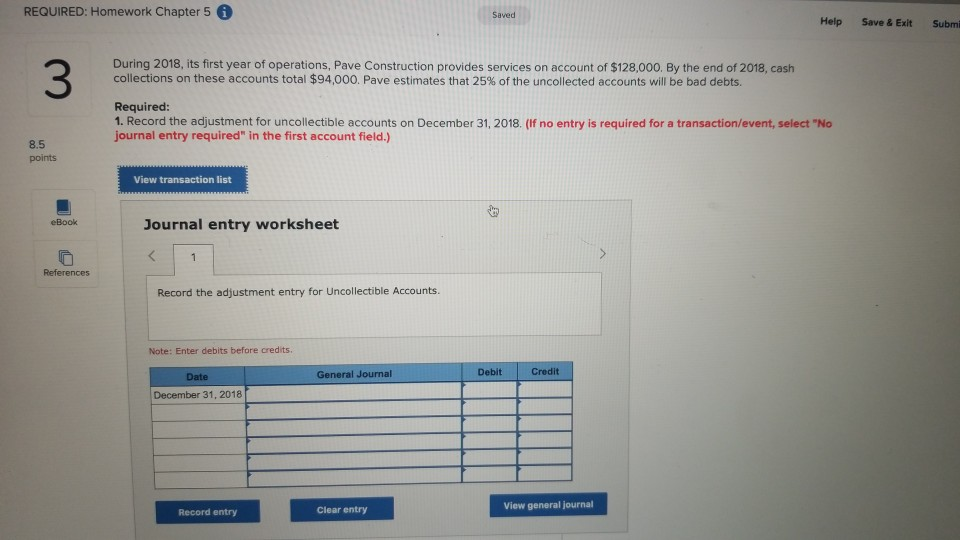

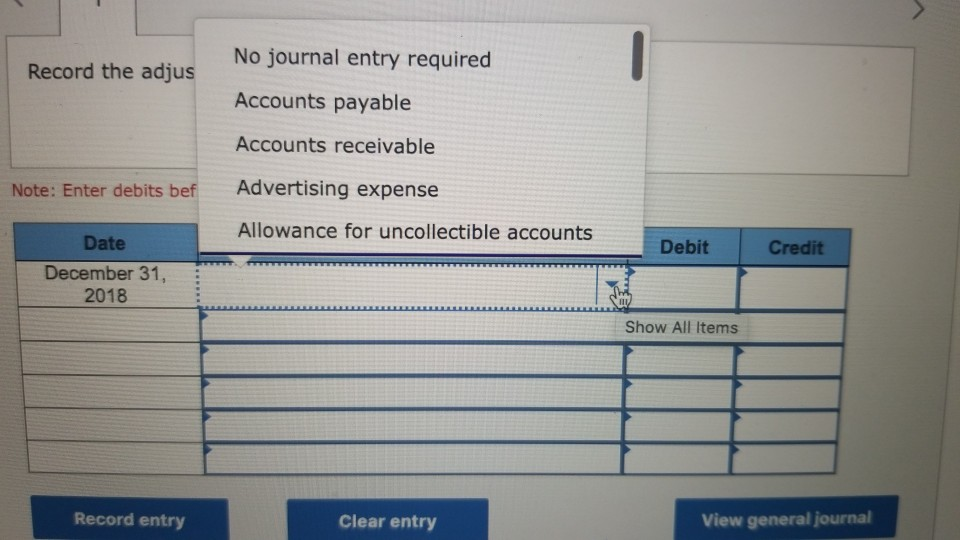

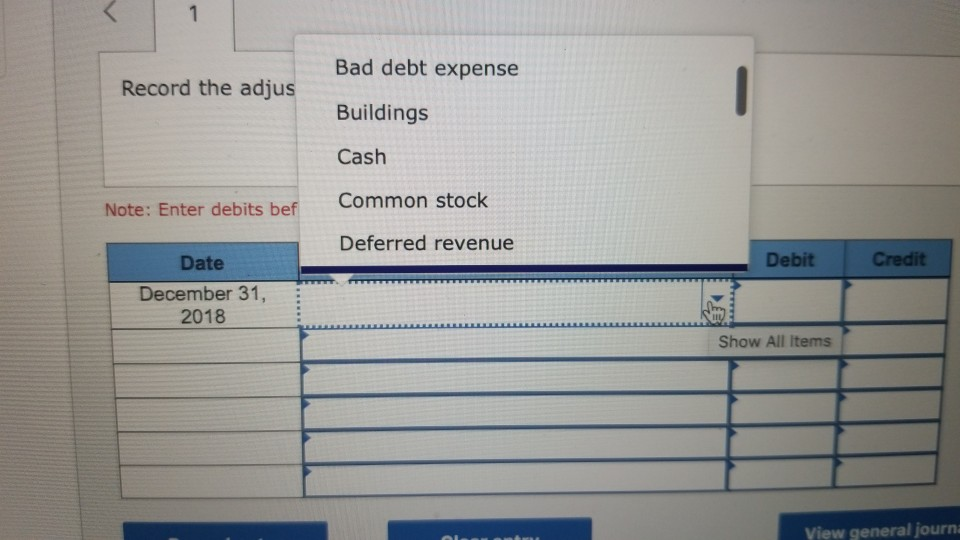

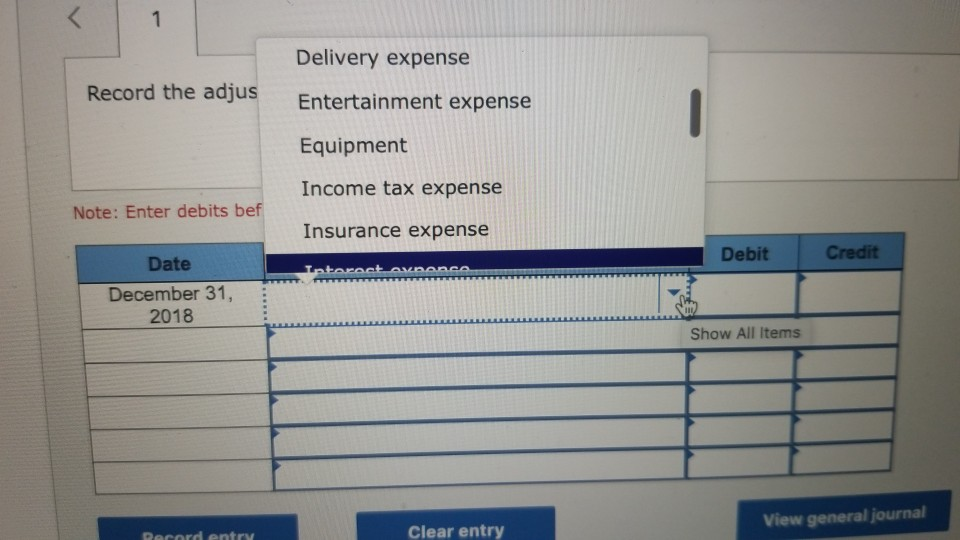

REQUIRED: Homework Chapter 5 Saved Help Save & Exit Submi During 2018, its first year of operations, Pave Construction provides services on account of $128,000. By the end of 2018, cash collections on these accounts total $94,000. Pave estimates that 25% of the uncollected accounts will be bad debts. Required: 1. Record the adjustment for uncollectible accounts on December 31, 2018. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) 8.5 points View transaction list eBook Journal entry worksheet References Record the adjustment entry for Uncollectible Accounts. Note: Enter debits before credits General Journal Debit Credit Date December 31, 2018 Clear entry View general Journal Record entry Record the adjus No journal entry required Accounts payable Accounts receivable Note: Enter debits bef Advertising expense Allowance for uncollectible accounts Debit Credit Date December 31, 2018 Show All Items Record entry Clear entry View general journal Bad debt expense Record the adjus Buildings Cash Note: Enter debits bef Common stock Deferred revenue Debit Credit Date December 31, 2018 Show All items View general journ Delivery expense Record the adjus Entertainment expense Equipment Income tax expense Note: Enter debits bef Insurance expense Debit Credit toroct OMDance Date December 31, 2018 Show All Items Clear entry View general journal Interest expense Record the adjus Interest payable Interest receivable Interest revenue Note: Enter debits bef Inventory Land Debit Credit Date December 31, 2018 Show All Items Legal fees expense cord the adjus Notes payable Notes receivable Postage expense Enter debits bef Prepaid advertising Prepaid insurance Debit Credit Date December 31, 2018 Show All Items Prepaid rent Rent expense Record the adjus Repairs and maintenance expense Retained earnings Note: Enter debits bef Salaries expense Salaries pavable Debit Credit Date December 31, 2018 Show All Items Sales allowances -d the adjus Sales discounts Sales returns Sales revenue mter debits bef Service fee expense Service revenue Debit Credit Date ember 31, 2018 Show All Items the adjus Supplies Supplies expense Tour revenue ir debits bef Utilities expense Utilities payable Debit Credit Ite ber 31, 18 Show All Items

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts